After the abrupt departure of former CEO Stephen Promnitz triggered shareholder angst, lithium developer Lake Resources [ASX:LKE] today announced the appointment of a new CEO and Managing Director David Dickson.

He is currently the senior advisor to private equity firm Quantum Energy Partners.

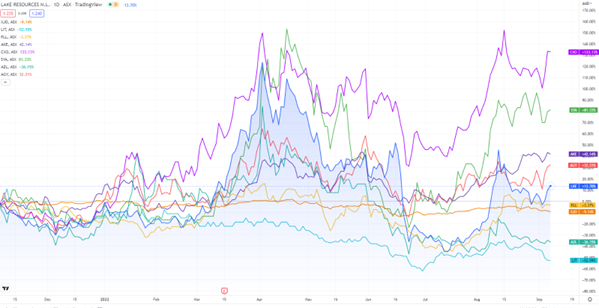

LKE shares spiked in early trade before levelling off by the afternoon, trading at $1.23 a share at the time of writing.

Year to date, LKE shares are up 12%, having trading as high as $2.65 a share at the start of the year before correcting.

Source: www.tradingview.com

Lake’s new CEO and MD

This morning, Lake introduced its new CEO and managing director.

David Dickson, described as an industry leader with 30 years of experience, will be taking the reigns as LKE pushes for production.

The company left investors confused when long-serving CEO Steve Promnitz abruptly exited with very little explanation back in June.

On the same day, Mr Promnitz was said to have sold all his LKE shares.

Lake’s stock stumbled in the aftermath.

Who is the new Lake Resources CEO?

David Dickson most recent role was as a senior advisor to private equity firm Quantum Energy Partners, which provides capital to the decarbonisation sector.

Dickson also served as CEO for McDermott International for seven years.

Lake’s Chairman, Stuart Crow, said:

‘This is a major achievement to have secured a CEO like David as Lake goes from project development to construction to become a major lithium producer.

‘David combines proven leadership experience and engineering expertise with a deep strategic understanding of off-taker and investor perspectives on energy supply chains,

‘David knows all the major oilfield services and EPCM contractors who are looking to expand into the renewable economy – at a time when major projects are struggling to source this capability and support.

‘Including those companies skilled in environmentally friendly drilling and reinjection – a key to Lake expanding at scale.’

LKE’s future with Dickson

Lake Resources thinks they have found a chief executive with a ‘proven track record’ for delivering projects into commercialisation.

Mr Crow highlighted Dickson’s skills as an experienced negotiator, expecting these to prove beneficial to Lake securing offtake partners.

While Lake’s bet on Direct Lithium Extraction technology was questioned by short seller J Capital in July, Crow said Dickson’s appointment is a vote of confidence for the company’s ‘cutting-edge’ technology.

Lake also believes Dickson’s expertise will boost North and South American projects, fast tracking key focus areas and milestones in marketing segments.

Dickson commented:

‘Lake Resources has the opportunity to set a new global standard for producing clean, high-purity lithium at speed and scale, at a time when lithium demand is growing rapidly.

‘To be a part of the global energy transition and bring a crucial new technology into large scale lithium production is an immense privilege.’

Overlooked ASX lithium stocks

Lithium dominated 2021, with lithium stocks accounting for eight of the top 10 performing stocks on the All Ords.

But lithium stocks have taken a breather this year, as investors took profits following frothy valuations.

Lithium juniors suffered big drawdowns from their 52-week highs.

But despite the correction, lithium still has secular headwinds supporting it.

The difference now is that the easy money has already been made.

So are there any overlooked lithium stocks on the ASX?

Our team at Money Morning think so. In a recent free research report, we have profiled three overlooked ASX lithium stocks worthy of consideration.

Regards,

Kiryll Prakapenka