Lithium developer Lake Resources [ASX:LKE] has reignited investor interest with a flurry of news at its flagship Kachi Lithium Brine Project in Argentina.

LKE unveiled its maiden Ore Reserve and Phase 1 Definitive Feasibility Study (DFS) today.

Shares were up by 7.7% in trading today at 14 cents, as the DFS indicated the economic potential of the site. However, some analysts remain uncertain.

Lake has seen its shares fall by more than 80% in the past 12 months. These heavy falls began in June after they delayed the project by six years.

The technology involved in the more environmentally friendly lithium brine extraction was also shown to cost almost double its pre-feasibility study estimates.

Will today’s news shift the market’s scepticism?

Source: TradingView

Definitive Feasibility Study and MRE

The maiden Ore Reserve is a critical milestone for LKE, combining prior studies done between 2022–23. Lake completed extensive modelling and extraction tests in the past 18 months.

These show the viability of a 25,000 tonnes per annum (ktpa) lithium carbonate operation over a 25-year life of mine (LoM).

The company said its mine plan includes 16 production wells and 21 injection wells that can easily process the found grades.

‘The modelling demonstrates that the feed grade will average above 245mg/L with minimal dilution and that the operation can be developed in an environmentally responsible manner,’ commented Michael Gabora, Director of Geology and Hydrogeology.

Notably, over 85% of the LoM production comes from Measured Resources.

The DFS added further fuel to the fire, estimating a post-tax net present value (NPV) of US$2.3 billion and an internal rate of return (IRR) of 21%.

Sales estimates for the battery-grade lithium were US$21 billion and US$16 billion in EBITDA over the 25-year LoM.

That would be an annual average EBITDA of US$635 million and a solid EBITDA margin of 76%.

However, a project of this scale comes with steep upfront costs.

Lake Resources estimates an initial capital expenditure of US$1.38 billion for phase one, requiring hefty capital raising.

The company has engaged Goldman Sachs to secure funding. This will likely involve finding a strategic partner and potentially securing further offtake agreements.

Apart from financing, the next step for LKE will be submitting an environmental impact assessment in early 2024.

A final investment decision is targeted for Q1 2025 and production around 2027.

Lake Resources CEO David Dickson commented on the results today, saying:

‘Demand growth is expected to continue with strong forecasts for the next two decades — at the time our top tier Project comes into production. Kachi will be producing a high-quality, high-specification battery grade product to match this increasing demand.’

How likely are Mr Dickson’s comments, and are the DFS numbers too good to be true?

Outook for Lake Resources

While the DFS paints a rosy picture, I would urge caution when assessing Lake Resources.

The lithium price assumption of US$33,000 per tonne used in the calculations raises eyebrows. Compare that to Goldman Sachs’ own long-term estimate of US$15,000 per tonne.

This discrepancy is a major factor, as an average price of US$28,100 per tonne could already reduce the project NPV by 28%.

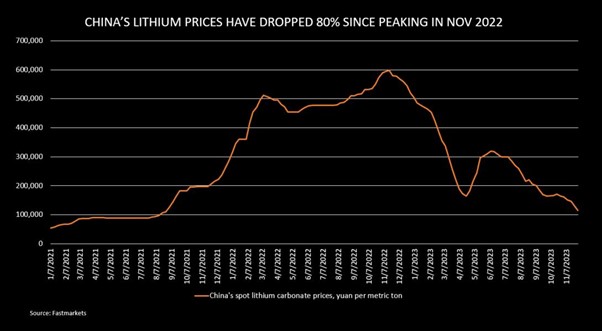

With the recent price collapse, Lithium Carbonate prices are currently at US$13,667 per tonne.

Much of the bull versus bearish outlook of the company revolves around these lithium prices.

While my own bias is towards prices not returning to the lofty heights seen in November 2022, yours could be different.

Source: Fastmarkets

The flurry of news from the company today has certainly been enough to convince some investors.

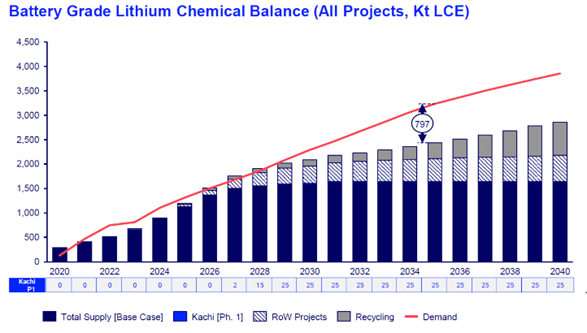

The main focus of price forecasting revolves around supply more than demand, with UBS forecasting a 40% jump in supply in 2024.

If these supply surges happen, we could see a global lithium surplus of 12%, up from the current 4% this year, according to CITIC Futures.

Lake prefers estimates from Wood Mackenzie, which estimates demand overtaking supply in 2031:

Source: Wood Mackenzie

Looking beyond supply, a bullish note for LKE could be from demand for its brine-extracted lithium.

European carmakers may prefer lithium that meets environmental, social, and governance (ESG) standards. This could make the product more attractive to them.

The ESG standards of its lithium may not be enough to convince the bulk of the demand, which currently comes from China.

China produces about 70% of the world’s batteries and over half of its EVs.

Despite these concerns, Lake Resources’ shares reflect a return of some investor confidence.

Today’s results laid the groundwork for development. LKE now faces the task of securing funding and navigating price variations in the lithium market.

If successful, the Kachi project holds promise to mark the company’s position as a leader in sustainable lithium production.

The electric age’s new oil

The future demand for critical minerals like lithium is a hot topic for debate.

But demand for another critical resource has a much clearer long-term picture.

The movement of economies away from fossil fuels means skyrocketing demand for one red metal in particular.

Goldman Sachs dubs it the ‘new oil‘, and it’s critical in our ability to build a new grid and power EVs.

Without it, our hopes of Net Zero and full electrification will fail.

But record demand has not been met with adequate supply.

Geologist James Cooper thinks the time is ripe for investors to consider jumping in.

What’s this critical metal, and what is the opportunity?

Click here to find out more about the electric age’s ‘new oil’.

Regards,

Charlie Ormond

For Fat Tail Daily