Today we look at the Qantas Airways Ltd [ASX:QAN] share price in the context of the latest news.

Qantas cancelled international flights until late October, on the back of news from Tourism Minister Simon Birmingham that Australian boarders are likely to remain closed until 2021.

This came as another blow to an industry already reeling from the impact of the coronavirus.

In looking at the travel sector there is a lot to consider and a lot of unknowns. So, how will this affect the major players in the tourism sector?

You can see the QAN weekly share price chart below, dating back to just before the GFC:

Source: Optuma

What’s been happening with the QAN share price…

At the time of writing, the Qantas share price is up 1.61% to $4.42, but overall, still down from the start of June where QAN shares moved up to the resistance level of $4.97.

In recent weeks, not much has changed. The company announced a halt in international flights until late October 2020. Along with this came the news that Qantas is considering moving some of its Airbus A380s into long-term storage in the Californian desert ahead of a possible early retirement for the superjumbos.

A Qantas spokesman said:

‘We expect all 12 of our A380s to be in storage for some time as we wait for international travel demand to recover.’

Not alone in this move, other global airlines are seeking similar solutions with Singapore Airlines parking some of its aircraft out in Alice Springs.

Without these sky busses moving all over the globe filled with people, there no doubt will be an impact to the rest of the industry that relies heavily on the movement of people.

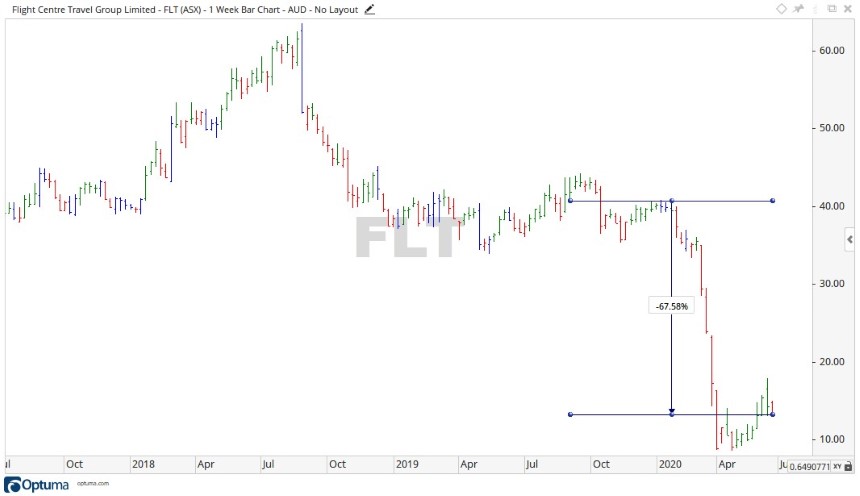

Flight Centre Travel Group Ltd [ASX:FLT] and Webjet Ltd [ASX:WEB] have both taken hits of over 60% to their share prices. With Flight Centre even announcing the sale of their Melbourne HQ during the onset of the pandemic to raise some capital.

Here are the weekly charts for the FLT and WEB share prices:

Source: Optuma

Pretty much the same action on both.

Where to from here…

Right now, the world is very much on edge. China has raised its emergency warning to its second-highest level and cancelled more than 60% of the flights to Beijing amid a new coronavirus outbreak in the capital.

Here at home in Australia, we now have an unemployment rate of 7.1%, with that rate potentially set to rise.

Qantas, Flight Centre, and Webjet all have their strengths, yet in the current climate are facing uncertain times. It’s very hard to predict how long this situation will carry on over the globe and when these companies will see growth come back into their share prices.

One option is to place all three on a watchlist with an alert set, should their share prices move past resistance points I’ve marked out above.

For more investable ideas that could help you beat this market turmoil, check out our ‘Coronavirus Portfolio’. It’s a report that explains in detail the types of assets that could perform well and some crafty ways to navigate the choppy markets. Check it out for yourself, right here.

Regards,

Carl Wittkopp,

For Money Morning

Comments