Explorer, evaluator, and developer of mineral deposits in both Australia and Canada, Panoramic Resources [ASX:PAN] announced on Thursday morning that it has updated its mine plan based on September 2022’s mineral studies.

Not only will Savannah have a longer life of mine, but the minerals miner also suspects there to be higher annual metal production and improved financial outcomes for the project.

PAN was trading for 12 cents at the time of writing. The stock price has plummeted 22% in the past month, and 59% across the last 12 months.

Compared to its sector average, PAN is also down by more than 61%, and 56% below the market average:

Source: TradingView

Improvements to Savannah’s prospects

On completing its September 2022 minerals resource and ore reserve estimates, the diversified miner has looked closer at its current cost and ramp-up profile for the Savannah Nickel Operation and made some heady conclusions.

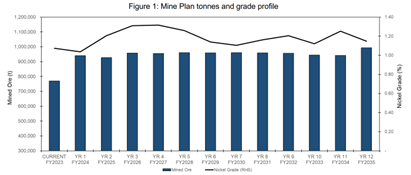

It appears the miner’s surveys have returned uplifting results, suggesting Savannah’s mine life is to be extended to more than 12 years, through to FY35, all the while providing majority of ore from the Savannah North orebody.

Together with this news is a higher average annual metal production, as well as financial outcomes that come with it, with average annual production from FY24 to the end of FY35 of 9,402t (tonnes) nickel, 5,046t copper, and 714t cobalt metals (concentrate).

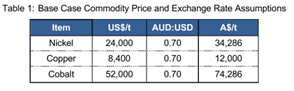

All-inclusive average costs are forecast to be around $8.57 a pound of nickel payable by the end of FY35.

Commenting on updated plan, PAN Managing Director and CEO Victor Rajasooriar said:

‘The updated Mine Plan for Savannah confirms the significant value of the asset and where we expect the steady-state performance of the asset to reach with the ramp up now well advanced. The path is paved for at least 12 years of strong production through to the end of FY35. This update is based on the latest Resource update and applies the learnings gained from our recent operating experience, updated commodity price forecasts and the high-cost environment we are currently experiencing.

‘The Mine Plan continues to provide an attractive base case for Savannah, with significant scope to further enhance the mining inventory by upgrading Inferred Resources and testing the Savannah North orebody at depth and along strike where it remains open. Furthermore, the Project is highly leveraged to nickel price upside that is expected to be driven by the electric vehicle market, as evidenced over the past year.’

Panoramic says the updated mine plan builds on its previous technical studies, with fundamental aspects of the operation mostly unchanged — things like mining methods, geotechnical parameters, and ore processing.

Mine scheduling has been adjusted to ramp up ore production to nameplate capacity of 960,000t annually from FY24, with Savannah North ore underpinning Pan’s strategies and 20,0000 tonnes a month of Savannah ore already scheduled.

Source: PAN

Drill baby drill: the drilling boom approaches

Believe it or not, the diverse range of raw materials is an industry making massive bull market-like gains in the face of recession, interest rates, and wider market sentiment.

This can be described as an alternate universe, the universe of booming drillers.

More of these booms are marked to happen for every single metal that can be found on the period table.

It’s been described as a ‘new golden age’ for junior explorers — and for investors who get in early.

Aussie mining is at its best right now, but if so many of them topped 2022, can they really do it again in 2023?

Yes, it’s very possible. Many are small caps primed to grow into mid-to-large caps, but how do you tell which ones?

You may need a little help from our commodities expert James Cooper.

He’s found six ASX mining stocks that are heading to top the charts.

Regards,

Mahlia Stewart,

For The Daily Reckoning Australia