As I mentioned in Part One and Part Two of my ‘Forecasts for Resource Stocks in 2023’ articles, I believe the big theme this year will be China’s reopening.

I’m not talking about the rally that took place in early January thanks to China’s end to COVID lockdowns, I’m talking about something far larger…

With around 1.4 billion citizens virtually locked up over the last three years, it’ll take a few months yet before a surge in economic activity begins to manifest into official numbers.

But according to Business Insider, around half of China’s population now falls into the middle-class category.

Having sat in hiatus, it means a staggering 700 million Chinese now have the capacity to spend more…be it travel, housing, business growth, or investing.

For context, the US middle class also makes up around 50% of the population, or around 165 million people.

China now has the greatest share of middle-class earners on the planet, which arguably makes it the most underrated, yet important, economy for global growth.

Again, I don’t believe January’s rally has priced in the potential here.

Yes, we have US recession fears looming, but the China story is far more important, particularly from an Australian investor perspective.

It means a total shift in investor mindset is needed as China reignites its economic engines…and it’s the emerging economies that may be the unlikely winners this year. Let me explain…

With 700 million middle-class citizens now free to spend and travel, it means smaller Asian countries may soon host millions of additional Chinese travellers.

Enormous demand for flights and accommodation looks likely.

It could prove to be a boon for Australia’s travel industry too.

But that’s just part of the story when it comes to China’s economic ‘reawakening’…

Weakening US dollar

After a stellar performance in 2022, the US dollar is set to face headwinds this year.

The first one is this…

The US is the largest beneficiary of foreign investment. Investors across Asia and Europe have poured money into US equities and real estate.

It’s one of the contributing factors that’s helped stage a record-breaking performance for US-based indices, including the Nasdaq and S&P 500 over the last 10 years.

But with the tech boom in the US unwinding, could all this foreign investment soon return home?

With US stocks continuing to weaken against global equities, it’s feasible we’ll see more foreign economies repatriate their US-based investments.

With China’s reopening, investing in local businesses, real estate, and stock markets throughout Asia could be a far more lucrative proposition as the China story reignites.

It’s why I believe international markets are set to outperform US equities in 2023 and beyond…

Something we haven’t seen since the early 2000s.

All these factors add pressure to the US dollar.

Not only that, with a US recession possible in 2023, the Federal Reserve looks set to wind back its 2022 rate hiking, possibly even reducing rates in the latter part of the year.

This would add further pressure on foreign-owned US deposit holders facing a double whammy of lower yields and a depreciating US dollar.

So, what does this mean as an investor?

2023 could signal a time to invest in emerging markets and those centred around resources.

As global investors unwind their focus on US-based assets, emerging economies should benefit.

In fact, the trend might already be underway…

According to the United Nations Conference on Trade and Development, foreign investment in developing Asia hit a record US$619 billion in 2021. As the article states (emphasis added):

‘Foreign direct investment (FDI) flows to developing countries in Asia rose by 19% to an all-time high of $619 billion in 2021, according to UNCTAD’s World Investment Report published on 9 June 2022.

‘This marked the third consecutive year that investment flows to the region grew despite the COVID-19 pandemic, which led to a 35% plunge in global FDI in 2020.’

Currencies from resource-based nations set to surge against the USD

History has a strange pattern of repeating…

The investment environment right now mirrors the conditions from the early 2000s.

A major tech sell-off (after the dotcom bust) was followed by a surge in capital outflow from the US into emerging economies and resources.

As you might recall, the early 2000s saw an appreciation in many international currencies relative to the US dollar.

As the US dollar weakened, currencies tied to resources including Australia, Canada, and Brazil, swelled.

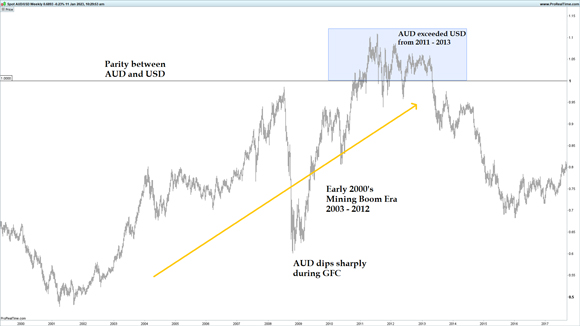

In fact, the Australian dollar held parity with the US dollar toward the end of the last mining boom and even exceeded it from 2011–13, as you can see below:

|

|

| Source: ProRealTime |

With an enormous boost to our terms of trade, strong commodity exports helped fuel the Australian dollar to record highs.

Expect to see similar conditions unfold over the coming years as capital finds its way back to emerging and resource-based economies.

It’s all part of the ‘pivot’ to real asset investments

Thinking back to 20 years ago, the ‘dotcom’ bust was followed by a surge in commodity prices and enormous investor interest in emerging economies.

All this on the back of a falling US dollar.

The period saw the birth of investor interest in ‘BRIC’ nations… Brazil, Russia, India, and China.

So, are we beginning to transition back to this investment theme?

Perhaps…

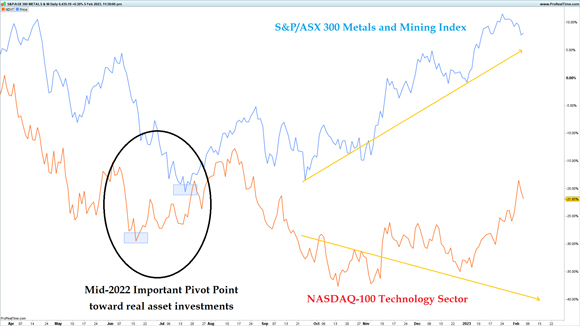

Mid-2022 is a period that every investor and trader should take note of…while stock markets were panicking over US interest rate rises and spiralling inflation, strength was quietly building in key parts of the economy.

I’ve pulled up two indices, one demonstrating strength, the other weakness at this all-important ‘pivot point’ in mid-2022:

|

|

| Source: ProRealTime |

Following a major low in late June 2022, the Nasdaq 100 tech sector continued to post further lows in the second part of the year.

This was the catalyst for strong bearish sentiment in equities across the globe.

But not all stocks were performing poorly.

Strength was emerging in what I believe will be the key areas of investment for the future.

In stark contrast to the tech sector, the S&P ASX 300 Metals and Mining Index began to trend upward, despite the upheaval in markets throughout 2022.

In my mind, the mid-point of last year signalled the beginning of a long journey toward a secular shift into real asset investments.

As investors sold-off US-based growth equities, ‘higher lows’ began to form throughout the mining, energy, utility, and farming-related sectors.

Importantly, the charts were signalling an emerging trend…something we would have missed had we relied on fundamental analysis alone.

That’s especially true for our copper play. Copper was an important focus for our Diggers and Drillers portfolio in the second half of last year.

As a metal tied exclusively to global growth, copper certainly wasn’t on investors’ radar back in the gloomiest days of 2022.

But with the use of technical analysis, we were able to identify the emerging trend early…despite the backdrop of increasingly desperate rhetoric in financial markets.

That’s proved fruitful in early 2023, with copper now making headline news. It’s why our key copper play is up almost 50% since the recommendation went out to our Diggers and Drillers subscribers late last year.

Using this same strategy again in 2023, it’s why I believe China’s reopening will defy many analysts’ expectations. This is likely to spill over into emerging Asian nations as global capital shifts its focus from the US.

The effects should be especially positive for resource-based economies and their currencies.

If you’d like to hear more about capitalising on this opportunity, you can do so here.

Until next time, have a great week.

Regards,

|

|

James Cooper,

Editor, The Daily Reckoning Australia