At time of writing, the share price of Macquarie Group Ltd [ASX:MQG] is up .23%, trading at $159.37, on the back of a record profit.

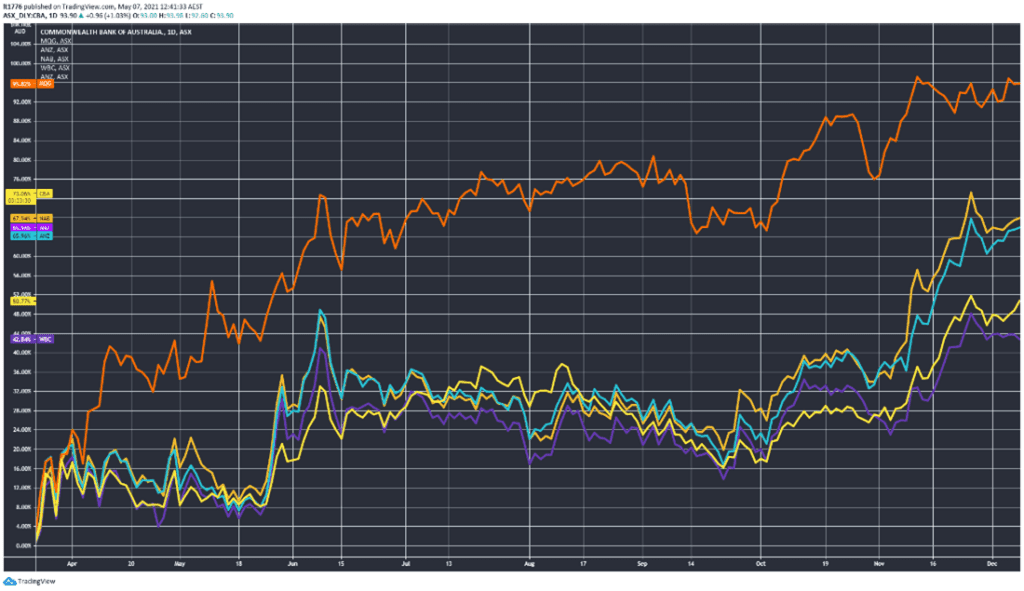

You can see how MQG shares (orange line) stack up against the Big Four banks below from the late March market trough:

As you can see it’s not even close, MQG shares tacked on a mammoth 95% from then until now. With all the other banks lagging behind, we ask what’s the outlook for MQG shares and banks more generally. The answer may surprise you.

MQG’s record profit in context

Here are the bullet points:

‘• FY21 net profit of $A3,015 million, up 10% on FY20; 2H21 net profit of $A2,030 million, up 106% on 1H21, up 59% on 2H20

‘• International income 68% of total income1 in FY21

‘• Assets under management of $A563.5 billion at 31 March 2021, down 6% from 31 March 2020

‘• Financial position comfortably exceeds regulatory minimum requirements — Group capital surplus of $A8.8 billion2,3 — Bank CET1 Level 2 ratio 12.6% (Harmonised: 16.2%); Leverage ratio 5.5% (Harmonised: 6.3%); LCR 174%4; NSFR 115%4

‘• Annualised return on equity (ROE) 14.3%, compared with 14.5% in FY20

‘• Final ordinary dividend of $A3.35 per share (40% franked), FY21 ordinary dividend of $A4.70 per share (40% franked), representing a 2H21 payout ratio of 60% and FY21 payout ratio of 56%’

Now that may sound like gobbledygook to some, but they are really strong results for MQG.

Why limited share price movement on the day?

The answer is simple — there are heaps of analysts working on MQG’s performance and it’s possible these results were anticipated long before they were released.

The Australian Financial Review notes that this beat expectations of a $2.85 billion net profit.

Further coverage outlines how:

‘The profit was delivered on a 3.6 per cent rise in revenue to $12.8 billion, and helped largely by a blockbuster second half, where net profit for the most recent six-month period rose 60 per cent year-on-year.

‘The result cements Macquarie’s successful navigation through the COVID-19 period, with the majority of the revenue, 68 per cent of total income, coming from offshore operations.’

No doubt Macquarie took a big leap forward over the last 14 months, a record profit is proof in the pudding.

Meanwhile, how are the other Big Four banks tracking?

ANZ, NAB, and WBC all ‘smash it’ — will they continue to do so?

Australia and New Zealand Banking Group Ltd [ASX:ANZ] reported a 126% increase in cash profit to $2.9 billion, and threw in a 70-cent dividend on top.

Not bad.

It’s a similar story with National Australia Bank Ltd [ASX:NAB].

NAB’s reported a 94% increase in cash earnings to $3.3 billion, in turn, doubling its interim dividend to 60 cents a share.

Westpac was in on it too.

Westpac Banking Corporation [ASX:WBC] reported cash earnings of $3.5 billion, up 256%, and a 58-cent dividend.

Analyst-defying stuff all around.

Many retail punters who took the plunge on the big banks during this period may be rightfully feeling clever.

A safe, no-brainer bet on the continued success of the four- or five-headed hydra that runs finance in this country.

But as my colleague Ryan Clarkson-Ledward wrote recently, Westpac is facing fresh allegations by ASIC of potentially dodgy behaviour. Read that article for context.

The point is that despite these record profits across the major banks, we may no longer have to live with this painful oligopoly.

Macquarie and the Big Four face competition on two sides.

On one end you have a growing number of fintechs — if you are interested in these companies be sure to check out our three small-cap fintechs report.

On the other end you have the prospect of governments potentially cutting banks out completely via CBDCs. They’d do this to compete with the growing power of crypto, along with a host of stablecoin-based DeFi projects.

If all that sounds a bit confusing, don’t worry. Make sure to check out this special briefing by Ryan Dinse and Greg Canavan on what they are calling a ‘New Game’. Traditional finance players like the big banks profiled here are moving quickly to adapt to it. But there’s a good chance they won’t be able to move fast enough.

You can watch the whole presentation right here. It’s a compelling watch.

Regards,

Lachlann Tierney,

For Money Morning

PS: Promising Small-Cap Stocks: Market expert Ryan Clarkson-Ledward reveals why these four undervalued stocks could potentially soar in 2021. Click here to learn more.