Yesterday we touched on the boom times going on in Australia right now.

The media is seeding this further with lots of stories on people making more money from their house than their wage and on it goes.

All this will increase the urgency for people to plough more money into the sector. It’s the rational thing to do.

On a national level, however, it’s a gross misallocation of resources.

People chasing the unearned gains in the real estate market is entirely unproductive in an economic sense.

But that doesn’t mean it can’t be very profitable.

I should make some exception for genuine property developers who at least add value by adding to the existing housing stock.

But the free lunch obtainable via land value inflation and cheap credit (that the RBA underwrites) can make their projects far more profitable than they might otherwise be.

A friend of mine just cleared a million bucks from some high-end townhouses.

Buying the land in 2016 was the key part of the whole shebang.

And what’s this? The RBA is getting a little worried about the housing boom, is it?

It’s mostly their fault, as far as I can see. The RBA has something called the ‘Term Funding Facility’.

This allows the Aussie banks to borrow at 0.1% until 2024, as I understand it. Those banks can then write a mortgage charging 2%. This is very profitable.

Roll the wheel, Mary-Jane!

Bzzz. Humm. Ding-a-ling.

What did you get, contestant?

Oh, banks trying to write as many mortgages as they can to cash in on the housing boom.

And then the RBA says it’s alarmed. Guffaw. Oh shucks, first home buyers.

Don’t you know it’s all about managing inflation and wages?

I had to laugh when I saw a tweet from economist Cam Murray the other day.

I can’t find it directly.

But apparently there’s some enquiry into Australian monetary policy.

We don’t need an enquiry.

It’s pretty simple what they keep doing: that’s just keep jacking up the housing market!

The whole thing is absurd. But that doesn’t mean you and I can’t keep making a buck out of it.

For example, the RBA pins down interest rates in the name of employment.

This inflates land values and makes dividend-paying businesses more appealing.

What could be more appealing to own than a real estate-based business that can grow its rental yield.

I’ve been commentating on this market for a long time.

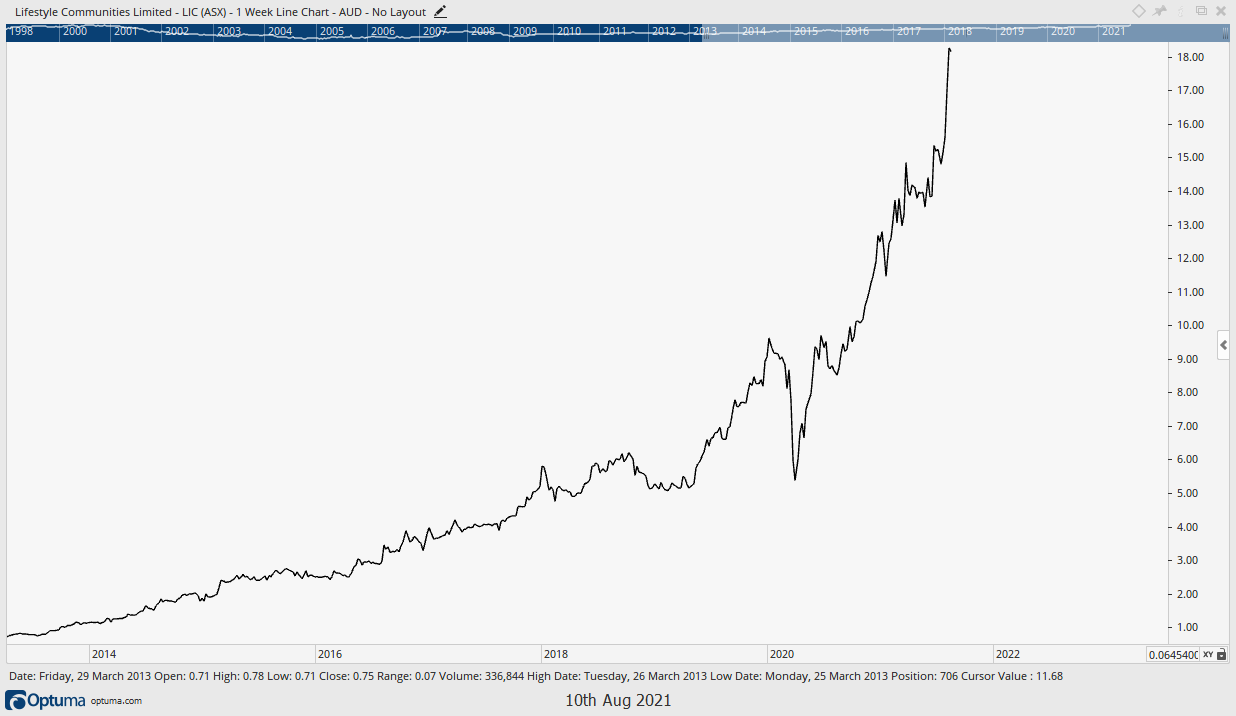

Way back in 2014, I remember writing about a stock called Lifestyle Communities Ltd [ASX:LIC] for readers of Cycles, Trends & Forecasts. It was about $2 at the time.

This is what it has done in the last seven years or so. Check it out:

|

|

|

Source: Optuma |

Not a bad ride for LIC shareholders over the last seven years, presuming they could withstand the COVID shock.

That’s the kind of effect a building real estate market can have when you overlay a growing, profitable business on top of it.

There may be more in it over the next four years too.

Suffice to say that property insights can inform the stock market and vice versa.

Make sure you’re putting these kinds of insights to work in your portfolio by going here.

Regards,

|

Callum Newman,

Editor, The Daily Reckoning Australia

PS: Australian real estate expert, Catherine Cashmore, reveals why she thinks we could see the biggest property boom of our lifetimes — over the next five years. Click here to learn more.