Today, Firefinch [ASX:FFX] spin-out venture Leo Lithium [ASX:LLL] revealed some strong results for operations at its Goulamina lithium project in Mali, West Africa.

Trading for 79 cents a share at the time of writing, the lithium stock received a rush in share value to the tune of more than 5% by midday.

LLL has been performing solidly in the past 52-week cycle, having risen 132.5% over that time. It also bumped up by more than 12% over the market average — a reflection of lithium stocks regaining some small portion of their former glory:

Source: TradingView

Leo Lithium’s strong assays and new mineralisation discovery

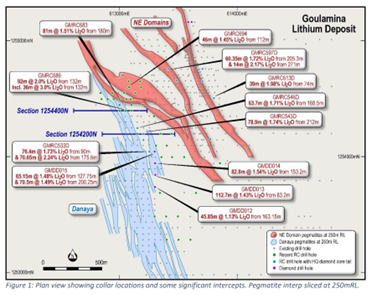

Earlier this morning, Leo Lithium and lithium group Firefinch — which has remained suspended on ASX trade since last year after the group faced reporting enquiries — posted strong assay results from Danaya and the Northeast Domain at the Goulamina Lithium Project.

Drilling at this project has now delivered thick, high-grade mineralisation outside the current resource. This includes significant down-hole pegmatite intercepts of 92 metres at 2.01% lithium oxide from 132 metres, including 36 metres at 3% lithium oxide.

The lithium explorer also said it had achieved 112.7 metres at 1.43% lithium oxide from 83.2 metres, 60.35 metres at 1.72% lithium oxide from 205.3 metres, and 76.4 metres at 1.73% lithium oxide from 90 metres.

These highlights were included in the group’s report today, presented as follows:

- 92 metres at 2.01% Li2O, from 132 m including 36 metres at 3.00% Li2O, from 132 metres (GMRC689)

- 7 metres at 1.43% Li2O, from 83.2 metres (GMDD013)

- 35 metres at 1.72% Li2O, from 205.3 metres and 14 metres at 2.17% Li2O from 271 metres (GMRC597D)

- 4 metres at 1.73% Li2O, from 90 metres and 70.65 metres at 2.24% Li2O, from 175.6 metres (GMRC533D)

The Resource Drilling Program at Goulamina had the main objective of increasing the confidence level of the orebody and converting a significant amount of Inferred Resource into the Indicated Resource category.

An additional objective was also to increase the overall resource base at the project.

At present, the mineralisation has been kept open at depth and along strike, as exploration reverse circulation (RC) drilling continues at both the Northeast and Danaya regions at Goulamina.

An update of the group’s mineral resource estimate (MRE) is officially anticipated next month.

Leo Lithium’s Managing Director, Simon Hay, commented:

‘The latest results show excellent intercepts and grades outside the current pit shell. With the potential to grow the Mineral Resource outside the current project area, the opportunity to unlock further value from the outstanding Goulamina asset continues to be apparent.

‘With drilling continuing, we remain on track to update the MRE for Goulamina in late June and release a reserve upgrade in August.

‘Our project also remains on schedule for the first spodumene concentrate product in late H12024, and early revenue materialising from the DSO in the second half of this year.’

Source: LLL

From lithium to copper — what was hot in 2022 and what’s hot now

Lithium was hot in 2022, and although there have been some recent signs of its popularity returning, it’s copper that we’re about right now.

After all, copper is the best option for electricity conduction, and its properties are — at present — impossible to match.

This makes it stand out like a sore thumb on the critical metals hit list for net zero goals.

If you subscribe to Fat Tail Commodities you will hear from our resident geologist and commodities expert, James Cooper, and his take on why copper is so special.

He’ll even throw in the latest top stock picks for the copper industry.

Keen to get the intel?

Then click here today.

Regards,

Fat Tail Commodities

Comments