At the time of writing, the share price of MGC Pharmaceuticals Ltd [ASX:MXC] is flat, trading at 3.2 cents a share.

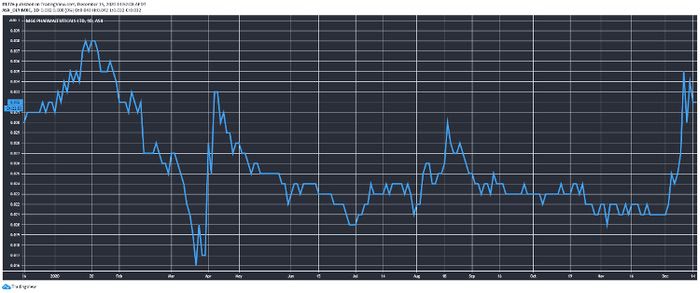

After a slide that persisted through to December, the MXC share price subsequently rose sharply this month:

Source: TradingView

Let’s look at the details of its phase two trial results for its product, ArtemiCTM.

Successful trial leads to spike in MXC share price

In early trading, the MXC share price went as high as 4.2 cents but later settled flat.

Here are the key details from today’s announcement:

‘● Full results of MGC Pharma’s phase II double blind clinical trial show ArtemiCTM has successfully met the primary and secondary study endpoints

‘● ArtemiCTM statistically significantly improved the clinical recovery of 50 COVID-19 infected patients in the treatment group in comparison with placebo

‘● 100% of the patients in the treatment group met the Trial’s primary end point and fully recovered within 15 days of follow up

‘● ArtemiCTM delivered a NEWS score (main parameter of clinical improvement in COVID-19 patients) of less than or equal to 2 in 100% of patients in the treatment group…

‘● Next steps for the product development will include immediate evaluation of a Phase III Trial in COVID-19 and flu patients and classification of ArtemiC™ under new name as IMP (Investigational Medicinal Product) which will be produced in MGC EU GMP facilities

‘● Following successful Phase III Trial results ArtemiCTM can be produced and sold by the Company as a supplement, through its existing production facilities and distribution networks’

There’s plenty to digest in the announcement, but the main punchline is that phase two results demonstrate efficacy as an anti-inflammatory treatment for COVID-19.

Outlook for MXC share price

MGC Pharma has other products in the pipeline for a range of diseases.

It was a difficult year for a number of pot stocks, but a number of companies are starting to show signs of life.

However, the fact that today’s early spike in the MXC share price fell flat means a number of investors may have taken the opportunity to exit on a high note.

Regards,

Lachlann Tierney,

For Money Morning

PS: If you want to learn how to trade a volatile stock like MXC, you can grab a free copy of Murray Dawes’ latest technical analysis report right here. Murray shows you what to look for in a chart, and it’s a great read if you want to wrap your head around risk.

Comments