As the ASX serves up mixed reactions to last night’s budget, one stock shares that are in the green today is Pushpay Holdings Ltd [ASX:PPH].

The PPH share price is trading 2% higher at time of writing, bucking the wider pessimism that is gripping much of the market.

A turn of events that is hardly surprising given the news shared by the company this morning.

Posting an incredible full-year result for the FY21 period and lifting expectations for 2022 as well.

Let’s dig into the numbers.

Strong growth, stronger outlook

The most prominent takeaway from Pushpay’s results has to be its incredible earnings and net profit.

With a reported EBITDAF of US$58.9 million, up a whopping 133% year-on-year. With net profit sitting at an equally impressive US$31.1 million, up 95% year-on-year.

All of which is thanks to a better top-line result as well, with revenues up 40% to US$179 million.

That is precisely the kind of growth that investors are looking for and was forecast. With Pushpay not only meeting its guidance forecast for the year, but also meeting it after several upgrades as well!

But perhaps the most important factor that many will gloss over is Pushpay’s massive strides in its margins. Because not only are they making more money, but they’re spending less on their overheads.

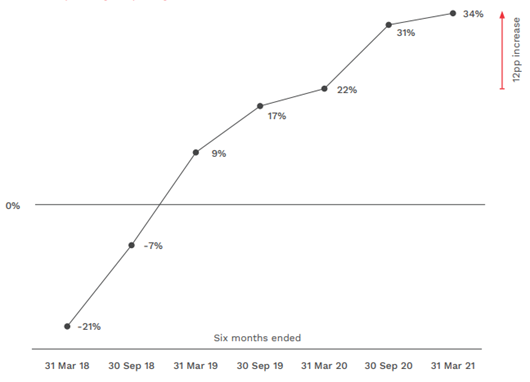

As can be seen by the following chart of EBITAF as a percentage of operating revenue:

We reveal four little-known small-cap stocks that cannot be ignored…Download your free report now.

A factor that Pushpay themselves attribute to ‘strong operating revenue growth, improved gross margins and disciplined cost management.’

All of which has put the business in a fantastic position to keep growing. Which is no doubt music to investors ears.

However, there was also some more news to share today aside from results. With long time ex-chairman (current director), Bruce Gordon, confirming he will be stepping down and retiring come 16 June.

A loss that could cause a few jitters for investors, but also opens up the doorway for fresh blood. So only time will tell just how much Pushpay will miss Mr Gordon’s presence.

Because as current Chairman, Graham Shaw comments, he has been an integral part in the company for some time:

‘On behalf of the Board and management, I would like to sincerely thank Bruce for his immense contribution and dedication to Pushpay. Bruce has served on the Board for severn years, stepping in as CEO on an interim basis for 18 months and leading the Company through many phases of growth.

‘Bruce has been instrumental in shaping Pushpay into what it is today and positioning us for continued success. We are extremely grateful for his inspiring leadership and support, and wish him all the best with his future endeavors.’

What’s next for Pushpay Share Price?

Looking beyond today’s news it’s clear that Pushpay is in an enviable position.

A business that is still growing and still primed to deliver strong returns. All of which should leave them in good stead for the foreseeable future.

Granted, that is obviously not guaranteed, but the momentum behind Pushpay is strong.

A genuine fintech success story that is still on the up.

For more fintech stock ideas, check out our telling report on the niche sector. Including three companies worth taking a punt on right now.

You can get your free copy of this report, right here.

Regards,

Ryan Clarkson-Ledward,

For Money Morning