‘Is there anywhere in the world where real estate prices aren’t booming?’ someone asked on my Twitter feed the other day.

US house prices are rising at their fastest pace for 15 years.

Prices in Britain increased by 8% last year.

Even in Germany (where the homeownership rate ranks among the lowest in the developed world) median prices were up by 9% over 2020.

Pundits are wondering when things might pull up.

At every point within the boom phases of the real estate cycle, the same is questioned.

And yet onwards and upwards prices continue to float.

The real estate cycle explains how we got here today — and shows where we’re heading.

This is based off the historical behaviour of UK and US property markets (the two largest economies since the beginning of the Industrial Revolution).

It evidences a set 18-year boom/bust land cycle.

Australia correlates with the same trend. (Read more about that here!)

The mainstream media lead most people to believe that indicators like GDP growth, wages, and (especially) interest rates are the best guide to the economy.

They imply that people cue their behaviour off these signals about when to be in the stock market, or buying property, and the level of risk that goes with it.

However, it’s completely wrong.

The two most important indicators for reading the cycle are what we call at Cycles, Trends & Forecasts the ‘twin drivers’.

Land values and bank credit.

Property is the core of the global financial system.

It is, by far, the largest asset class.

This is true the world over.

A graph from The Economist shows this very clearly.

Take a look…

|

|

|

Source: The Economist |

The Aussie dwelling market reached record highs for the past four months.

At the end of April, the total value of Australian housing broke the $8 trillion dollar mark.

Stay up to date with the latest investment trends and opportunities. Click here to learn more.

That’s four times the size of Australian GDP — and around $1 trillion more than the combined value of the ASX, superannuation, and commercial real estate stock.

More accurately, however, we don’t have high ‘house’ prices here in Australia.

We have high land prices.

It’s land that appreciates, not houses.

As a society, we chase the ‘unearned’ gains from rising land values.

Every purchaser I service as a buyer advocate is seeking to bag a windfall in a few years’ time from this speculative trend.

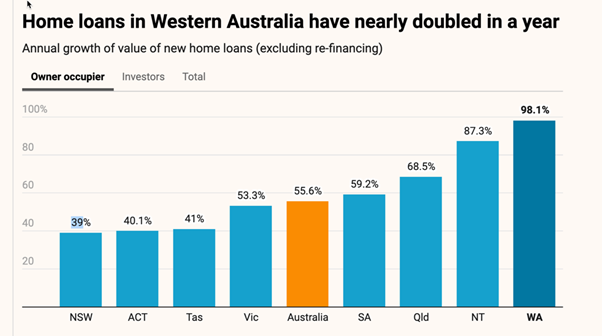

The latest lending finance data gives evidence to it.

|

|

|

Source: Greg Jericho |

It shows a boom in the value of home loans taken out in March.

In Western Australia, it is nearly double the amount taken out in March last year.

Perth’s real estate market is set up for a spectacular rise over the next few years.

(Something we forecast using knowledge of the real estate cycle back in 2019 in Cycles, Trends & Forecasts.)

So, when are things going to pull up?

Well not for a few years yet.

We’re heading to an overall peak in 2026. This is prior to the next significant downturn.

That doesn’t mean there can’t be a pullback in the interim, however.

One of the cities we forecast would be harder hit following the COVID panic was Melbourne.

It certainly played out last year, with the intensive lockdowns in Victoria.

And although the property market is currently running red hot, the Andrews government could be about to put a stop to it.

Higher land taxes and stamp duties are on the way.

$2.7 billion worth of new taxes to be levied on property owners.

It’s summarised as follows:

- A premium stamp duty on property transactions above $2 million.

- Land tax on property investments increasing by 0.25% for holdings between $1.8 million and $3 million, and 0.30% in excess of $3 million.

- A new windfall gains tax for properties whose value is boosted by a council rezoning. (To apply to properties where the value is boosted by more than $100,000, with a 50% tax on windfalls above $500,000.)

Stamp duty is a terrible tax. It places a large penalty on moving home — reducing turnover.

The effect on the market is to lower property prices by the value of the tax.

Land tax is a better tax — discouraging land banking and encouraging building activity. But should only be implemented if taxes are stripped from the productive sector as compensation.

As it is, increased land taxes alone will absolutely dampen prices.

It’s going to drive property investors to other states.

We’ll see a pullback in Melbourne’s property market and price growth could plateau in the not-too-distant future.

Therefore, my best advice for investors wanting to take advantage of the cycle through to 2026 is to follow the money — target Perth.

Best wishes,

|

Catherine Cashmore,

For The Daily Reckoning Australia

PS: Australian real estate expert, Catherine Cashmore, reveals why she thinks we could see the biggest property boom of our lifetimes — over the next five years. Click here to learn more.