The Openpay Group Ltd [ASX:OPY] share price is down today after its quarterly update revealed top-line growth but operating cash losses.

The OPY share price opened today’s trade up 3.3% but fell as the morning progressed.

At the time of writing, Openpay shares are down 4.6%.

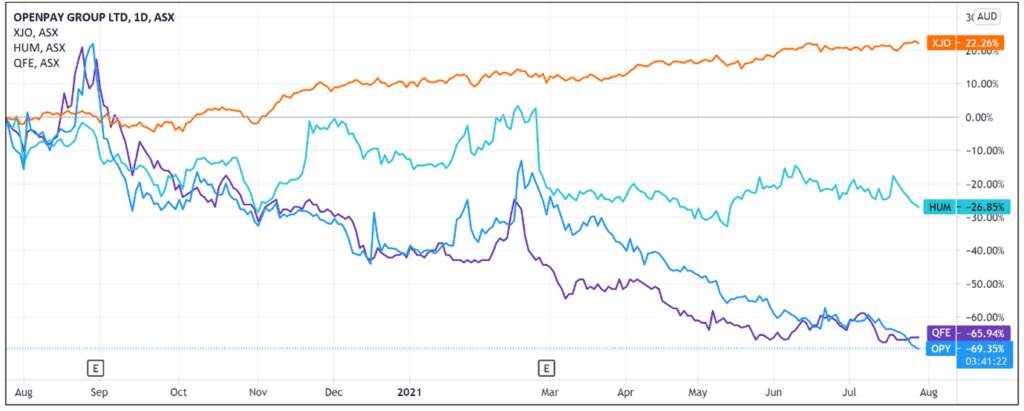

Today’s decline continues Openpay’s slide this year, with the stock down 65% over the last 12 months, underperforming the ASX 200 by 90%.

Openpay continues top-line growth

Here are the key highlights from OPY’s latest quarterly results:

- Active customers grew 69% to hit 541,000

- 51% of all active customers are from the UK

- Active merchants grew 77% to hit 3,800 — the highest such increase in active merchants in OPY’s history

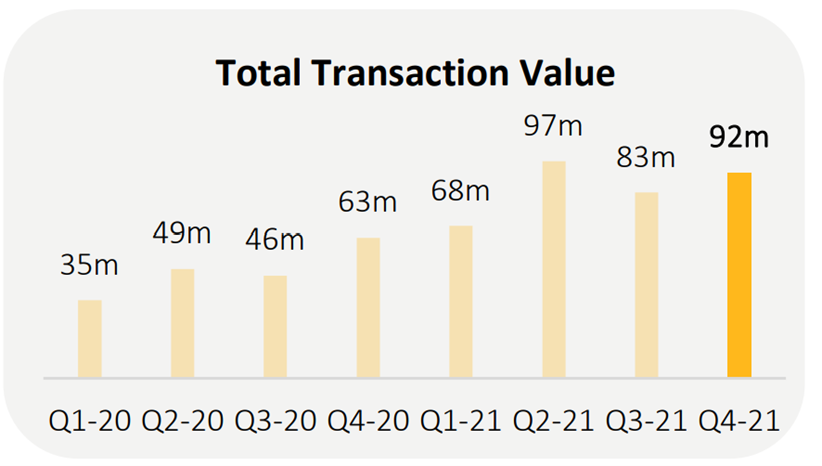

- Total transaction volume (TTV) rose 46% year-over-year to reach $92 million

Although TTV increased year-over-year and over the previous quarter, it was still down 5% from Q2 FY21.

‘Pivotal quarter’

Openpay CEO Michael Eidel called the quarter ‘perhaps the most pivotal for Openpay since we announced our US launch in December.’

The quarter was significant as it included the acquisition of leading UK BNPL auto provider, Payment Assist.

Prior to the acquisition, OPY already had 51% of its active customers come from the UK segment. So the acquisition can likely help solidify the UK as OPY’s strongest market.

This UK push contrasts with the likes of Afterpay Ltd [ASX:APT] and Zip Co Ltd [ASX:Z1P], whose growth focus remains on the US.

But Openpay isn’t passing up the chance to expand into the lucrative US market. It is set to launch its Opy USA BNPL service in October 2021.

The launch will be anchored by an ‘integration with large wholesale merchant aggregators and key strategic partnerships’ in OPY’s core verticals of healthcare, automotive, and home improvement.

