I came across this extraordinary quote last night.

It read:

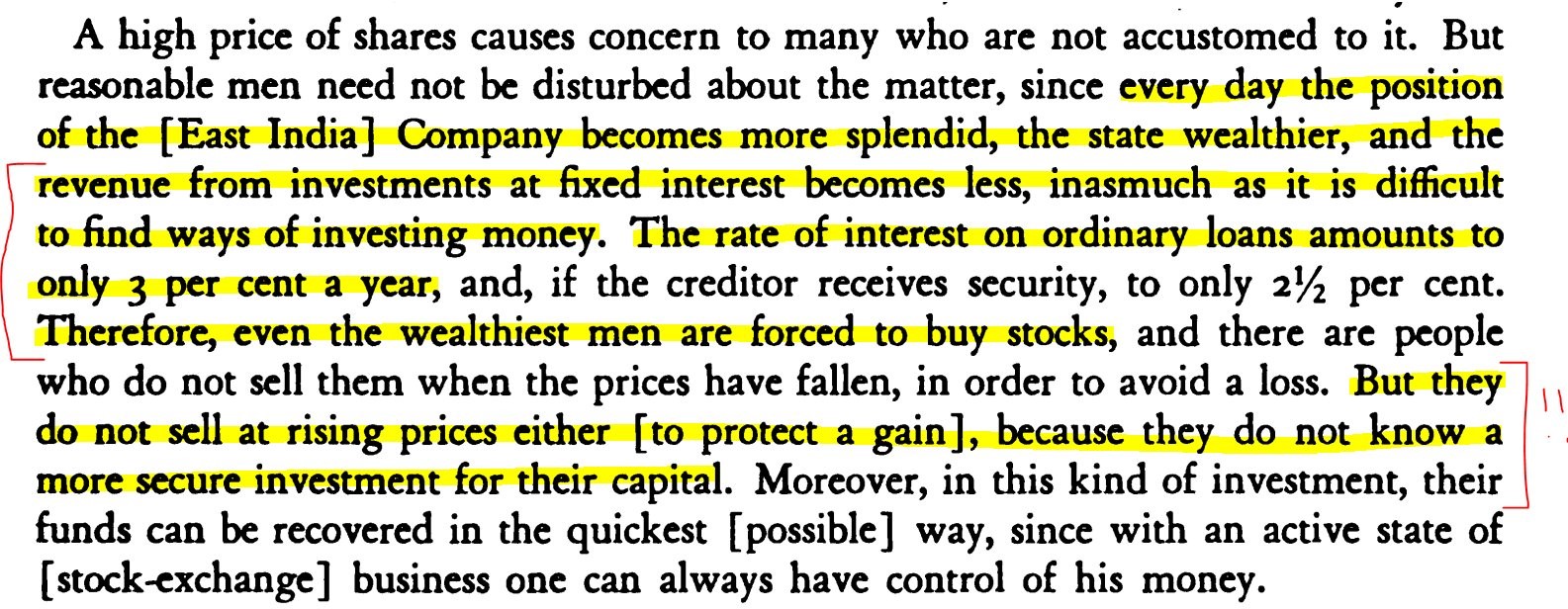

‘Interest on ordinary loans amounts to.. 2.5%… Therefore, even the wealthiest men are forced to buy stocks… and do not sell at rising prices either, because they do not know a more secure investment for their capital.’

What’s amazing is that this was written in 1688!

It was in a book called Confusion de Confusiones, which was written by Joseph de la Vega, a Portuguese Jew living in Amsterdam over 300 years ago.

Stay up to date with the latest investment trends and opportunities. Click here to learn more.

Here’s the full passage for context:

|

|

|

Source: Courtesy of Jamie Catherwood (Twitter @Investor Amnesia) — Confusion de Confusiones |

