Sydney-based fund manager Perpetual [ASX:PPT] is unhappy with its current levels of growth. This is hardly news for anyone following the company, as its shares have dropped sharply from the early year highs.

After its $2 billion takeover of its rival Pendal last year, the financial services giant has struggled to deliver tangible benefits from the deal.

PPT is now down -7% in the past 12 months after the company saw a sharp drop after releasing its middling FY23 results.

Investors have regained some hope, with shares currently up by 4.20%, trading at $23.30 per share. The movement came after PPT told shareholders it had ‘started exploring the benefits’ of separating its businesses.

Perpetual said it may consider separating its corporate trust and wealth management business and creating a more ‘focused’ asset management business.

What has spurred this change, and what does it mean for investors?

Perpetual split on the cards

The listed fund manager has had a tough year in the markets. The global fund group saw FY23 underlying net profit after tax of $163 million, 10% higher than FY22.

Its statutory net profit after tax was $59 million, down 42% from last year, though much of this was due to costs associated with its acquisition.

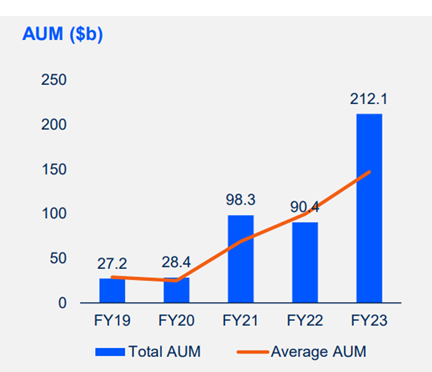

The company has deployed large sums of cash to increase its assets under management (AUM) through buyouts.

Source: Perpetual FY23 Report

Thanks to those acquisitions, AUM doubled last financial year, reaching $212 billion. But underperformance by those new buys and a general malaise in the market this year has hurt funds.

Perpetual saw approximately $8.1 billion in outflows, predominantly from its US equities strategies.

Rob Adams, Perpetual group chief executive, said:

‘Whilst net outflows for FY23 were disappointing, we continue to be encouraged by the trajectory of flows across several capabilities including Barrow Hanley which improved its overall flow profile on the back of demand for its global and emerging market strategies combined with a moderation in US equity outflows.’

Despite the outflows, 78% of the group’s investment strategies have outperformed benchmarks over three years.

One notable exception is the newly acquired Pendal, where nearly a third of the funds underperformed the market.

Pressure has been on the firm to return to solid performances after Perpetual’s head of equities, Paul Skamvougeras, resigned in the run-up to the Pendal takeover.

So, what is the likelihood of a major shakeup, and what could it mean for shareholders and investors?

Outlook for Perpetual

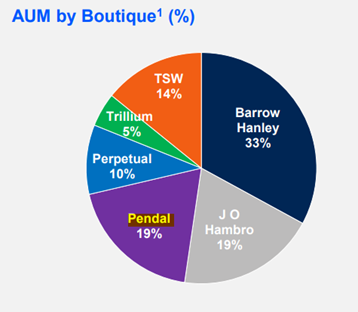

The strategic refocus for PPT will likely lie in its collection of boutique asset management funds. The company has seen strong performance in its specialist ESG Trillium Fund and Barrow Hanley.

But its disparate collection of boutique offerings has made it tough to manage along with its other segments.

This is how its FUM is currently split between the group.

Source: Perpetual FY23

Its Corporate Trusts and Wealth Management arms are likely on the chopping block with its new simplifying strategy.

This may mean potential divestment and/or demergers of these parts of the business.

The Group has reportedly approached Goldman Sachs, Bank of America, and Luminis Partners to assist with its next move.

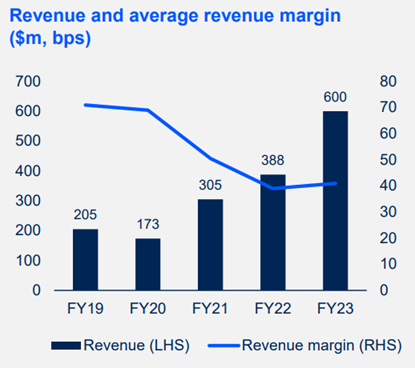

A major part of the shift will be the desire to return revenue margins to the group, which has struggled in the challenging investor environment.

Source: Perpetual AGM 19-10-23

The refocus would also likely give the company space to bring Pendal into the fold properly. The promised synergies from the merger have yet to be seen. It seems the fierce autonomy each fund holds extends to wider management.

For shareholders and investors, the refocus should be a welcome one. A clear part of this is to return shareholder confidence and earnings.

Perpetual has been well known for its sharp critiques of other company’s capital allocation. Their latest Australian strategy is to invest heavily in company shares and use its shareholder position as a bully pulpit.

As Australian head of equities, Vince Pezzullo, said:

‘We don’t know how to run a gas plant, but we do know how to allocate capital and recognise good decision-making.’

The latest move seems to get ahead of the growing discontent among shareholders and set the path straight. Otherwise, the finger may be pointed in the other direction.

An investment worth watching

If you’re looking for other stories to invest in, look no further than the incredible moves of Bitcoin [BTC].

The asset many had claimed dead has now pulled a return of 160 % for the past 12 months. That makes it the best-performing asset class this year. That’s 106% better than gold, which has also had a strong run.

Compare that to the ASX 200s -2.07%, and you can see why more people are taking notice.

Our exponential investor and tech specialist, Ryan Dinse, has been a long-time cryptocurrency investor and isn’t surprised at all.

In fact, he mapped out these movements. What is next on his timeline?

Could Bitcoin go to US$1 million? Does that sound ridiculous, too good to be true?

Watch his video here to see how the market looks as the bull run begins and where it could be headed next.

Regards,

Charlie Ormond

For Fat Tail Daily