The MGC Pharmaceuticals Ltd’s [ASX:MXC] CannEpil+ product to treat refractory epilepsy has been granted approval for UK import.

MGC Pharmaceuticals said this marks the first time an epilepsy treatment containing THC and still undergoing clinical trials was approved by UK authorities for import.

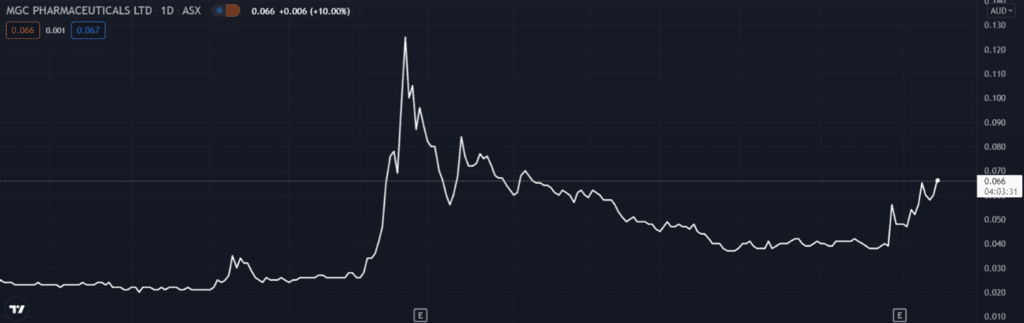

The news saw MGC Pharmaceuticals Ltd’s [ASX:MXC] shares jump 10% at the time of writing.

MGC Pharma stock has climbed almost 160% in the last 12 months.

Despite the significant gain, the firm is still down from its 13-cent, 52-week peak.

The question now is whether today’s positive announcement can send MGC’s share price back to its prior highs.

Promising Small-Cap Stocks: Market expert Ryan Clarkson-Ledward reveals why these four undervalued stocks could potentially soar in 2021. Click here to learn more.

Landmark UK import permit granted for CannEpil+

CannEpil+, based on MGC’s CannEpil, is a phytocannabinoid treatment for refractory or drug-resistant epilepsy.

MXC announced today that CannEpil+ was approved for UK import by the Medicine and Healthcare products Regulatory Agency (MHRA).

CannEpil+ has also been approved for prescription for patients in the UK.

CannEpil+ will initially be used to treat 10 patients in the UK suffering from refractory epilepsy, with MGC Pharma providing CannEpil+ free of charge to these patients for six months.

This is the first time that UK authorities have approved an epilepsy treatment still on a clinical pathway (Phase IIB) containing tetrahydrocannabinol (THC).

Roby Zomer, Co-founder and Managing Director of MGC Pharma, said:

‘The approval for the import of CannEpil+ to the UK and the associated compassionate prescriptions is an important step towards our global roll out of the treatment, and our continued commitment to patients.

‘Achieving MHRA approval has been an ongoing process for some time with our UK partner Elite Pharmaco, and we expect the first patients in the UK to begin treat with CannEpil+ in the coming months.’

What next for MGC Pharma?

Today’s announcement follows MGC securing import approval in India for its proposed COVID-19 treatment as a final step in obtaining Emergency Use Authorisation for the treatment of patients with COVID‐19.

Last month, MGC also signed a US$24 million supply agreement with AMC Holdings for MGC phytomedicine products over three years, with a minimum of US$3 million within the first year.

These are positive developments, and it will be interesting to see whether they can spur momentum for the stock in the medium term.

Now MGC is just one firm in the emerging pot stock sector. If you’re interested in more pot stocks,

He discusses three promising pot stocks.

One is an innovative medicinal cannabis producer that helps patients with critical health conditions. Another is a global investment group that manages multiple cannabis-related ventures across the value chain. And the other is an exciting ETF that invests in established leaders within the cannabis industry.

It’s a great introduction to the sector.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here