Paladin Energy Ltd [ASX:PDN] is seeking $215 million to restart its Langer Heinrich uranium mine in Namibia.

The decline in the uranium market led PDN to place the mine into ‘care and maintenance’ in May 2018.

But Paladin is sensing conditions are improving and tapped the market for funds.

The equity raise comes after PDN gained more than 110% in the last 12 months:

Source: Tradingview.com

Paladin taps market for $215 million

Paladin has launched a $200 million fully underwritten institutional placement to fund a production restart at Langer Heinrich.

A further non-underwritten share purchase plan is expected to raise a further $15 million.

New shares are set to issue at 72 cents per share, representing an 8.9% discount to the last closing price of 79 cents.

The Langer Heinrich Mine is a large open pit mine located in the western region of Namibia.

While Paladin has a 75% stake in the mine, the remaining 25% belongs to the Chinese National Nuclear Corporation (CNNC).

The mine has been under maintenance since 2018, but Paladin thinks the time is right to get it back up and running.

PDN said the decision to restart production was supported by:

- Successful uranium marketing strategy

- Strong uranium market fundamentals with ‘positive macro tailwinds for uranium driven by nuclear’s position as a reliable, low carbon baseload power source’

- A Mine Restart Plan providing a ‘low-risk pathway to a return to production’

Paladin estimates that after the equity raising it will have about $259 million in cash, with no corporate debt.

Source: Paladin Energy

Paladin secures sales tender award

In another announcement this morning, Paladin revealed it had secured a sales tender award.

PDN’s tender award is for an offer to supply uranium concentrates to a subsidiary of Duke Energy, a ‘leading Fortune 150 North American power utility.’

This alliance with Duke Energy is consistent with Paladin’s uranium marketing strategy of securing contracts with global industry counterparties.

Paladin CEO Ian Purdy commented:

‘The improving outlook for uranium markets and the transition towards the decarbonisation of global electricity generation provides the platform for an exciting period ahead for Paladin and I look forward to updating you on our progress.’

And what does the $215 million capital raise mean for investors?

Paladin share price outlook

Restarting the Langer Heinrich Mine is undoubtedly a big milestone for Paladin after the mine’s years of dormancy.

Securing agreements with global power utilities is also positive.

But given uranium’s recent bear market, how will investors react? How cautious will they be?

Paladin itself thinks the market is looking strong.

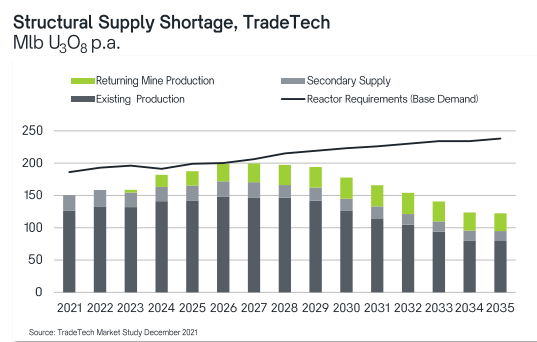

PDN cited figures suggesting that ‘current primary uranium supply is unable to meet current demand.’

The miner thinks projected production from returning mines will not be sufficient to meet the upcoming deficit.

Source: Paladin Energy

Of course, if you are hesitant about uranium stocks, there are plenty of other unique, high-potential opportunities to consider right now.

Particularly for those interested in small caps.

These sorts of companies are high-risk, but the risk is offset by the large potential gains.

Our leading small-cap stock market analyst Murray Dawes has recently found seven stocks on the ASX today he believes fit this description.

I recommend you check the seven stocks out.

You can download Murray’s free report here.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Along with your free report, you’ll get a free subscription to Money Morning — an investment e-letter that aims to help everyday Aussie investors find the hottest trends and stocks on the ASX, long before the mainstream’s reporting on them…click here to get started.