Emerging battery minerals company with two exploration and development projects, the Solaroz Lithium Project in Argentina and the Burke Graphite Project in QLD, Lithium Energy [ASX:LEL] says its total graphite inventory for the latter has now doubled 2.6Mt of contained graphite.

LEL shares were rising more than 3% by the early afternoon on Friday following the good news.

The minerals explorer has had a boost to its stock by 23% so far in 2023, and is tracking in line with the wider market movement:

Source: TradingView

LEL graphite inventory doubles at Corella

Lithium Energy has today impressed its shareholders with a drastic increase to its total graphite inventory at its operations based in QLD. It ramped up to double its resources to 2.6 million tonnes of contained graphite with the addition of the maiden mineral resource estimate (the MRE) at the Corella Graphite Project.

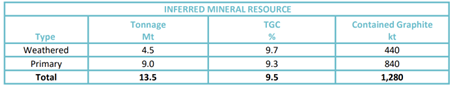

LEL delivered a total of 13.5 million tonnes at 9.5% total graphitic carbon (TGC) for 1.3 million tonnes of contained graphite in this initial MRE from Corella, with a higher-grade inferred portion of 4.5 million tonnes at 12.7% TGC for 570,000 tonnes of graphite.

Operations are still ongoing at Corella, with further results to come as the deposit remains open to the east, west, and at depth. This offers further extensional upside that could add materially to the maiden estimate.

A new programme of metallurgical test work will now be undertaken to assess Corella’s graphite as potential additional feedstock for an expanded purified spherical graphite (PSG) production facility based in QLD.

Executive Chairman for Lithium Energy, William Johnson commented:

‘The major increase in our graphite inventory contributed from the Corella Project adds significant value to the overall Burke Graphite Project. In particular, the additional resource provides the Company with the potential for expanded development options for our proposed vertically integrated battery anode material manufacturing facility based in Queensland. These potential options will be considered as part of the engineering studies currently being undertaken at Burke.’

Source: LEL

Lithium Energy said that it expects the natural graphite to be upgraded by standard flotation techniques to produce a concentrate suitable as feedstock to a purified spherical graphite (PSG) processing facility, with construction already in the proposal stage.

Once the company manages to get the facility up and running, it will be one step closer to developing PSG products for sale in the burgeoning Li-ion battery anode industry.

Test work is currently being planned to test the graphite’s grade and recovery performance in the flotation process and in the PSG processes, which work in a similar manner to previously conducted test work from the Burke Deposit.

The results taken from the Burke Graphite Deposit have already suggested suitability for use in the production of lithium-ion batteries.

The company expects the Corella graphite to form part of the overall vertically integrated pit-to-PSG product plan underpinned by the high-grade Burke graphite material.

Copper mining stocks 2023

Moving on from lithium and graphite, there’s another metal you’d be wise not to let slip under your radar — one of an unmistakable reddish hue.

Certain copper stocks are making an impact in 2023. If you subscribe to Fat Tail Commodities, you could instantly download the most recent insider report on the subject from James Cooper — all for free.

James will give you instant tips on three of the latest top stock picks for the copper industry. He’ll also cover the copper supply crisis and how best to take advantage — right now.

Interested in jumping at a potentially lucrative opportunity reserved for the shrewdest of investors?

Find out more and click here today.

Regards,

Fat Tail Commodities

Comments