The Mineral Resources Ltd [ASX:MIN] updated investors with its September quarterly today, revealing iron ore and spodumene shipments were down on prior quarter.

Mineral Resources noted that ‘unplanned border closures and lockdowns’ associated with curbing COVID-19 continued to impact operations.

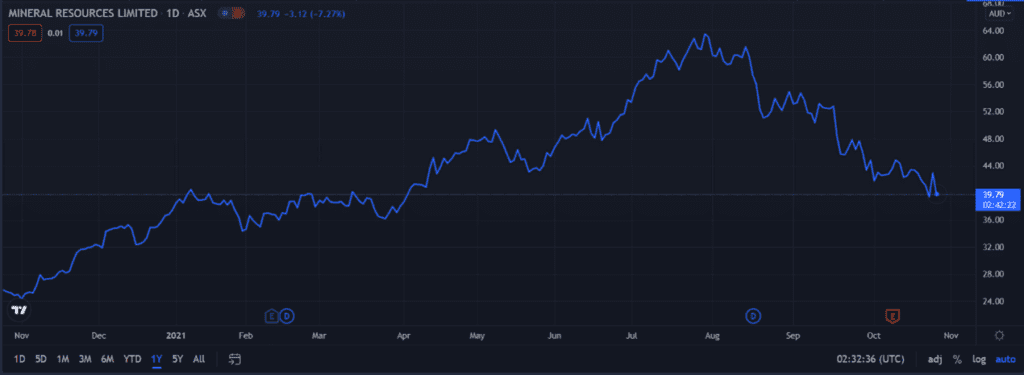

Mineral Resources Ltd [ASX:MIN] share price are currently exchanging hands for $39.79 per share, down 7.3%:

Today’s sell-off is a sharp contrast to the market’s positive reaction yesterday to Mineral Resources announcing the restarting of operations at their joint venture Wodgina Lithium mine.

MIN’s faltering September quarter

MIN’s iron ore shipments reached 4.956 million wet metric tonnes for the quarter.

While this was 40% up Q1 FY21, it was 5% down on the preceding Q4 FY21.

Despite the quarter-on-quarter dip, MIN still kept to its earlier guidance, saying it’s on target to meet FY22 guidance of 21–22 mtpa.

The average realised iron ore price for the quarter was US$78.32 per dmt.

MIN said the realisation was hampered by current quarter shipments priced on the lower September Platts price. Negative adjustments totalled US$33.8 million for finalisation of FY21 shipments.

Now let’s cover MIN’s lithium production results.

The miner’s Mt Marion project produced 99,536 dmt of spodumene during the quarter, 13% lower than Q4 FY21.

However, shipments dipped even further, declining 54% on Q4 FY21.

MIN attributed the slump to a shipment being delayed to the second quarter of FY22.

Mining was impacted by significant rainfall experienced in July, which limited access to higher-grade ore and lowered recoveries for the quarter.

Average realised spodumene price for the quarter was US$740.6 per dmt.

As with its iron ore targets, Mineral Resources has stuck with its guidance. The company said Mt Marion remains on target to meet FY22 guidance of 450–475 ktpa.

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

Is this a blip or a trend for the MIN Share Price?

While iron ore and spodumene shipments dipped this quarter, MIN was unfazed in its longer outlook. The company has still stuck with its earlier guidance for both iron ore and spodumene shipments.

MIN is also set to get a boost from its joint venture with Albemarle on the Wodgina Lithium Mine. MIN noted that the first spodumene production at Wodgina is expected during 3Q CY22.

The restart of production at Wodgina may offset some of the market’s worries for the medium-term outlook for iron ore prices and MIN’s iron ore sales.

Now, while a falling iron ore price has obvious implications for our big miners, it also has deeper ramifications for our economy…and your portfolio.

Iron ore is Australia’s biggest export, and China accounts for 80% of our iron ore exports by volume, a perilous situation for Australia’s economy as our divorce from China sours.

With China seeking to diversify away from our exports and Brazil ramping up production, the medium-term outlook for iron ore prices — and Australia’s resources-dependent economy — is bleak.

But the deeper ramification lies with the Reserve Bank, which will likely keep rates at record lows to offset Australia’s falling terms of trade.

The repercussions go well beyond the iron ore miners and the resource sector — what our Editorial Director Greg Canavan calls ‘Life at Zero’, is here to stay, and in his latest report, he shows you how to adjust your portfolio accordingly.

If you are interested,

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here