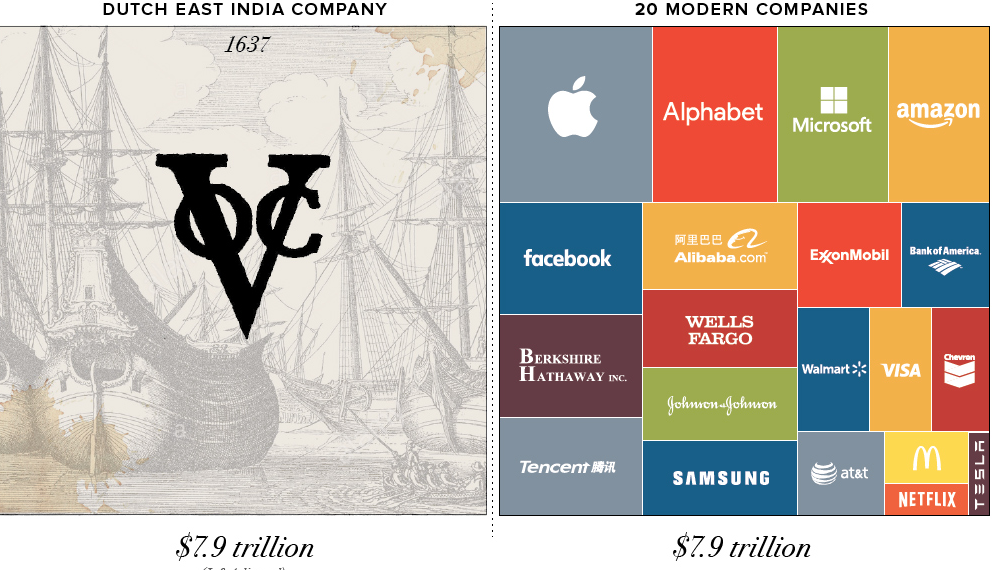

Vega was commenting on the rapid rise in the value of stocks such as the famous Dutch East India Company — a company that’s estimated to be the most valuable company to have ever existed.

So valuable it dwarfs the current tech giants of even today (adjusted for inflation).

|

|

|

Source: Visual Capitalist |

It’s no wonder investors back then were wondering if perhaps valuations had gotten out of control!

But regardless of the specifics, doesn’t the sentiment sound familiar?

Nosebleed stocks valuations in an environment of low interest rates and cheap money. It pretty much sums up the ‘everything bubble’ we’re living through right now.

And it’s an investor’s biggest dilemma.

Sure, stocks might look overvalued, but what’s the alternative?

Money is losing its value

The hidden truth?

Things aren’t going up per se.

One thing is just going down. Fast.

Yes, stocks are going up, property is going up, gold is going up…all because the value of money is being trashed.

Negative interest rates, money printing, higher and higher deficit spending. They’re all attacks on the soundness and value of money.

Looked at that way, we’re not really seeing everything going up, but just one thing — money — rapidly going down.

But I’m making no judgments, nor issuing any doomsaying predictions on this matter today.

The market is as it is. And as it always has been.

As the great early 20th century trader Jesse Livermore once said:

‘The pockets change, the suckers change, the stocks change. But Wall Street never changes. Because human nature never changes.’

I thought this point was worth reiterating today.

As the quote at the start showed, investors have been grappling with the same issues for centuries, if not millennia.

It’s both a good reminder and a warning at the same time.

A reminder that things don’t really change, things are never ’unprecedented’ or ‘different this time’.

But it’s also a warning that you need to be able to look beyond the headlines if you really want to make money in the markets.

And on that front, one thing is clear to me…

This never goes out of style

Amid all the macro noise, the elections, the coronavirus panics, and the political bickering, there’s one sure fire way to make money in this type of market.

And that’s to ignore it!

I’m serious here.

If you want to make good returns over the next couple of years, you need to forget the headlines and instead look for good companies to invest in.

That sounds obvious. But it’s easy to forget these days.

Everyone thinks they have to have an opinion on the ‘big picture’ at all times.

But if you can just find good stocks, ran well, with good prospects to grow and make profits (as good companies do), then investing can really be as simple as that.

Now I’m obviously biased, but I think the best place to find such opportunities is in the small-cap space.

It’s the one area of the market that isn’t heavily influenced by all the macroeconomic games going on.

For example, small-cap stocks aren’t getting priced at ridiculous multiples just because they’re part of an index fund.

For example, Amazon.com, Inc [NASDAQ:AMZN] is a great company, but it’s priced at a price earnings (PE) ratio at a whopping 103.

103 years to get your original stake back?

No thanks!

I’m not the only one that thinks like this either…

Your guide to 2021’s hottest small-cap stocks

My friend and colleague Ryan Clarkson-Ledward runs the excellent Australian Small-Cap Investigator advisory, an investment advisory service dedicated to finding good Aussie small-cap stocks in any and all market conditions.

And while not every pick has been a winner, he’s doing a damn fine job.

Just this year he tipped a small betting company that’s already up over 180%, a mining tech company that’s up 21% (I really like this one), and two gas stocks up around 30%.

I stress these were all picks from this year and in small companies you won’t read about in many other places.

I think this is the way forward for investors who are keen to take the added risk and back themselves in 2021.

It’s your chance to find hidden value in a volatile sector while everyone else is distracted by the screaming headlines.

If you’re keen to find out how you can get involved, read this now…

Good investing,

|

Ryan Dinse,

Editor, Money Morning

PS: Four Well-Positioned Small-Cap Stocks — These innovative Aussie companies are well placed to capitalise on post-lockdown megatrends. Click here to learn more.