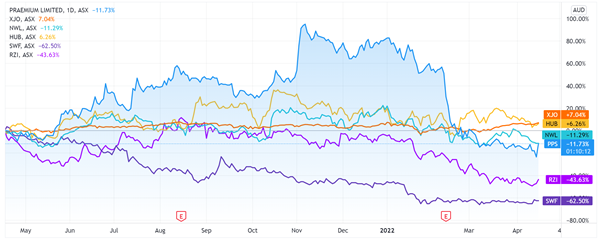

Finance app Praemium [ASX:PPS] is up 15% today after releasing a positive March 2022 quarterly update.

Despite today’s spike, the fintech company is down 50% year-to-date, falling sharply in February after disappointing half-year results.

The fintech industry has been hammered in the wake of the pandemic, with other financial platforms like Netwealth Group [ASX:NWL] and HUB24 [ASX:HUB] underperforming the broader market this year.

But does Praemium’s result today suggest a turnaround?/stock-ticker/asx-%5bnwl%5d

Source: Tradingview.com

Praemium’s quarterly flows rise 82%

Praemium announced that net inflows during the March 2022 quarter rose 82% to $725 million from the prior corresponding period.

The Australian segment net inflows accounted for $446 million, while international inflows accounted for $279 million.

Digging deeper, we find that the Australian segment boosted its inflows from $45 million — a big jump of nearly 900%.

However, international net inflows shrunk 26%.

Year-to-date net inflows rose 112% to $3.6 billion.

Again, the Australian segment saw net inflows jump from $900 million to $2.6 billion year-to-date.

International net inflows rose more modestly, totalling $1 billion, up from $800 million on the prior corresponding period.

Praemium’s total funds under management rose 26% to $47.7 billion.

The 26% increase was made up of three factors:

- Australian platforms rising 23% to $20.7 billion from a previous count of $16.9 billion.

- International platforms up 28% with $5.6 billion on last quarter’s $4.4 billion.

- Praemium’s non-custodial Portfolio Administration and Reporting Service (VMAAS) also climbing 28%, from a previous $16.7 billion to $21.4 billion.

Now, while net inflows did rise this quarter over the March 2021 quarter, Praemium’s total net inflows were lower this quarter than the preceding three.

In the June 2021 quarter, PPS’s total net inflows were $1.04 billion.

In the September 2021 quarter, net inflows totalled $1.66 billion.

And in the December 2021 quarter, net inflows came to $1.25 billion.

The March 2022 quarter net inflows, however, came in at $725 million.

Praemium did not announce any profitability metrics in today’s update.

PPS share price outlook

Praemium previewed a ‘strong pipeline of new business opportunities’ and predicts ‘continued FUA and revenue growth for the remainder of FY2022’.

PPS also said it’s focusing on ‘market-leading functionality’ and growth strategy by means of digital consent, enhanced fixed-term fees, and ESG insights.

Praemium’s CEO Anthony Wamsteker said:

‘We are delighted to report continued outstanding momentum this quarter with FUA levels of $47.7 billion. Net inflows have continued to grow strongly over the course of the current financial year.

‘This shows Praemium is delivering on our strategy to become one of Australia’s largest independent specialist platform providers.

‘It was also very pleasing to add a further $362 million into our highest revenue margin product, the Praemium SMA scheme, which is a record net inflow for a third quarter. We anticipate this strong growth trajectory to continue, with a healthy sales pipeline translating to FUA and revenue growth for the remainder of the financial year.’

Now, while Praemium finds itself operating in a sector that investors are warier of lately, other sectors are flourishing.

In fact, there are stocks out there that you may not know about, embedded in industries with technological and innovative ideas that could bring in the millions.

If you are interested in finding out what some of these are, then check out this free research report on seven stocks to watch like a hawk.

Regards,

Kiryll Prakapenka,

For Money Morning