Sam Altman, the CEO of OpenAI, is no stranger to bold bets on the future. His latest project, Worldcoin, is one of the most ambitious — and controversial — yet.

I bring this up because this week brought fresh headlines:

‘Wall Street analyst Dan Ives has joined a small Nasdaq-listed firm that plans to hold Worldcoin as its treasury asset.’

If you don’t know Dan, he’s famous for two things. Being the biggest AI bull on TV… and his colourful outfits in interviews.

|

|

| Source: Bloomberg Surveillance |

While financial endorsement matters, the bigger story lies in what Worldcoin represents: a push toward biometric surveillance in the name of digital identity.

Worldcoin’s signature device is called the Orb — a sphere that scans a person’s iris to generate a unique identifier known as World ID.

In return, participants are rewarded with the project’s cryptocurrency, WLD. The rewards vary by country, but it’s roughly $26 bucks in the US today.

The pitch is simple: in an age of AI deepfakes, bots, and synthetic voices, the world needs a reliable way to prove you’re human.

So, would you look into the orb and give up your biometric data for chump change?

|

|

| Source: CNBC |

I trust you would fall firmly into the ‘NO’ camp, but I’d be interested to hear if you think differently.

While US$16–30 may seem paltry to us, these sums have a much different meaning in Africa and other developing countries.

That’s how the company initially built up its numbers to entice Western investors. A huge drive through sub-Saharan Africa and other poorer nations — exploitation in a digital age.

Now the system is quickly spreading in the West. Sites are already active in the US and the UK, with Orb locations open in many major cities.

So far, World reports over 13 million verified users, who can log into platforms like Reddit or Discord using their World ID.

For Altman and his team, this is the foundation of a new digital infrastructure: proof-of-personhood that is portable, anonymous, and blockchain-based.

As AI grows more powerful (they argue), society will need this kind of verification to protect against fraud and abuse.

A Speculative Storm

Enter Dan Ives, Wedbush Securities’ superstar analyst.

This week, he became chairman of Eightco Holdings, a small company that raised US$250 million to buy and hold Worldcoin as its core asset. Eightco is even changing its ticker to ORBS.

Ives called World ‘the de facto standard for authentication and identification in the future world of AI.’

His involvement is already boosting confidence in the project among investors, much as Michael Saylor’s MicroStrategy once did for Bitcoin.

The token price is up 80% in a week.

| |

| Source: Coingeko |

But financial endorsements are only one side of the story.

The real debate is whether scanning people’s eyes to access the digital world is a step toward safety — or surveillance.

The Prisoner

In my opinion, Worldcoin risks becoming a global biometric database, no matter how many privacy promises the company makes.

The project says raw eye images are deleted and only encrypted ‘iris codes’ are stored.

But even anonymised biometric data is sensitive: once compromised, unlike a password, your eyes can’t be changed.

Can a company, no matter how well-intentioned, guarantee that billions of biometric scans will remain private and secure for decades? Unlikely.

Beyond security, there’s the issue of consent and power.

If digital IDs become required for accessing services, critics warn that participation may shift from voluntary to effectively mandatory.

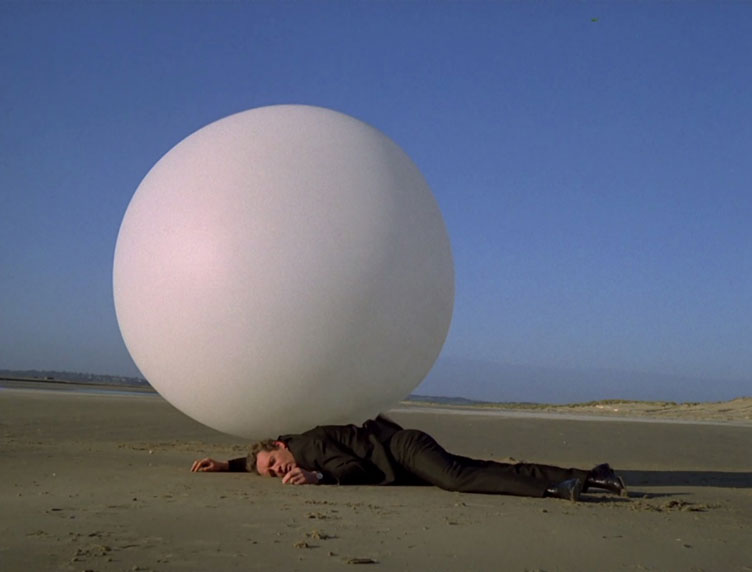

The whole thing reminds me of my favourite old dystopian show, The Prisoner, in which a certain orb also lorded over questions of identity and security…

|

|

| Source: The Prisoner 1967, Patrick Mcgoohan |

Lessons From Other Digital ID Systems

History serves us some cautionary tales.

India’s Aadhaar system, the world’s largest biometric ID program, has reached over a billion people but has also been dogged by reports of data leaks, misuse, and discrimination.

Instead of levelling the playing field, Aadhaar has deepened inequalities for those unable or unwilling to enrol.

In many states in India, if you don’t have an ID, you can’t receive official education certificates, or are at the mercy of local bureaucrats for benefits.

As Yale researchers concluded:

‘When the telecom company, the bank, your school, and the hospital have your Aadhaar number, it’s a small step to linking up your behavior with communications, finance, education, health, and everything else.’

|

|

| Source: Insights |

In the West, we’ve historically bristled against attempts by governments to impose digital controls.

But now Worldcoin is attempting to position itself as a decentralised, private alternative — but the questions are strikingly familiar.

The fusion of identity, AI and cryptocurrency adds another layer of complexity. By rewarding users with WLD tokens, Worldcoin mixes financial incentives with its biometrics.

In my eyes (pun intended, sorry), this looks more like a ‘pay-for-data’ scheme, where vulnerable populations trade long-term privacy for short-term economic relief.

At the same time, using crypto as the backbone of digital identity makes the system susceptible to the speculation we often see in crypto.

For now, Worldcoin’s US$1 billion market capitalisation is tiny compared to Bitcoin or Ethereum, but its ambition is global.

A Future of Eyeball Scans?

Supporters argue that without robust digital ID systems, the coming wave of AI could erode trust in everything from banking to elections. Proving who is human, they say, is essential.

But I’d counter that once biometric surveillance becomes normalised, it is almost impossible to roll back.

Today, Orb scans for crypto rewards are optional. Tomorrow, scans for jobs, benefits, or even voting could be mandatory.

Larry Fink of BlackRock recently remarked that tokenised finance will only succeed if identity verification is solved.

If Worldcoin becomes that solution, the stakes stretch far beyond speculative tokens — they touch the very question of how much privacy individuals will have in a digitised society.

Worldcoin is still in its early stages. It has millions of users — not billions. Regulators are watching closely, and public opinion remains divided.

Yet the project clearly captures the zeitgeist: the collision of AI, crypto, and the surveillance state.

Dan Ives’ endorsement may excite investors, but for us, the more pressing question is whether Worldcoin represents a path to greater security — or a Trojan horse for biometric surveillance.

Regards,

Charlie Ormond,

Small-Cap Systems and Altucher’s Investment Network Australia

Comments