The Digital healthcare developer Oneview Healthcare PLC [ASX:ONE] share price is up 9.46% at the time of writing. Lifting on the back of its latest quarterly result.

Regular readers may recall this stock thanks to its recent cloud platform debut. A story that we covered here.

Because as noted at the time, this stock has surged in 2021. With today’s update showcasing and reiterating that same strong growth narrative.

Let’s take a closer look…

Growing operations, growing cash flows

As management highlights, the March quarter was a big one for Oneview.

The launch of their cloud platform was obviously huge. A world first of its kind, according to the company.

On top of that though, they tied up several new or expansion contracts during the period. Building momentum for their products and services, as well as bringing in some much-needed revenues.

Speaking of which, receipts from customers totaled €2.82 million for the quarter. A 64% increase quarter-on-quarter.

A strong sign of the growth potential of this stock, albeit from a low base.

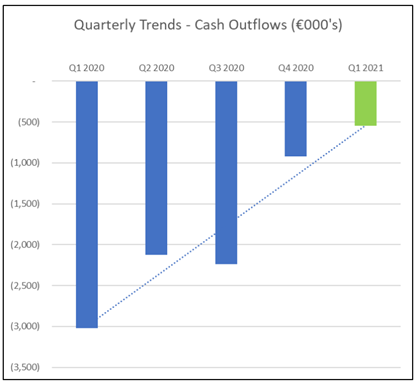

However, Oneview also made a point of showcasing how their cash outflows are steadily falling. Bringing them closer to breakeven cash flow, and hopefully positive cash flow soon.

We reveal four little-known small-cap stocks that cannot be ignored…Download your free report now.

Here is a breakdown of their last five quarters for reference:

Looking ahead, if Oneview can keep growing their sales, then this trend should continue. And for investors that is exactly the kind of prognosis they will be after.

Indeed, CEO James Fitter believes there is a lot more to look forward to, commenting:

‘This has been a transformational quarter for Oneview in many ways. The Company is proud to continue to not only improve its services offering for clients but continue its commitment to innovation.

‘I’d like to thank investors for their continue support, and also the staff at Oneview for the success the Company has experienced in achieving key engineering milestones. We look forward to updating the market on further developments as we continue to improve experience, optimize patient flow and deliver virtual care solutions for our customers around the world.’

What’s next for Oneview Share Price?

Again, the focus for shareholders will certainly remain on growth. Both operationally and in terms of top-line results.

How and when Oneview will achieve this growth though is the big variable. Because depending on how fast they can capture a solid market for their software, the share price will move accordingly.

After all, as a tech player there is a certain expectation of expediated growth. A precedent that has been set by other past and present success stories.

But, Oneview certainly isn’t the only stock with this kind of opportunity. The ASX is chock-full of tech and software plays that are equally waiting to seize upon their growth potential.

We’ve even put together a list of five of our favourites in our latest report.

You can check them out, for free, right here.

Regards,

Ryan Clarkson-Ledward,

For Money Morning

Comments