In today’s Money Morning…a troublesome ‘grain of salt’…proactive not reactive economics…Powell is putting the Fed in a very awkward position…and more…

And so, it begins…

The latest Fed statement released overnight shows that the narrative is changing. Now with the majority of committee members anticipating a need to start raising rates by 2023. And seven of the 18 total members are signalling that we may even see a rate hike as early as next year!

So, it seems the spectre of inflation is doing what it does best.

Albeit, despite the fact that the Fed’s goals for ‘maximum employment’ are looking far more tenuous. A sign that prices are likely rising far faster than wages in the US.

But the market, of course, cares little for that.

All it is concerned about is when rates will rise, and when tapering will begin. Which, if you’re unfamiliar with the latter, is when we can expect the Fed’s asset purchasing program to wind down.

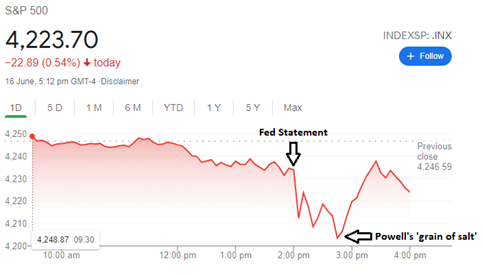

Which is precisely why US stocks sold off heavily upon the release of this latest Fed statement. Because if rates start rising sooner than expected, and the Fed’s money printing comes to an end, things could get ugly for investors.

That is unless Powell has something to say about it…

A troublesome ‘grain of salt’

See, less than an hour after the Fed’s statement went public, Powell was on the offensive. Coming to save the day for shareholders across the nation!

Or at least, that’s how it seemed:

‘Let me say a couple of things first of all; not for the first time about the dot plot.

‘These are of course individual projections, they’re not a committee forecast, they’re not a plan. And we did not actually have a discussion of whether liftoff [rate hikes] is appropriate in any particular year, because discussing liftoff now would be highly premature — wouldn’t make any sense.

‘The dots are not a great forecaster of future rate moves, it’s just because it’s so highly uncertain. There is no great forecaster of future dot…so dots to be taken with a big grain of salt.’

In other words, through some questionable rambling, Powell did all he could to allay market fears. And investors seemed to lap it right up…

Just take a look at how all three of the major US indices responded:

|

|

| Source: Google Finance |

|

|

| Source: Google Finance |

|

|

| Source: Google Finance |

So, while all three finished in the red, Powell did his damn best to stem the bleeding. A move that seems dramatically at odds with what the rest of his committee members appear to be thinking.

And more importantly, Powell was reluctant to mention when tapering would begin. Only stating that he sees ‘real value’ in telling us all ‘well in advance’, concluding that the Fed will ‘try to be clear’.

Make of that what you will, but in my view it is beginning to dawn on Powell that he is in over his head.

Proactive not reactive economics

See, whatever direction the Fed does decide on moving forward in — whether it be rate rises, tapering, or more — they’ve backed themselves into a corner.

Or rather, Powell has backed them all into a corner.

Because no matter how much he may try to cushion the blow with his reassurances, it seems the economics is slipping away from him. After all, the Fed’s improbable goals of maximum employment and modest inflation are already proving hard enough to manage. Whilst Powell is seemingly trying to achieve that without upsetting the stock market in the process.

He seems determined to complicate things for himself.

But then again, what else would you expect from a central banker?

Especially one who seems stuck with a reactionary rather than proactive mindset. The kind of disposition that almost undid the global economy back in ‘08.

Even our own RBA realised that in the aftermath of the last major downturn. As this old excerpt notes:

‘Central banks may need to become more proactive in dealing with dangerous asset bubbles before they become destabilising to the financial system, according the RBA.

‘In a paper co-authored by Reserve Bank governor Glenn Stevens, the central bank argues that keeping official interest rates too low for too long could inadvertently fuel imbalances that would lead to asset price bubbles.’

Powell, though, seems insistent on denying this obvious logic. Whether it be willful ignorance or plain old stupidity, I don’t know.

But I sure as hell would be nervous as a US investor.

And while our situation here in Australia is a little different, it wouldn’t take much for us to head down a similar road. Not to mention the fact that if Powell goes down the scorched earth route, it will reverberate across all markets.

So, while I’m not trying to suggest it is time to get out of the market while you can, I am suggesting you stay wary.

Powell is putting the Fed in a very awkward position.

How they get out of it will be something every investor will need to pay attention to.

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning

Ryan is also the Editor of Australian Small-Cap Investigator, a stock tipping newsletter that hunts down promising small-cap stocks. For information on how to subscribe and see what Ryan’s telling subscribers right now, click here.