The Plenti Group Ltd’s [ASX:PLT] share price is largely flat today despite the lender growing its loan book by 61% year-on-year.

Plenti — the consumer lending and investing platform — saw its shares drop as much as 4.5% in early trade before recouping some of the losses to trade 1% down at e time of writing.

PLT’s FY21 results release today coincided with the IPO of another non-bank lender.

Pepper Money Ord Shs [ASX:PPM] debuted on the ASX today with an implied market capitalisation of $1.3 billion at the offer price of $2.89.

Both lenders are likely to end today in the red, with Pepper Money currently trading 13% below its offering price.

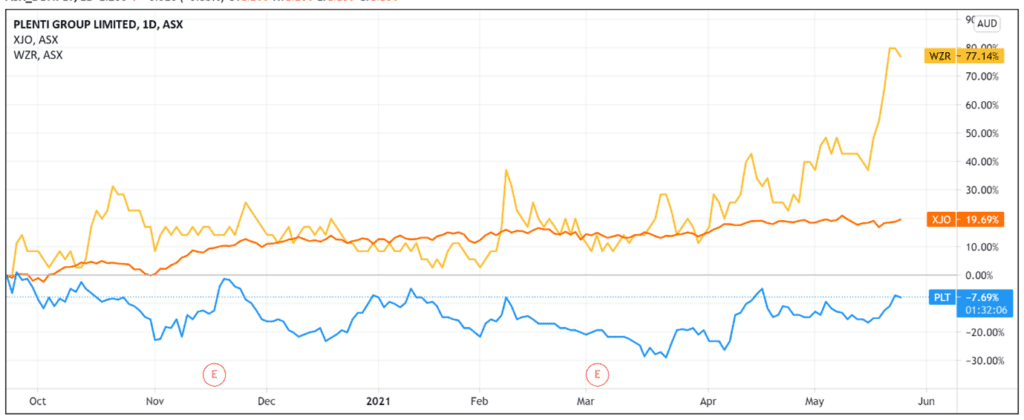

As for Plenti, year-to-date the PLT stock has largely traded sideways and is down 7% over the last 12 months, underperforming the ASX 200 benchmark by 30%.

Plenti of highlights

Here are Plenti’s financial highlights:

- ‘Record loan originations of $470 million, up 64% year-on-year.

- ‘Record loan book of $615 million, up 61% year-on-year.

- ‘Record revenue of $53.1 million, up 28% year-on-year.

- ‘Pro forma cash NPAT of $(6.8m), a 42% improvement year-on-year.’

And here are the company’s operational highlights:

- ‘Increased warehouse facility capacity from $50 million to $450 million.

- ‘Reduced funding costs on new loan originations by 190bps year-on-year.

- ‘Materially reduced operating costs per dollar funded, evidencing operating leverage.

- ‘Delivered market-leading credit performance with 0.96% net loss rate and low 90+ day arrears.

- ‘Delivered significant technology and product advancements, including introduction of BNPL finance.

- ‘Successfully completed IPO, raising $55 million.’

Outlook for the Plenti Share Price

Source: Tradingview.com

Looking out, PLT stated that its financial priorities include reaching a $1 billion loan portfolio by March 2022.

The company also noted that it is setting itself the target to achieve positive monthly cash NPAT before June 2022.

As part of this profitability target, Plenti is also driving towards a cost to income ratio below 35% over the medium term.

Plenti posted record loan originations and record revenue in FY21, but the market wasn’t that enthusiastic about its record breaking.

And rival non-bank lender Pepper Money isn’t popping at its IPO, currently down on its offering price.

What could be a possible explanation?

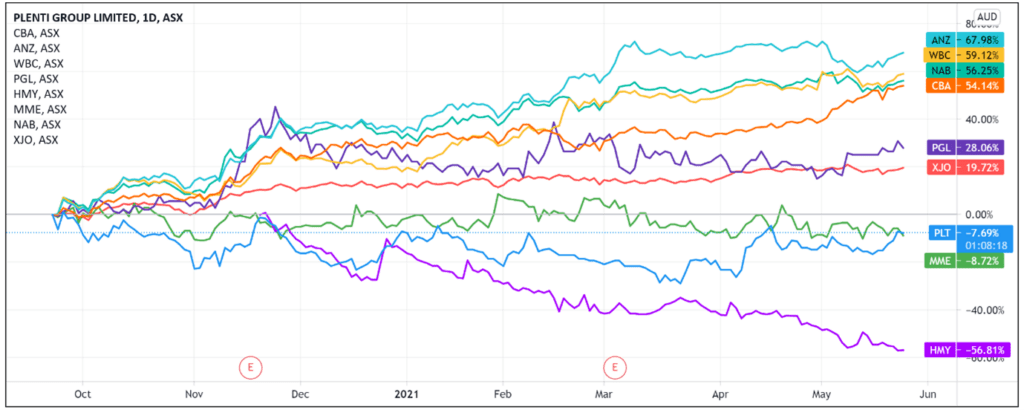

It is interesting to compare the share price action of the Big Four banks compared to the ASX-listed non-bank lenders like Plenti.

As the above chart shows, the Big Four are all outperforming both the ASX 200 and their non-bank lending rivals.

The big four banks have recovered well from the March 2020 doldrums and have posted bumper results last month, as we’ve covered recently.

For instance, Australia and New Zealand Banking Group Ltd [ASX:ANZ] reported a 126% increase in cash profit to $2.9 billion.

National Australia Bank Ltd [ASX:NAB] reported a 94% increase in cash earnings to $3.3 billion.

And Westpac Banking Corp [ASX:WBC] reported cash earnings of $3.5 billion, up 256%.

Strong numbers that most likely made the bluest of blue-chip stocks even more attractive to investors in a climate marked by a rotation out of growth into safer, value plays.

Especially since the banks’ profitability dwarfs the profitability of the fintech upstarts.

For instance, Plenti’s FY21 pro forma cash net loss after tax came in at $6.8 million.

It could be the case that newer fintechs like Plenti are being sidelined right now despite growth in areas like originations and loan book size.

Whichever way you look at it, it’s clear that Australia’s stalwarts — the Big Four banks — have more competition from upstart fintechs than ever before.

Whether they can ride out that competition or whether they’ll eventually cede market share to these new players is difficult to say at the moment.

But if you’re interested in the fintech sector, then I suggesting checking out our fintech report.

Alternatively, if you’re fascinated by all the crytpcurrency fuss and wondering what to make of the claims regarding the impact of blockchain and cryptos on financial systems, then check out this special briefing by Ryan Dinse and Greg Canavan on what they are calling a ‘New Game’.

Traditional finance players like the big banks profiled here are moving quickly to adapt to it. But there’s a good chance they won’t be able to move fast enough.

You can watch the whole presentation right here.

Regards,

Lachlann Tierney,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here