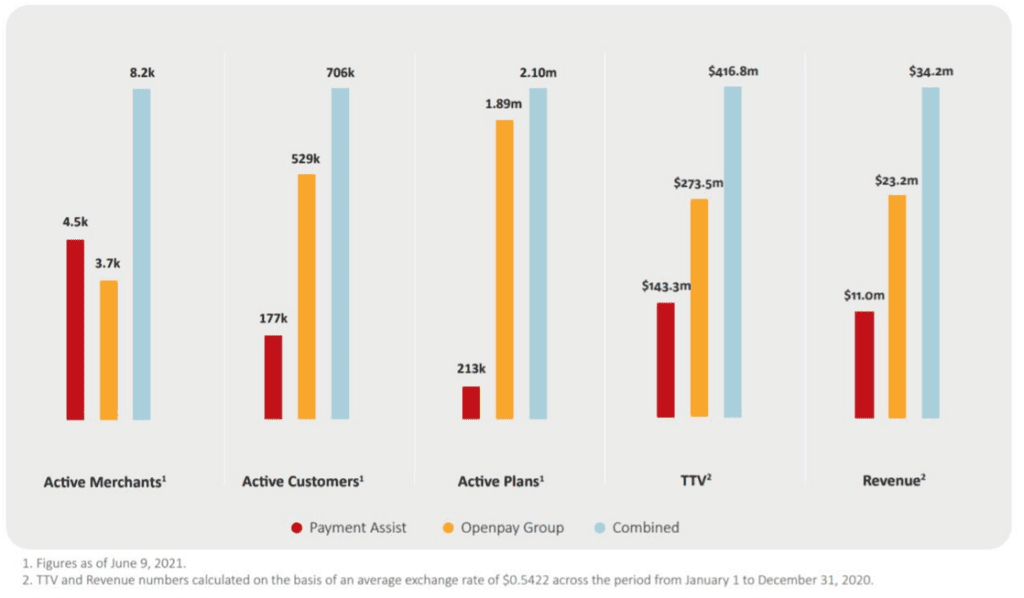

As of 9 June 2021 — and combining the metrics from the recently acquired Payment Assist — Openpay had 706,000 active customers, 8,200 active merchants, and total transaction volume of $416.8 million.

Interestingly, prior to being acquired, Payment Assist boasted more active merchants than Openpay.

Openpay share price outlook

Citing its ‘significant achievements’ in FY2021, Openpay thinks it can scale up its business to create the ‘unit economics which provide clear pathway to profitability in the mid-term.’

A common question with BNPL stocks is this — how much growth is left in the BNPL space?

Can newer entrants carve out a niche or will the BNPL sector consolidate around big players like Afterpay, Klarna, and Affirm?

Something Openpay mentioned in its latest quarterly can help answer the question.

OPY raised the interesting point that the BNPL market is no longer all about top-line and customer growth.

In the company’s view, the market increasingly values ‘healthy margins and defendable competitive positions based on integration partnerships as moats.’

Of course, healthy margins are partly a function of competition. The more competitors on the market, the harder it is to maintain healthy margins as rivals start competing on price.

However, if a company has a genuine competitive advantage, that makes maintaining margins easier.

Regarding margins, Openpay claimed in today’s release that it has ‘market-leading revenue margins’ at 6.5% for the quarter and 7.6% for the year.

For reference, in H1 FY21 Afterpay posted a revenue margin of 3.8% of underlying sales and a net transaction margin of over 2% of underlying sales.

Source: Company presentation

Investors will note, though, that the revenue margin has trended down from the Q32020 peak, maybe suggesting the effects of a competition squeeze.

OPY still maintains its longer-term objective of a 9% margin.

Investors will likely also note Openpay’s revenue margin was not enough to cover operating losses.

For the quarter ended 30 June 2021, OPY received $95.91 million from customer receipts against $95.68 million in merchant payments.

Openpay ended the quarter with a net cash loss from operating activities of $21.93 million.

The losses were offset by $43.88 million from financing activities, leaving the company with $52 million in cash and cash equivalents.

Openpay still has $162 million worth of unused finance facilities available.

If you are interested in fintech stocks, then check out our report on three new small-cap fintechs with exciting growth potential.

Regards,

Lachlann Tierney,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here