Northern Star shrugged off a wider market sell-off today after the company released a solid quarterly update that has the company on track to meet its FY24 production guidance.

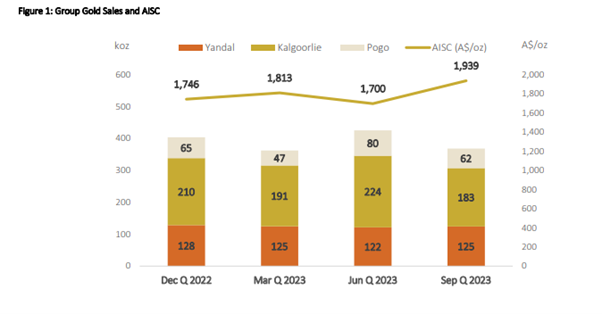

Despite a softer quarter of production due to shutdowns at three production centres, NST managed to produce 369,000 ounces of gold in the three months ending 30 September.

That was down from 426,000 ounces in the prior period but had previously been flagged by the company as it expects to heavily favour production in the 2HFY24.

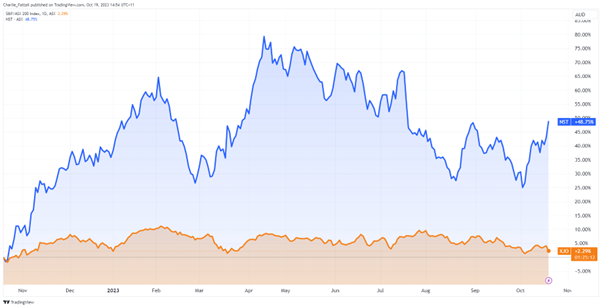

Northern Star has been popular with investors this year who are eyeing rising gold prices and the potential of robust production in the company’s future.

Shares are up by 4% today, trading at $11.95 per share. Momentum continues after hitting a six-month bottom of $10.04 in early October while gold faced similar lows.

Despite the gold price pressures, the miner has seen substantial growth over the past 12 months — making it the top large-cap performer in the sector — with shares up 48.75%.

Source:TradingView

Northern Star quarterly update

The September quarter was a transitional quarter for Northern Star, as the company completed major planned shutdowns at its three production centres and prepared for the ramp-up of its Thunderbox mill.

The company’s recently expanded production centres, Yandal and Pogo, somewhat offset the impact of the shutdowns at KCGM, where Northern Star has begun Mill Expansion capital works.

The KCGM Mill Expansion Project aims to increase processing capacity from 13Mtpa to 27Mtpa by FY27 and deliver higher gold production at lower costs.

Despite the shutdowns, Northern Star generated solid quarterly underlying free cash flow from its operations of $28 million.

In total, for the quarter, NST was able to produce for an all-in sustaining cost (AISC) of AU$1,939 per ounce. The costs were higher this quarter due to the maintenance and commenced expansion works.

Over the three months, gold was sold for an average of AU$2,815 per ounce, achieving gold sales revenue of AU$1.04 billion.

Source: Northern Star

Within its balance sheet, the miner held AU$1.2 billion of cash and bullion, with $2.2 billion of liquidity.

Commenting on the results today, Managing Director Stuart Tonkin said:

‘During the quarter we safely and successfully completed major planned shutdowns at our three production centres. This provides a clear pathway for the company to achieve its full-year guidance, which as previously flagged is 2H weighted…’

‘Northern Star generated solid quarterly underlying free cash flow from our operations as our recently expanded production centres — Yandal and Pogo — offset KCGM, where we have begun Mill Expansion capital works. Our focus remains steadfast on operational excellence to maximise free cash generation.’

Outlook for Northern Star

With planned maintenance behind them, the coming quarters should be highly productive for the company as its full-year guidance stands at 1.60–1.75 million ounces.

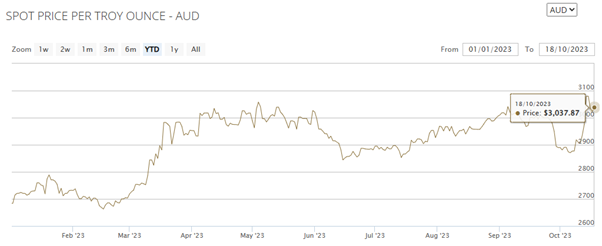

This should time well for the company as indicators point to healthy gold prices that should see substantial revenue for the 2HFY24.

The company says it is on track to deliver 1,600–1,750 koz of gold sold at an AISC of AU$1,730–1,790 an ounce.

The only thing that could punish the miner in the months ahead would be an overabundance of caution shown in its hedging.

The company’s hedging commitments total 1.68 million ounces at an average price of AU$2,929 per ounce. Spot Gold prices have already passed the AU$3,000 per ounce mark and could see further upside as geo-political and debt concerns drive the market.

Source: ABC Bullion

For investors watching Northern Star’s progress this year, they will soon see it become the major player.

The looming takeover of Newcrest Mining [ASX:NCM] by American outfit Newmont [NYSE:NEM] will make Northern Star the largest listed gold producer on the ASX.

Stuart Tonkin has already ruled out purchasing any spun-off assets from the Newcrest deal, which is understandable, considering the company has already committed funds to the mill expansions and a share buyback.

The company also committed $30 million to exploration, focusing on life-of-mine extension for its projects.

Overall, it looks to be the end of a consolidation period for the company, which should pay off in the next half of the year.

Golden opportunity

With gold prices looking strong in the coming months, it’s not only gold miners that can benefit from rising prices.

Right now, gold is surging as investors look at high government and public debt and fears of a wider Middle East war.

Gold is up 6.33% this quarter and has spiked in recent weeks with a strong uptrend.

But this could be more than just a short-term fear-based move.

Our market watcher and Editorial Director Greg Canavan, thinks this is where the financial insiders are moving.

He calls it the ‘Great Gold Lockup‘ and sees it as an engineered rise in gold demand.

If you want to learn more on how you can position yourself and how to access your ‘Ultimate Australian Gold Gameplan’, then,

Click here before gold goes any higher.

Regards

Charlie Ormond

For Fat Tail Commodities