The MetalsTech Ltd [ASX:MTC] enters binding agreement with Lithium Royalty Corp and secures $18 million for its lithium assets.

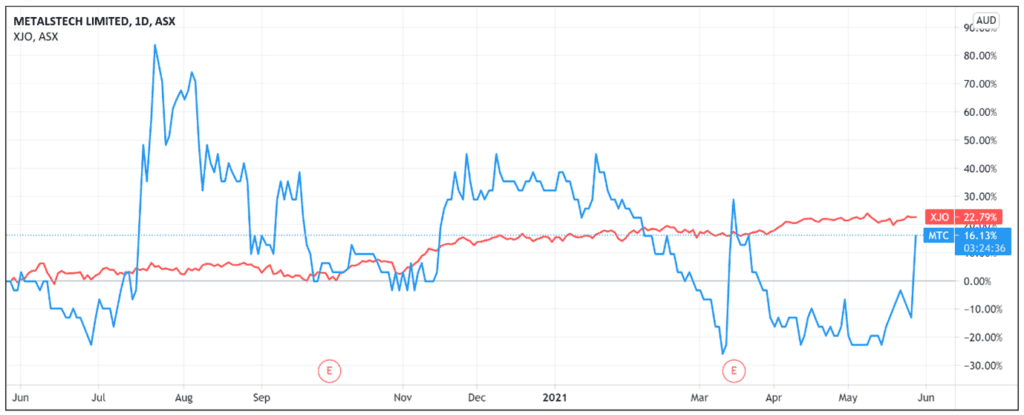

MTC share price is up 35% at the time of writing.

The lithium and gold explorer’s gains today recouped some of its recent losses, with the MetalsTech share price down 12% year to date.

MTC is currently trading 35% down from its 52-week high.

Let’s examine MetalsTech’s deal in detail.

MetalsTech’s lithium royalty deal

The gold and lithium explorer told the ASX today that it entered a binding agreement with Lithium Royalty Corp (LRC) relating to MTC’s portfolio of lithium assets.

The deal includes LRC making a $6 million cash payment to MetalsTech for a 3% gross revenue royalty over MTC’s Cancet, Adina, and Sirmac-Clapier lithium assets.

MetalsTech will retain gold rights over the lithium assets.

LRC predominantly invests in revenue royalties having established lithium royalties over Galaxy Resources Ltd’s [ASX:GXY] Mt Cattlin lithium mine and Core Lithium Ltd’s [ASX:CXO] Finniss lithium project.

MetalsTech’s proposed lithium assets spinout

Additionally, a proposed spinout of the lithium assets through its wholly-owned subsidiary Winsome Resources (WR1) will see MTC shareholders receive a proposed $9 million worth of shares in WR1.

This is subject to ASX and MTC shareholder approval.

If approved, the arrangement will see 45 million WR1 shares distributed to MTC shareholders in proportion to their MTC holding at a record date which will be set post shareholder approval.

According to the company, this is the ‘equivalent of 1 free WR1 20 cent share for every 3.4 MTC shares held.’

The proposed spinout must still pass plenty of regulatory loops, including the appointment of a lead manager to the WR1 IPO and the appointment of additional directors.

Lithium Royalty Corp agreed to cornerstone the potential WR1 IPO by pledging $3 million at an IPO price assumed to be 20 cents per share.

MTC’s cash injection

According to MetalsTech chairman Russell Moran, the deal with Lithium Royalty struck the right risk-reward balance and provided a non-dilutive cash injection.

Mr Moran stressed that the incoming funds from the deal will help MTC expand the drilling program at its Sturec Gold mine.

MetalsTech seeks to grow the mine into a one-million-ounce gold resource.

As we’ve previously covered, the Sturec brownfield gold mine in Slovakia has Current JORC (2012) Resource of 21.2Mt @ 1.50 g/t Au and 11.6 g/t Ag, containing 1.026Moz of gold and 7.94Moz of silver on an open cut scenario.

The explorer possesses a further 388kt @ 3.45 g/t Au and 21.6 g/t Ag containing 43koz of gold and 270koz of silver on an underground basis.

As MTC’s chairman alluded, the cash injection would certainly be welcomed by the explorer.

For the quarter ended 31 March 2021, MetalsTech reported a net loss from operating activities of $471,00.

Year to date (nine months) operating loss totalled $1,773,00.

In that period, the company reported no receipts from customers.

The only cash income MTC recorded year to date (nine months) was $3,300,000 worth of proceeds from equity issues, bringing the explorer’s cash and cash equivalents to $936,000 at the end of the period.

With total relevant outgoings reaching $844,000, the company was facing only 1.1 quarters of funding available if it did not secure additional capital.

So, today’s deal extends MetalsTech’s economic runway and no doubt alleviates near-term cash worries.

Of course, MTC doesn’t have infinite assets to sell so investors will likely shift their focus to how soon the explorer can commercialise its projects and whether its current cash holdings can last.

Additionally, the market will likely continue to monitor the progress of WR1’s proposed spinout.

If you’re interested in finding out more about lithium stock investment opportunities, then make sure to check out this free report.

It reveals three stocks that could surge on the back of renewed demand for lithium in 2021. It is free to download right now.

Regards,

Lachlann Tierney,

For Money Morning

PS: In this new report, Money Morning’s Ryan Dinse reveals why he is convinced that lithium is going to rebound in 2021. Get the FREE Report