The PPK Group Ltd [ASX:PPK] share price is up 9% today after Deakin University and PPK’s subsidiary strike lithium breakthrough.

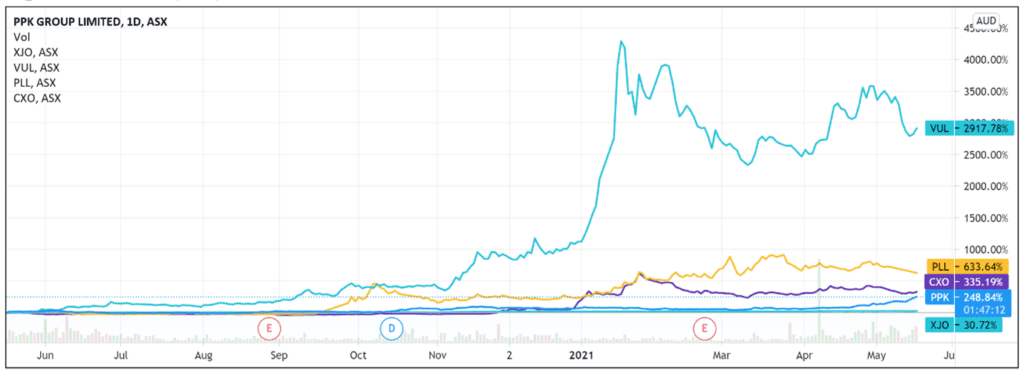

Having traded for just under $4 a share 12 months ago, PPK is now exchanging eager hands for more than $12 per share.

PPK shares have gained 210% in a year and have jumped 110% year-to-date.

‘Revolutionary’ new battery

Early this morning, PPK requested a trading halt pending a public announcement concerning ‘sensitive information from Deakin University … regarding a research development related to a PPK Group joint venture entity.’

The market didn’t have to wait long to appraise this sensitive information.

Two hours after requesting a trading halt, PPK announced that its 48% owned subsidiary Li-S Energy, together with research partner and fellow shareholder Deakin University, developed a ‘revolutionary new lithium sulphur battery.’

While lithium sulphur batteries possess higher energy capacity than existing lithium-ion batteries, to date they also degrade at a much faster rate.

Commercial applications have therefore been limited.

PPK’s announcement today, however, suggests that Deakin’s research team was able to improve the performance and life cycle of a lithium sulphur battery while retaining its high-energy capacity.

Three Ways to Invest in the Renewable Energy Boom

Who is PPK ?

Originally founded as a mining services company, PPK Group transitioned to a commercialisation company in recent years.

While retaining a mining services division, PPK now also owns or holds stakes in businesses from Craig International Ballistics, which supplies body armour to the Australian Defence Force, to Advanced Mobility Analytics, which develops AI for managing traffic.

PPK’s lithium play joint venture entity is Li-S Energy. Li-S Energy aims to commercialise lithium sulphur batteries.

Li-S researchers at Deakin University believe boron nitride nanotubes can be the answer to previous challenges in making lithium sulphur batteries viable over lithium-ion batteries.

Li-S Energy recently raised $20 million in a pre-IPO, giving it an approximate nominal market capitalisation of $300 million.

What is BNNT and lithium sulphur?

PPK’s ‘revolutionary’ lithium sulphur battery use boron nitride nanotubes (BNNT) technology.

BNNT is a space age and lightweight material used as an insulator in rechargeable batteries.

It also has applications in body armour, radiation protection, heat shields, fireproof clothing, and dental prosthetics.

Discovered in 1994, BNNT is 10,000 times thinner than a human hair but 1,000 times stronger than steel, and a sixth of its weight.

Last month, PPK Executive Chair Robin Levison told journalists that lithium-sulphur batteries using BNNT would be ‘far superior’ to existing lithium-ion batteries:

‘We believe that in every way you measure an electric vehicle battery — energy, density, recharge time, mileage, we think the Li-s will be at least three times superior.’

What are the next steps for the PPK Share Price?

PPK believes lithium sulphur batteries represent a ‘step-change in the global battery industry.’

But today’s breakthrough, while offering PPK validation, is only the beginning.

Further testing to increase the battery’s charge/discharge cycle will be conducted, for instance.

PPK’s subsidiary Li-S Energy also flagged it intends to first optimise the design and then scale up production ‘over the coming years.’

So, while the market was impressed by today’s announcement, it probably also recognises there is a long road to commercialisation ahead.

Lithium is capturing plenty of attention recently.

Its rising spot price and widely anticipated adoption of electric vehicles propelled many lithium stocks higher over the last 12 months.

These macro factors may even have spurred PPK to focus on lithium batteries as the commercial application of choice for its BNNT ventures.

So, if you’re eyeing off the lithium sector but wishing to gain further insight, I suggest reading this free report on ASX lithium stocks in 2021.

Regards,

Lachlann Tierney,

For Money Morning

PS: In this new report, Money Morning’s Ryan Dinse reveals why he is convinced that lithium is going to rebound in 2021. Get the FREE Report

Comments