The MGC Pharmaceuticals Ltd [ASX:MXC] share price is up after its leading European distributor increased purchase order volume of MGC’s ArtemiC by 85%.

The distributor Swiss PharmaCan AG (SPC), upped its order following an initial agreement which was reached in February.

MGC’s ArtemisC products have an anti-inflammatory effect and according to the company, can ‘prevent deterioration of COVID-19 patients and achieve faster clinical improvement.’

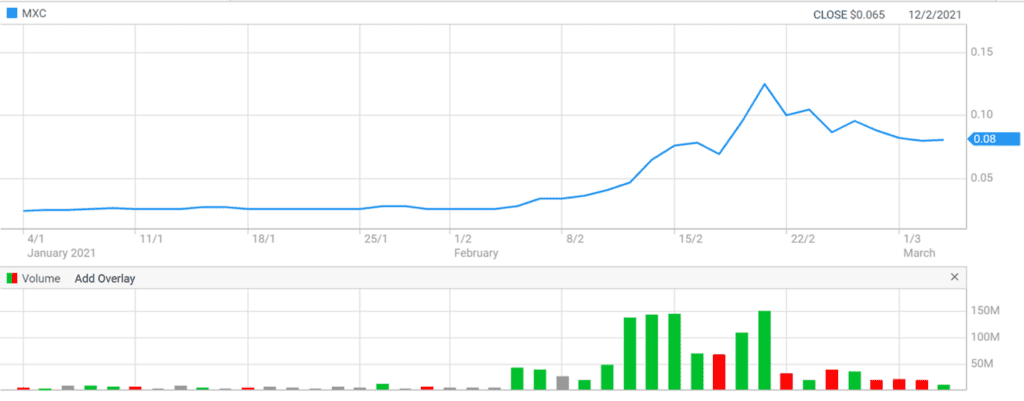

The MGC share price jumped 7% in early trading, peaking as high as 8.6 cents but later settling largely flat with the share price up 1.25% at the time of writing.

Four Innovative Aussie Small-Cap Stocks That Could Shoot Up

Despite the early spike, MGC’s shares are still down from the 13-cent YTD peak.

Let’s take a deeper look at MGC’s announcement.

MCG share price up on increased purchase order volume

Here are the key highlights:

- ‘In February 2021, MGC Pharma signed an exclusive Master Agreement with leading European nutraceuticals producer and distributor, Swiss PharmaCan AG (SPC), for the worldwide supply and distribution of ArtemiC Rescue as a food supplement for a 3-year minimum period

- ‘This Master Agreement follows the completion of a successful Phase II double-blind, placebo-controlled clinical trial on 50 COVID-19 patients across Israel and India that met all its primary and secondary endpoints (per ASX releases in 2020)

- ‘SPC’s initial purchase order for ArtemiC Rescue has now been increased by 85% from the initial ArtemiC Rescue wholesale order received in February on signing, increasing this first order to in excess of $425,00 (+£275,000) wholesale revenue to MGC Pharma

- ‘The Master Agreement includes a minimum wholesale order quantity to MGC Pharma of 40,000 units per quarter of ArtemiC Rescue

- ‘Swiss PharmaCan AG to exclusively distribute ArtemiC Rescue worldwide, with specific focus on countries currently reporting high numbers of COVID-19

- ‘The Company has sufficient manufacturing capacity at its production facility in Slovenia to produce commercial scale batches of ArtemiC rescue for distribution by Swiss PharmaCan AG.’

The main takeaway here is the big tick of approval for MGC’s food supplement product by a large nutraceutical’s distributor.

It is a sign of confidence for MGC that leading distributors are wishing to up their orders and enter into exclusive distribution agreements with it.

MGC’s co-founder and managing director, Roby Zomer, commented that ‘this further agreement will provide more people access to natural therapeutic benefits of the supplement and ease suffering following the successful phase II trial results in December.’

MCG’s streak of positive news continues

The announcement follows a streak of positive news for MGC.

As we’ve covered earlier here on Monday Morning, in February MCG became the first pot stock to list on the London Stock Exchange (LSE).

The company also reported successful Phase II double-blind, placebo-controlled clinical trial on 50 COVID-19 patients late last year.

Outlook for MXC share price

What can today’s MXC share price tapering off suggest?

Although the order increase is good news, investors may not have been too impressed that this increase only led to $425,00 in wholesale revenue to MGC.

This is especially so considering MGC’s half yearly report released this February showed a consolidated loss of $5.9 million and revenue down a significant 58%.

Nevertheless, in that report the company stated that ‘following the London Stock Exchange listing and associated share placement, the Group is in a strong financial position to pursue identified growth initiatives.’

Their half yearly shows a cash balance of $1.5 million, and subsequent to the report a capital raise of around $11.7 million.

Not the worst cash position, given a variety of factors, including the increased appetite by investors for pot stocks.

The MGC share price outlook depends heavily on how well it can progress with its key clinical research programs and how well it can scale the distribution of its widening product range.

Investors may feel that today’s ASX announcement did not provide sufficient information to judge one way or the other.

Additionally, as our Money Morning analyst Lachlann Tierney said recently regarding the outlook for MXC shares, the fact that today’s early trading spike in the MXC share price fell flat ‘means a number of investors may have taken the opportunity to exit on a high note.’

If you’re interested in pot stocks like MXC and are looking for more pot stock ideas, do make sure to check out our new free report.

This report assesses the state of the industry and looks at three stocks that are brimming with potential for 2021.

Get your full copy, for free, right here.

Regards,

Lachlann Tierney

For Money Morning

Comments