Family-oriented private social network developer Life360 Inc [ASX:360] saw fit to present its accumulated data for the entire 2022 calendar year.

The 2022 full-year revenue for Life360 came to US$228.3 million (AU$343.2 million), which was in line with company guidance, and represented a year-on-year increase of 103%.

On the other end of the scale, the company also reported a net loss of US$91.6 million (A$137.62) in 2022.

Shares for the tracking app’s stock were dropping just shy of 6% after the announcement hit the ASX.

360 may be up more than 5% in its own sector, but is fallen 7% on average in the past 12 months, and was trading at around $4.84 at the time of writing:

Source: tradingview.com

Life360 summarises 2022 results

Friday morning saw the developers give a snapshot of 2022’s calendar year — touting a 103% increase in revenue year-on-year, with a total of US$228.3 million.

The group pointed out this result matched guidance and was assisted by higher subscription revenue, which itself had increased by 77% (US$153.3 million).

By the year’s end, annualised monthly revenue — which did not include hardware — totalled US$224.4 million. This is 61% growth year-on-year, beating guidance.

January’s figures totalled US$229.6 million, which reflected subscriber price increases.

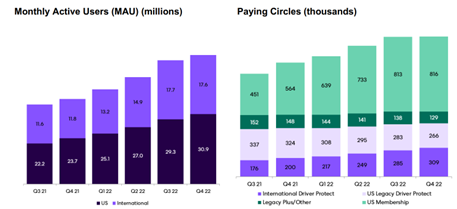

Life360 also broadcast its new record of annual growth in global monthly active users by gaining more than 13.1 million, which was another increase of 37% year-on-year and included record results in both the US and internationally.

Chris Hulls, CEO of Life360 reflected:

‘2022 has been a tremendous year of progress for Life360. Our largest ever annual Global MAU growth to almost 50 million cements our position as the market-leading family safety membership service.

‘We are approaching CY23 with an appropriate balance of fiscal responsibility and prudent investment to position the business for long-term success, and make the most of the many exciting growth options available to us.

‘As we announced in January, we have streamlined our workforce to drive a sharpened focus on our key strategic product initiatives, with annualized savings of at least $15 million. We also see opportunities for additional operating cost savings, including for platform commissions to continue reducing over time, and greater marketing efficiency.’

Source: 360

Year-end cash, cash equivalents, and restricted cash of US$90.4 million are in line with guidance.

CY23 guidance for more than 50% year-on-year growth for core Life360 subscription revenue.

Consolidated revenue of $300–310 million and positive Adjusted EBITDA3 and Operating Cash Flow of $5–10 million expected for the full year, with positive Adjusted EBITDA and Operating Cash Flow targeted on a quarterly basis beginning with Q2’23 and for full CY23.

Mr Hulls concluded:

‘Looking forward to CY23, we are very optimistic about our ability to continue to deepen our user engagement and reinforce our competitive position by ongoing investment to improve the core user experience.

‘Positive initiatives benefit the cost base, and together with strong revenue growth will allow us to leverage scale, and deliver our first full year of positive Adjusted EBITDA3 and operating cash flow in CY23.’

Australia, are you prepared?

Australia’s history of robust trade is breaking.

The global supply chain has also been twisted — you can see it on supermarket shelves.

There’s also the issue of closing banks, soaring prices, shrinking packaging, and gaps in the workforce.

The change is all around us, and Jim Rickards, one of the world’s top financial and geopolitical analysts, has joined the dots that nobody else has.

He says, ‘no one is talking about how this could end the Australian economy as we know it’, as soon as within the next 12 months.

If you can learn the patterns and prepare for change, you could run ahead of the curve.

If you want to learn more, click here.

Regards,

Mahlia Stewart,

For Money Morning