Headquartered in Berlin, Marley Spoon AG [ASX:MMM] is a subscription-based food delivery company that services Europe, Australia and the US.

The onset of COVID-19 has pushed Marley Spoon to new heights as people are forced to make purchases from home and avoid public outings.

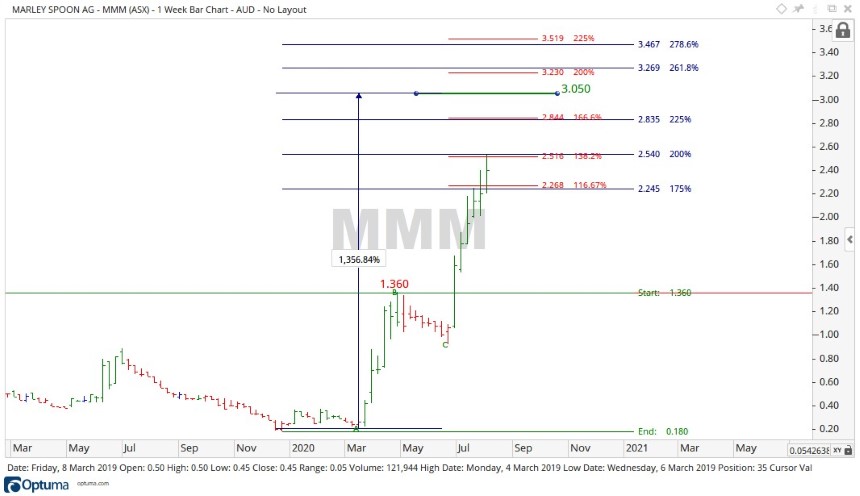

With the MMM share price trading at $3.05 at the time of writing, Marley Spoon is proving to be one of the winners from the global shutdown.

Source: Optuma

What’s happening with Marley Spoon?

Being relatively new to the ASX, after only listing in July 2018, Marley Spoon had previously never traded higher than $1.36.

But then COVID-19 appeared, life as we know ceased, we all got locked down, and the perfect set of circumstances arose for the company’s growth.

In a recent market update, the company announced some outstanding figures:

- Net revenue up 129% to 73.7 million euros

- Active customers up 104% to 350,000

- Total orders up 114% 1,551,000

In the current climate, this all makes a lot of sense. Being locked down at home, people have to deal with their jobs, kids, partners and the same day-to-day routine, with no or little reprieve. Marley Spoon provides a welcome change — if only at mealtime.

In a similar way, Marley Spoon is profiting from the same conditions of other stocks we have looked at — like Temple & Webster Group Ltd [ASX:TPW] and online payment providers like Afterpay Ltd [ASX:APT].

The length of the pandemic may just dictate the length of the growth these types of companies are enjoying.

Where can Marley Spoon go from here?

From the low in March, price shot up over 1,356%! In my opinion, this says more about the situation the company is operating in, and the nature of the world we are living in, than the power of the company.

In the long term, when life returns to normal, I feel more people will be keen to go out for dinner rather than eat at home. I know I will be!

Source: Optuma

Looking at the chart, we can see the share price is currently at an all-time high. If this momentum can continue, then the levels of $3.25 and $3.45 may provide future resistance.

Should price turn to the downside, the levels of $2.85 and $2.45 may provide support from a further fall.

Regards,

Carl Wittkopp,

For Money Morning

PS: Four well-positioned small-cap stocks: These innovative Aussie companies are well-placed to capitalise on post-lockdown megatrends. Click here to learn more.

Comments