Shares in Magnis Energy Technologies Ltd [ASX:MNS] are in a trading halt following reports ASIC is investigating MNS chair Frank Poullas.

The Australian today revealed Mr Poullas, chair of the next-gen batteries firm, is under investigation by the Australian Securities and Investments Commission.

Importantly, sources close to ASIC suggest the watchdog hasn’t ruled out widening its probe to investigate Magnis itself.

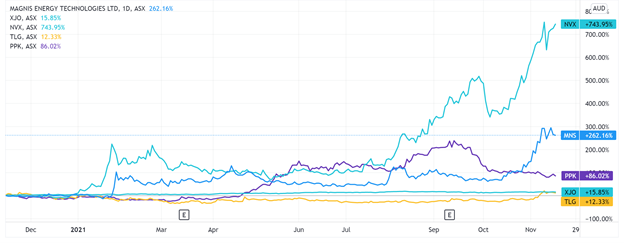

The global switch to electric vehicles and renewable energy has propelled MNS shares this year as the firm holds a majority stake in iM3NY, a New York battery plant slated to begin commercial production in 2022.

Magnis shares gained nearly 100% in the last month alone before entering a trading halt in response to ASIC’s investigation.

Discover our top three ASX-listed pot stocks in 2021. Click here to learn more.

ASIC investigating pumping activity surrounding MNS

ASIC’s probe into Frank Poullas follows the watchdog’s previous attempt to curb forums pumping the MNS stock.

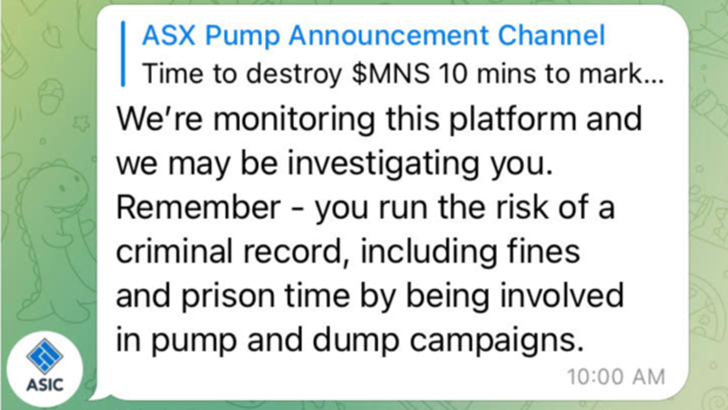

In October, ASIC entered a Telegram chat group of 400 traders, warning the traders that they risked breaking laws with coordinated ‘pump-and-dump’ campaigns.

Joining a Telegram channel called the ASX Pump Organisation, ASIC warned the members against trying to pump the Magnis share price.

Source: Australian Financial Review

Source: Australian Financial Review

The Australian reported that ASIC has now created over 170 documents related to its inquiries into pump-and-dump activity concerning Magnis.

Further detail on ASIC’s probe into Poullas were scant.

But The Australian did report that Mr Poullas was rewarded with 500,000 new MNS shares on Monday.

The ordinary shares were issued after Magnis reached a $500 million market cap valuation.

Magnis responds

In a short — but punchy — response to the reporting in the Australian, Magnis said the article contained a ‘number of unsubstantiated statements.’

While The Australian piece did not claim MNS was under investigation — only that sources close to ASIC suggest the watchdog could expand its probe — Magnis reiterated that it is not under investigation by ASIC.

Magnis concluded:

‘The media article repeats previously published speculation concerning trading in the Company’s shares and inquiries undertaken by ASIC in relation to some trading in those shares, the Company is not aware of any material which would indicate that the Company is or is likely to be under any form of investigation.

‘The Company remains committed to delivering on its majority owned gigawatt scale lithium-ion battery project in New York. The Company confirms it is in compliance with the ASX Listing Rules, and in particular, Listing Rule 3.1.’

If you want to learn more about the lithium industry, I suggest checking out this report.

And if you want an in-depth tour of investing in lithium, I suggest going over this guide that we published last month.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here