On Tuesday, coal stock New Hope Corp [ASX:NHC] released its FY22 results, reporting strong uplift in revenue and profit on ‘phenomenal’ coal prices.

NHC shares rose more than 8% late in afternoon trade.

NHC shares have gained 150% year to date.

The coal stock is up more than 450% since hitting $1.05 in early November 2020.

Source: TradingView

New Hope profit spikes on strong coal prices

Let’s take a look at NHC’s results for the reporting period from 1 August to 31 July:

- Revenue from Ordinary Activities went up 143.5% — from $1,048 million in 2021 to $2,552 million in 2022

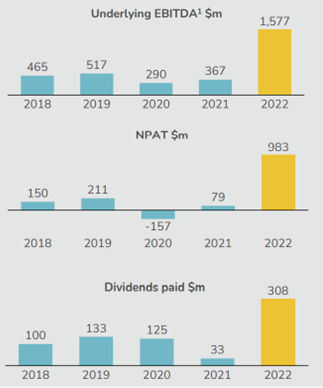

- Both Profit from Ordinary Activities after Tax and Net Profit rose 1,138.8% — from $79,350 million in 2021 to $983 million in 2022

- Underlying EBITDA came to $1,577.4 million in 2022 (in 2021 it was $367.2 million)

- Operating expenses increased 285% with a total of $1,138.6 million (2021 totalled $296.1 million)

- Cash and Cash Equivalents rose from $424.6 million in 2021 to $715.7 million in 2022

- 9Mt coal produced in 2022, 18% less than 2021’s 9.6Mt

Source: NHC

Unsurprisingly, NHC attributed the boost in revenue and profit to ‘record high’ thermal coal prices.

NHC’s average realised price was AU$101.36/t in FY21.

In FY22, the price surged to AU$281.84/t.

Gross revenue from coal sales increased from $1,006.0 million in 2021 to $2,488.9 million in 2022, a 147% jump.

Gross revenue from oil sales increased from $22.2 million in 2021 to $33.5 million, which also reflected ‘improved prices’.

NHC’s riding the profitable coal train

New Hope’s CEO Rob Bishop declared thermal coal prices could go higher in the near future — expecting strong coal market conditions to continue for a while yet.

Despite an 18% reduction in saleable coal production, extreme weather conditions and COVID-19 related supply and workforce issues, New Hope has benefitted from a colossal boost in coal and oil prices over the last 12 months.

NHC said it has now repaid its debt and closed its syndicated debt facility.

It also received Environmental Authority from the Department of Environment and Science for New Acland Stage 3, approval to increase production to 13.4Mt ROM capacity at flagship Bengalla and harked back to its investment of $94.4 million to acquire a 15% equity interest in Malabar Resources.

Five inflation-busting stocks

Few are immune to inflationary pressures.

Households and businesses are feeling the pinch.

But some businesses are better placed to deal with inflation than others.

In fact, some stocks might even be ‘inflation busters’ in the current environment.

Our team has recently put together a research report on five top dividend stocks.

Regards,

Kiryll Prakapenka,

For Money Morning