This may be the most insane article you’ve read in turbulent times like these.

Many pundits are advising caution now that markets are sounding the alarm as the fires of inflation escalate and engulf the global economy.

The firefighters are the governments and central banks that failed miserably to get it under control. Worse, they fuelled it with stimulus packages and prolonged near-zero interest rate policies.

Cast your mind back to last August when their narrative was so strong that doubters like myself ended up with egg on my face.

And now, who’s having the last laugh?

Alarm bells ring as investors brace for a severe bear market

Last Friday’s US Consumer Price Index data saw inflation surprise on the upside as the year-on-year inflation rate came out at 8.6%, topping the previous month’s reading. This quickly put to bed the market consensus view that we have seen peak inflation and, therefore, the Federal Reserve may be able to go easier with their rate hikes. It would at least relieve the asset markets that have dived.

No luck with that.

Bond yields jumped on the shock inflation announcement. The US 10-year bond yield rose more than 0.35% from the May highs at one stage to 3.5% and now sits above 3.3%.

The markets tumbled hard last Friday and earlier this week in US trading. Since the announcement, the Dow Jones Index has lost more than 2,000 points or over 7%. It’s a whisker away from bear market territory.

Our markets closed for the Queen’s Birthday public holiday, robbing us of the chance to reduce our exposure as investors followed the lead from the rest of the world. The ASX All Ordinaries Index shed around 400 points or just under 6% during the week. It still has another 500 points to lose before it enters bear market territory.

As for cryptos, that has taken another massive dump. Bitcoin [BTC] is now just over US$20,000, while Ethereum [ETH] is flirting with the US$1,000 barrier.

Suffice to say, more pain’s coming. This is because some pundits are saying that the Federal Reserve will not act as a backstop this time around.

The Federal Reserve has raised the interest rate by 0.75% to sit at 1.5–1.75%. It’s expected to raise rates by another 1.75% into the rest of the year.

I can imagine many investors are anxious about how much lower the markets could go and how much more damage their portfolios will take.

But there is one part of the market where morale should be on the rise, unlike the rest of the market.

You’ve guessed it — it’s gold stocks.

How so?

Because the last two years saw them grind down as markets flip-flopped on whether inflation will be under control. It could go lower, but those who have held on are hardened veterans. Those without nerves of steel have abandoned the pursuit long ago.

The contrarian play

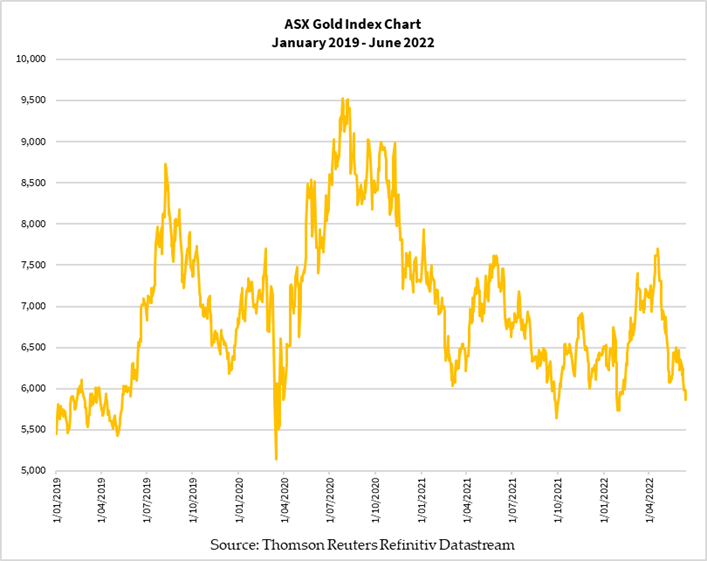

Gold stocks are a unique group of assets in that they’ve been trading in a bearish trend since the second half of 2020. They had a stellar run straight after the February to March 2020 flash crash but since August 2020 they’ve been grinding down.

The figure below shows how the ASX Gold Index [ASX:XGD] performed since 2019:

|

|

|

Source: Thomson Reuters Refinitiv Datastream |

The journey for gold stock investors since 2021 has been difficult to say the least. We experienced no less than four false rallies and each time it seemed so close to the real thing.

Looking back, I see it as a blessing in disguise. Especially now that the entire market is bracing for a nasty fall.

Here are a couple of reasons why…

Firstly, gold stocks are a great contrarian play. History shows that investors seek gold stocks for refuge in a declining market. They may fall with the rest of the market at first but tend to recover earlier because gold is an anchor of value in troublesome times.

In the subprime crisis crash of 2007–09, the broader markets bottomed in the first week of March 2009. Gold stocks traded at their lows in late November 2008.

In the flash crash of 2020, the broader markets hit their bottom on 23–24 March. Gold stocks bounced back a week earlier.

What about this time?

We don’t know when the broader markets will bottom and how low they’ll go. But gold stocks began heading down way earlier, so they’re likely to recover earlier once again.

Secondly, a market crisis should trigger a race to find a safe-haven asset. The US dollar and other fiat currencies are currently holding up thanks to the central banks raising rates. But there’ll come a time when central banks will stop raising rates or they botch their strategy completely and cause the economy to crash hard, destroying the little credibility they have left.

Once that happens, gold roars back with a vengeance.

And gold stocks?

History shows they could go ballistic.

Fortune smiles on the patient

How big are the gains that I’m talking about?

A selection of gold explorers delivered an average of 838% from October 2009 to November 2010. In the 2015–16 rally, another group of gold explorers rallied an average of 380% in less than 10 months. And in the most recent rally in late 2019 to early 2021, another group of gold explorers rallied 1,253% on average.

Many inexperienced investors cut their teeth into speculative gold stocks and end up bleeding their wallets dry.

After all, there are more than 200 listed companies on the ASX trying to make their fortune in gold mining. But only a small group of them will ever pour their first gold bar.

It’s a loaded game and many do this without an experienced guide. They’re better off going to the roulette table in the casino and trying their luck there.

Luckily for you, I have ridden on the shoulders of giants like Rick Rule, Eric Sprott, Peter Schiff, and many more to refine my skills in selecting gold stocks that could deliver you some spectacular gains. I had my ups and downs.

How did I go with my foray into gold stocks? You can find out here.

A word of warning, though: It looks easier said than done to make outsized gains speculating on gold mining stocks. It’s a cyclical play, and you need to ‘do your time’. Even the most solid gold producer could operate under difficult conditions and trade like a penny-dreadful.

For some inspiration on how to play gold stocks right, watch this interview I had with Rick Rule last August.

What do I read of this market for gold stocks?

The water is great. Time to jump in.

Join me on this journey now. It could be the best trades that you make.

God bless,

|

Brian Chu,

Editor, The Daily Reckoning Australia

PS: Have a friend who would enjoy The Daily Reckoning Australia? Share this link with them: https://go.fattail.com.au/DRAUS. They’ll receive our in-house gold expert’s top secrets for buying, selling, and storing gold in Australia.