Li-S Energy [ASX:LIS] rose 7% in Thursday afternoon trade after announcing it’s joined the Future Battery Industries Research Centre (FBICRC).

Unlike some of its peers, the lithium-sulphur battery tech developer hasn’t enjoyed the lithium rally of the past 18 months.

The LIS stock is well down on its September IPO price and is 55% down year to date.

Will today’s share price spike prove temporary or is this a sign of the market’s reappraisal of Li-S Energy’s outlook?

Source: Tradingview.com

LIS Partners With FBICRC

This morning, Li-S Energy announced it has joined the FBICRC.

LIS said the research centre can help it leverage research and development on advanced electrolytes for lithium metal and lithium sulphur batteries.

FBICRC, Australia’s largest battery technologies researcher, has combined 70 participants across 15 research projects and shares LIS’s vision for Australia’s EV future.

This announcement comes shortly after Deakin University’s BatTRI-Hub joined Li-S for Li-nanomesh anode, solid-state, and polymer electrolyte development.

FBICRC CEO Shannon O’Rourke said:

‘We know the global battery demand is expected to grow at least 9 to 10-fold over the next decade, so we must accelerate our development of this technology. Investments and collaboration from partners like Li-S Energy allow us to advance our research and capability in battery materials and precursor manufacturing, and in turn, broaden their own opportunities for market penetration.’

LIS CEO Dr Lee Finniear comments:

‘At Li-S Energy our goal is to deliver lithium sulphur and lithium metal batteries with unprecedented performance and cycle life, by using our unique BNNT and Li-nanomesh nanocomposites. These batteries are the “holy grail” of EV, drone and electric aviation markets, combining high energy storage and low weight.

‘Our collaboration with FBICRC accelerates our time to market by enabling us to access advanced electrolytes developed specifically for these high energy cells, further magnifying the benefits over lithium-ion.

‘We are proud to be supporting the Australian battery ecosystem through our joint investment and contribution to the FBICRC, and to be playing our part in projecting Australia onto the global stage as an innovative player in the drive to deliver the global Carbon Zero economy.’

LIS share price outlook

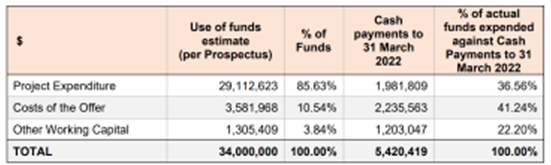

Last week, Li-S Energy released its 2022 March quarterly, in which the company recorded positive BNNT and Li-nanomesh results while updating the public on Li-nanomesh, zinc, aluminium, and sulphur cathode testing:

Source: LIS

Dr Lee Finniear commented on LIS’s progress during the quarter:

‘I am pleased to report that we have continued our strong technical progress throughout the quarter… During March we met with leading European Battery Research Institutes, manufacturers and potential OEM customers. What was clear from our conversations that the demand for a lighter, long lasting, more energy dense battery is stronger than ever. Li-S Energy is well positioned with both its lithium sulphur and lithium metal developments to play a key role in meeting that demand.’

Now, lithium isn’t the sole EV battery input.

Other materials are just as important in getting EVs off and running — like copper, nickel, cobalt, and graphite.

But as lithium continues to attract all the attention and capital flows, our Money Morning experts believe now is the time to look for a smarter way to play the EV boom.

They believe a potential answer lies with lithium’s ‘little brother’?

Click here to find out more about ‘The NEXT Lithium?’.

Regards,

Kiryll Prakapenka,

For Money Morning