Australian software firm Nuix [ASX:NXL] released a disappointing trading update today as NXL shares continue to fall.

Nuix shares were down 4% in late afternoon trade, with the NXL stock down 70% over the past 12 months.

Today’s fall means Nuix is trading at a new all-time low:

Source: Tradingview.com

Nuix trading update and plans to strategize

In Sydney today, Nuix gave its presentation and trading update for the last nine months ending 31 March.

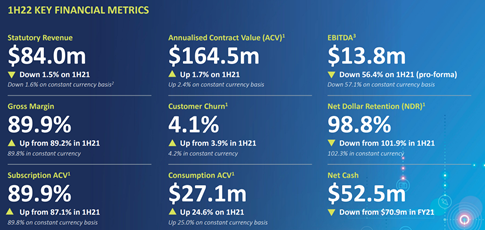

The company reported its annualised contract value was down 2% compared to the same time frame last period.

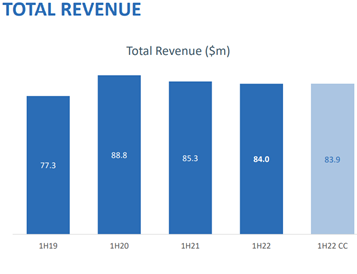

Likewise, statutory revenue was down 6% since the previous period.

Nuix admitted that customer churn was still on the low end, with revenue from new customers 27% below its prior period.

Pro forma EBITDA was also down 63%, which Nuix claims is caused by such incidentals as; sales investments, distribution, and developments — all of which are hoped to bring a positive turnaround for the company by next year.

There has also been a material increase in non-operational legal costs, totalling $11 million this year to date.

Despite the dismal results over the past nine months, Nuix is still upbeat.

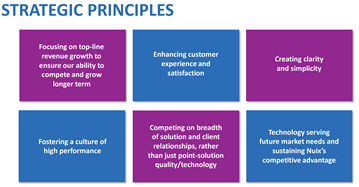

NXL aims to adopt new strategies and focus on face-to-face customer engagement in the wake of the pandemic, streamlining processes, building trust, and prioritising leadership decisions.

Part of the new and improved strategy will be to hone competitiveness and commercial performance, evolve technology platforms, and monetise data processing.

Nuix believes its focus on revenue growth will ‘ensure our ability to compete and grow longer term.’

Source: Nuix

NXL share price outlook

However, investors don’t seem convinced by Nuix’s assurances about opportune horizons and a future of growing revenue, with shares only continuing to fall.

In February, the company released its first-quarter results, detailing its aspirations of positive change and the need for reviewing strategy.

Statutory revenue was down $84.0 million at the time, with annualised contract value up $164.5 million and a 4.1% rise in customer churn:

Source: Nuix

What also can’t be helping investor confidence is the number of in-house changes the company has seen lately, with five shifts in management taking place across the last three-year period.

Nuix, tech stocks, and interest rates

Today, the Reserve Bank of Australia (RBA) released its awaited decision on interest rates.

In a surprise, the RBA raised interest rates higher than consensus estimates.

The Bank hiked the cash rate by 25 basis points, sending shares and bonds lower, as yields on Australian treasuries jumped.

In an inflationary context where central banks steadily raise rates, growth stocks with low or distant profitability usually suffer in a risk-off sell down.

Nuix being down today could reflect a souring attitude to ASX tech and growth stocks, especially since the RBA flagged a ‘further lift in interest rates over the period ahead.’

While sell-offs in growth stocks may make some leery, the ASX is not a stock market but a market of stocks.

Does the ensuing volatility brought on by the rate hike create opportunities?

Are some stocks primed for potential success in 2022 and beyond despite the macro context?

If you’re interested in finding out, check out this free report on seven stocks to watch like a hawk.

Regards,

Kiryll Prakapenka,

For Money Morning