Global lithium and chemical giant Albemarle [NYSE:ALB] has been granted a seven-day extension to its due diligence period. Albemarle has an uphill battle from here as it attempts to secure its lithium prize in WA explorer Liontown Resources [ASX:LTR].

Albemarle has seen its $6.6 billion takeover offer turn from a likelihood to a dream since the company first began pursuing Liontown for $4.3 billion last October.

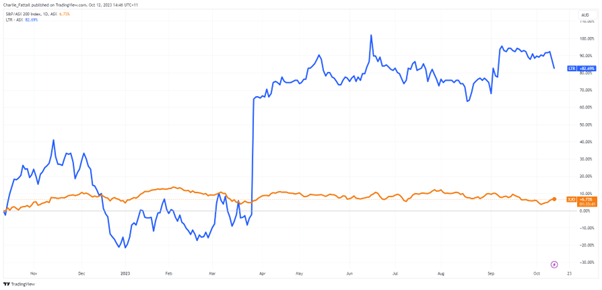

Since the initial news, shareholders and investors have bought heavily into LTR, with the share price rising 83% in the past 12 months as the deal was progressively increased to match what board members described as a ‘fair valuation’.

However, shares are down 2.23% today as the deal now hangs on life-support since Gina Reinheart again increased her stake in Liontown, moving to insert herself between the deal.

Source: TradingView

Reinheart’s rules

Australia’s richest person said yesterday that she had ‘achieved its strategic stake objective’ in accumulating a 19.9% stake in Liontown.

Iron ore magnate Gina Rinehart’s fortune currently stands at approximately $37.4 billion as she operates as executive chairman of iron ore giant Hancock Prospecting.

However, her moves in recent months could only be described as a raid on Liontown as she has spent $1.3 billion to purchase her stock around the value price of the Albemarle deal.

Now, with a majority stake, she is free to block any shareholder vote on the deal and instead force Liontown to deal with Hancock in future developments of LTR’s Kathleen Valley Lithium Project.

Liontown’s flagship Kathleen Valley project is considered a tier-1 battery metals asset with one of the world’s largest and highest-grade hard rock lithium deposits.

The project is expected to begin production in 2024 and deliver around 500,000 tonnes of 6% lithium oxide concentrate annually for 23 years, with an MRE of approximately 156 million tonnes at 1.4% Li2O.

The strategy here is a longer-term move by Mrs Rinehart to insert herself into the lithium future of Australia, which Kathleen is seen as a significant part of.

She has been aggressively buying up tenements of land in an area dubbed the lithium ‘corridor of power’ in WA.

Mrs Rinehart has also signed a deal with India’s Narendra Modi, with whom she is known to have a close relationship.

So with a massive stake in Liontown secured by Mrs Rinehart, is there any hope of the deal going forward?

Deal or no deal?

Mrs Rinehart has made it clear she wants long-term involvement with Liontown. She has previously not shied away from expressing her concerns about the operations at Kathleen Valley.

Hancock Prospecting has tried in the past to insert itself into the conversation. After the final construction contract was awarded to a rival, her company came out swinging, saying:

‘The (Kathleen Valley) project is a prospective high-quality hard-rock lithium deposit in its development phase, which whilst still having a number of significant risks including resource conversion, construction execution and metallurgical recovery, has the potential to operate at scale.’

Of course, many of the solutions to these perceived problems involved bringing her company and experts onboard.

Liontown has ignored these jibes, but it seems Mrs Rinehart is now pushing for a seat on the company board at a minimum.

So far, this appears to be all she has put on the table regarding an alternative to the deal. With her aggressive purchasing and sideline comments, she has attempted to muddy the waters and forestall any progress that doesn’t involve her.

‘Investors seem keen to know Rinehart’s plan,’ said Seth Goldstein, an equity strategist at Morningstar Research Services.

‘So far, there has been nothing except buying shares, any alternative proposal for value creation has not yet been presented.’

Until more clarity comes on what Albemarle can promise to Mrs Rinehart, these seven days of extension may come and go with nothing more than a modest increase to the share price offer.

Albemarle and Mrs Rinehart know they are playing for a lucrative future.

In 2022, an impressive 46% of the world’s lithium came from Australia, and from 2023 to 2026, the country’s revenue from exporting the commodity is expected to grow at a compound annual growth rate of 14.2%.

While prices for the battery metal have fallen from recent highs, some experts believe that the green energy transition will allow lithium to maintain momentum well into the future.

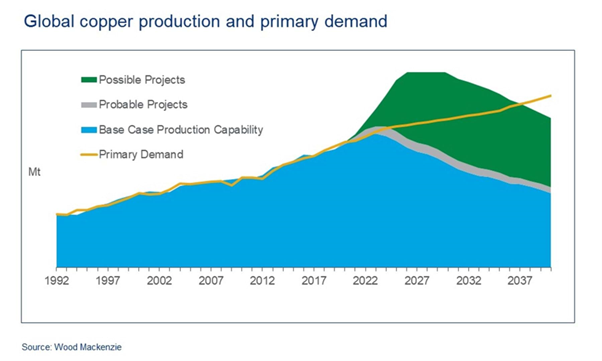

Another commodity that should be on your watchlist for critical future metals in the great transition is copper.

Copper grades and exploration have not kept up with demand, and future shortages could loom.

Source: Wood Mackenzie

The Potential Red Draught

Stopping climate change will require trillions and a global supply of critical minerals — one special metal from this range is copper.

This means that we’re going to need a lot of red metal, and more exploration will be required to restock supplies.

If you subscribe to Fat Tail Commodities, you will have access to resources expert James Cooper’s most recent research on the subject.

James will give you a wealth of investment ideas and veteran insights for the copper industry.

He’ll also explain the copper supply crisis and how you can position yourself to take advantage of incoming changes in the industry.

Find out more about the coming red drought and click here today.

Regards,

Charles Ormond, for Fat Tail Commodities

Comments