Family safety app Life360 Inc [ASX:360] released its results for the financial year end of 2022.

Life360 Inc’s H1 subscription revenue rose 90% and 60% for core Life360 subscriptions.

The company’s share price was up 5% on Tuesday.

However, Life360 is still down 40% year-to-date:

www.TradingView.com

Life360’s second quarter and half-year figures

The San Francisco-based company presented its financial results for the three and six months ending 30 June today.

- Total revenue is up 108% year-on-year to US$99.8 million.

- Subscription revenue is up 90% to US$69.1 million.

- Adjusted net loss widened to US$30.2 million.

- Cash and cash equivalents rose to US$79.3 million in the half, but Life360 expects that to shrink to US$65 million by the end of the year.

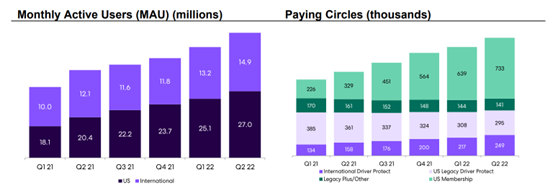

- Monthly active users rose to 42 million by Q2, up 29% YoY and 10% QoQ.

- Paying Circles was up 41% year-on-year, with net additions of 111,000.

- Average revenue per paying Circle rose 12% year-on-year.

Source: Life360

Outlook for Life360

Life360’s CEO, Chris Hulls, commented on the company’s performance and its future outlook:

‘As expected, CY22 H1 was a peak period for investment as we rapidly integrated core Life360 with the Tile and Jiobit acquisitions.

‘We expect significantly lower operating losses and cash burn in H2 as we benefit from the early results from the bundled Membership offer, and Tile’s usual strong Q4 seasonality. In addition, we expect cost efficiencies arising from the integration, with ~$11m of annualised costs savings expected in H2.’

On the company’s path to profitability, Hulls said:

‘We are seeing resilience from our subscribers and users in the face of more challenging global macroeconomic circumstances, with our usual ‘back-to-school’ seasonal uplift underway. While we continue to monitor global macroeconomic conditions, in fact we continue to see strong growth in our user and subscriber performance, and maintain confidence in a very promising outlook.

‘Our confidence in a trajectory to Adjusted EBITDA profitability and positive cash flow for CY24 is underpinned by the considerable conversion, upsell and retention upside from bundled Membership, our leaner organisational structure, and outlook for lower subscriber commissions based on out of app purchases.’

From family safety tech to battery tech

Now let’s talk about a different type of tech, battery technology.

The world is accelerating its adoption of electric vehicles (EVs).

But with EVs requiring much higher quantities of inputs like lithium, copper, and nickel, a world of EVs is a world hungry for battery tech metals.

And this offers opportunities…

Of course, lithium stocks have had their time in the sun. The easy money around lithium has been made.

But the battery tech theme isn’t going anywhere.

And there are other ways to play it…

Our small-cap expert, Callum Newman, has just published a research report on three battery material stocks he thinks are flying under the radar.

Cal calls them ‘Elon’s Chosen Ones’ — click here to read on.

Regards,

Kiryll Prakapenka,

For Money Morning