The PointsBet Holdings Ltd’s [ASX:PBH] share price is slightly up today after the NFL selects PBH as its approved sportsbook operator.

PBH share price was up 1.7% at time of writing.

Does today’s lack of movement in PointsBet’s stock suggest the market is unsure of how to quantify the commercial potential of today’s announcement?

Or was this a piece of news largely anticipated by the market which has already priced in plenty of growth for the company?

Let’s consider the announcement in greater detail below.

PointsBet becomes approved NFL sportsbook operator

The US’s National Football League (NFL) today announced it selected PBH as an approved sportsbook operator (ASO), beginning with the upcoming 2021 season starting in September.

What benefits does PointsBet receive for being an ASO?

PointsBet said the partnership with NFL gives it sponsorship opportunities and brand visibility via ‘unique integrations across various television and digital assets.’

PBH is also set to gain use of official NFL data, which it says will enhance its customer experience (and may also enhance its AI for better net win margins).

The company said becoming the NFL’s ASO will work well with PointsBet being an exclusive sports betting partner of NBC Sports.

PBH said it would leverage its NBC deal to ‘promote the PoinstBet brand during NFL events.’

PBH Share Price ASX outlook

Having announced a $400 million capital raising in July to strengthen its position for ‘long term success’, PointsBet is squarely in the growth phase.

With that can come plenty of market expectation.

For instance, PBH currently has a market cap of $2.46 billion on FY2020 revenue of $75 million.

And while the latest H1 FY21 saw net revenue jump from $27 million to $75.1 million, the firm is still trading on a large market cap with a H1 FY21 EBITDA loss of $69 million and a Price-to-Sales (P/S) ratio of 20.

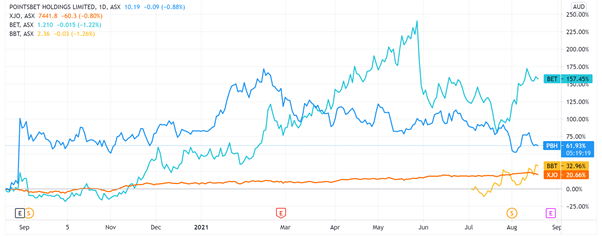

That said, industry peer BlueBet Holdings Ltd [ASX:BBT] has a P/S of 18.

Large industry player Draft Kings Inc [NASDAQ:DKNG] also has a P/S of 19.7.

Interestingly, ASX rival BetMakers Technology Group Ltd [ASX:BET] has a substantially inflated P/S of 85.

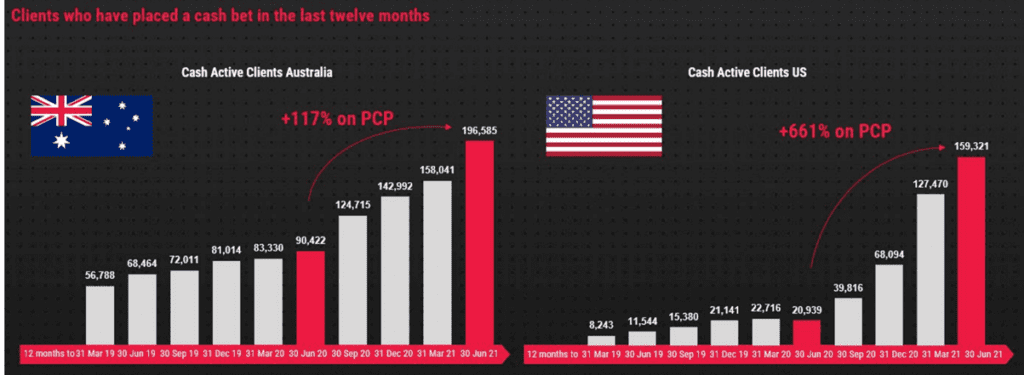

What shareholders will likely assess is the impact today’s NFL sportsbook announcement can have on PBH’s active US users.

As the company’s Q4 FY21 showed, US active clients are showing strong growth and are nearly approaching PBH’s Australia active client total.

So could PointsBet becoming an approved NFL sportsbook operator accelerate the growth in US active clients?

Potentially.

The company did report in 4Q FY21 that during the year, it was integrated into coverage in and around NHL and NBA playoffs, which allowed ‘PoinstBet to reach sports fans during peak events, helping it further grow its brand awareness.’

With its large marketing outlay and heavy investment in growth, investors will likely evaluate PBH’s success by how quickly it can grow its customer base in key markets and how much value it can extract from this base.

Source: Market Screener

PBH’s growth strategy has seen market analysts forecast large revenue growth into FY23, but the losses look set to rise well into FY22.

The key will be whether by FY23 PointsBet reaches enough critical mass with its users to start tapering marketing spend and improve its margin.

What PBH does highlight is the return potential of the small-cap sector.

This time two years ago, PointsBet was trading at $2.50, and even fell to $1.30 in March 2020. Since then, PBH has gained more than 300%.

As our market expert Murray Dawes pointed out yesterday, investing in small-caps can be ‘an incredibly rewarding experience if done properly.’

Murray, alongside fellow market analyst Ryan Clarkson-Ledward, runs a small-cap advisory that focuses on scouring the market for stocks that are ‘nearing their inflection point for growth and cash flows.’

So if you’re interested in reading about their work further, read on here.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here