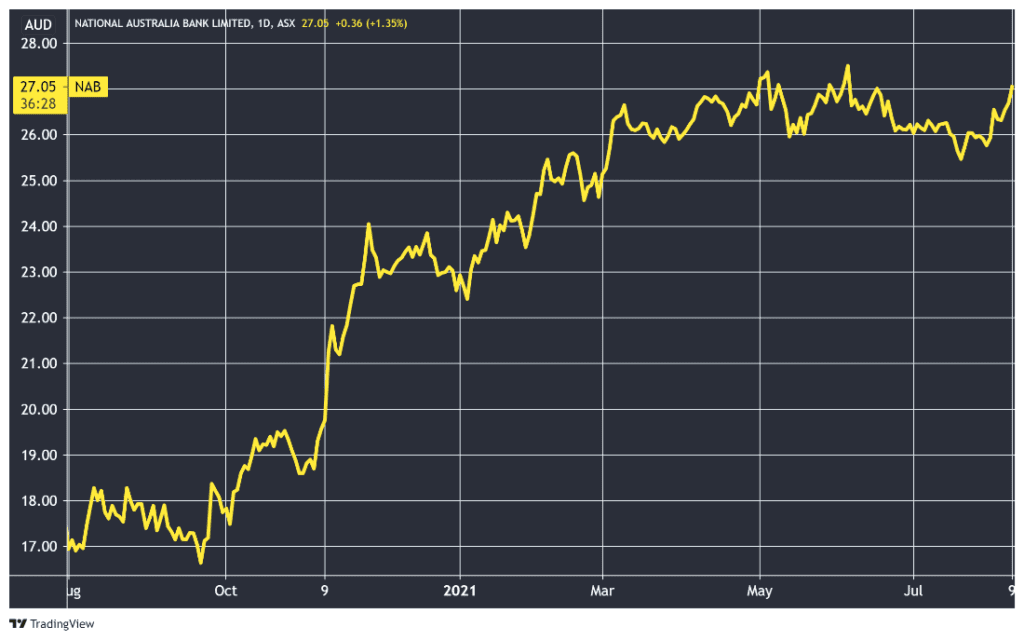

Today, the National Australia Bank Ltd [ASX:NAB] share price is up 1.31%, trading at $27.04, after making a move to acquire Citigroup’s consumer banking business.

As you can see, NAB shares are up significantly in the last 12 months on the back of an improving Australian economy:

In today’s article we will discuss how NAB’s agreement today fits in with the overall landscape of banking in Australia. Are the big banks like NAB still a buy? Read our outlook section at the bottom of this article to find out.

Details of NAB’s Citigroup acquisition

Here’s what today’s announcement said:

‘The Proposed Acquisition includes a home lending portfolio, unsecured lending business (operating under the Citigroup brand as well as white label partner brands)1 , retail deposits business, and private wealth management business2. As at 30 June 2021, the Citigroup Consumer Business had lending assets of approximately $12.2 billion (comprising residential mortgages of approximately $7.9 billion and unsecured lending of approximately $4.3 billion), and deposits of approximately $9.0 billion.’

Previously the Australian Financial Review speculated that all up the transaction could be worth $2 billion.

It’s worth noting that NAB also launched a $2.5 billion on-market share buyback, as well as an interim dividend of 60 cents.

Despite these being typical moves for a bank that’s thriving, here’s where things get far more interesting.

Back in March, NAB acquired neobank 86 400 for $220 million.

That got the ACCC’s regulatory seal of approval, but it’s unclear at this stage if the Citigroup acquisition will go ahead, despite the agreement.

Outlook for NAB shares

NAB — with its mammoth buyback, acquisition of Citigroup’s consumer banking business, and the neobank purchase in hand — looks to be making bold moves at the moment.

Bear in mind that the Citigroup Inc [NYSE:C] chart looks a lot like NAB’s. Big banks are finding new ways to thrive as central bankers prop up their lifeblood — the economy and the free flow of credit.

I highlighted the 86 400 purchase, though, as it is an example of ‘If you can’t beat them, join them.’

As in there are a range of exciting fintechs out there that loom as the investable bridge to a financial world that increasingly involves cryptocurrencies.

I’m sceptical of NAB’s long-term prospects in this competitive environment.

Basically, what if NAB carries on doing good business, but then some disruptive force such as cryptocurrencies comes along and eats their lunch?

If you want to learn more about fintechs, be sure to download this report on three new small-cap fintechs.

And be sure to check out Ryan Dinse and Greg Canavan’s recently launched service called New Money Investor. In this briefing you’ll find out all about how some investors are able to generate bank-busting crypto interest.

Regards,

Lachlann Tierney,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here