Pharmaceutical company Mayne Pharma Group [ASX:MYX] has been thumped by the markets after releasing disappointing trading results at its annual general meeting on Wednesday (30/11/2022).

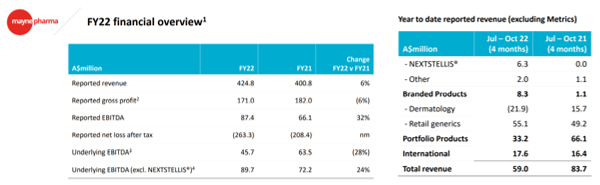

Total revenue underperformed the $83.7 million recorded for the four months of July to October 2021, with $59 million reported for the same time in 2022.

The medicinal products distributer suffered a 20% collapse in share value by the early afternoon, taking its year-to-date share value down more than 25%:

Source: Tradingview.com

Mayne Pharma briefs investors on FY23 business

On Wednesday, the pharmaceutical manufacturer released its business and trading update at its annual general meeting, wherein the company’s Chairman, Frank Condella, and CEO, Shawn O’Brien, outlined strategies to move the business onto a pathway for growth.

These strategies may require some caution, as the company revealed its trading results for the first four months of the 2023 financial year had severely underperformed those reported at the same time last year.

The company reported total revenue of $59 million was achieved for the first four months of FY23, $24.7 million less than same-time last year.

Mayne’s new NEXTSTELLIS® product revenue reached $6.3 million, while generic retail product revenue totalled $55.1 million.

Dermatology revenue ran at a $21.9 million loss, a huge contrast to last year, when this segment of business had brought in $15.7 million.

Mayne’s portfolio product revenue was half of what was earned last year, at $33.2 million.

The company said that its portfolio product revenue was impacted by ‘higher than expected’ sales, higher gross to net charges — an impact of US$20–30 million — and a loss of US$3.7 million through discontinued products.

Having undertaken an organisational restructuring, the group believes it has saved $2.5 million of annualised cost savings in 1HFY23 and expects to save more throughout FY23.

The company recently sold its Metrics Contract Services for a cash consideration of $722 million, which the board believes ‘represents compelling value for Mayne Pharma shareholders’ at around five-times revenue and 16-times EBITDA (based on historical data).

Most of the proceeds were used to pay off debts.

As at 31 October, the company reported a cash position of $320 million:

Source: MYX

MYX focused on growth in FY23

The company expressed the need to reset its business for growth potential and intends to use FY23 as the springboard to get itself there.

Mayne expects the rest of the FY23 half-year to suffer financial impacts from factors such as normalising trading patterns, rising copay card costs in dermatology, future campaign expenses, restructuring costs, and the usual end-of-calendar-year adjustments.

For the second half of the year, the group plans on launching its new CARDIZEM® and NUVARING® products.

MYX believes it can drive profitability and cash flow to a positive end for EBITDA by FY24, however, in the shorter term, it has made the tough choice of growth over profits.

Time will tell if the company can manage its growth in a way that does not push the business’s chances at recovery too far out of reach.

Five bargain stocks

The beginning of FY23 has been full of challenges.

With some effects of the pandemic still lingering, we are now faced with an influx of new challenges — inflation, the war, continually rising rates…

Due to this, everyone is looking to save a pretty penny where they can.

And it’s in times like these that some real ASX stock bargains can emerge — if you know where to look.

Our small caps expert Callum Newman has done the hard work for you.

He’s found five of what he calls ‘the best stocks to own in Australia’ right now.

And the best part is, right now, they don’t even cost that much.

Click here to discover Callum’s top five Aussie bargain stocks.

Regards,

Mahlia Stewart,

For Money Morning