Welcome back to The Daily Reckoning Australia for 2022!

Here’s hoping you had a great summer and are rested up for a big year.

There’s only one certainty when it comes to markets…and that’s we’ll never get what we expect as the new year unfolds.

However, there is one certainty that I am absolutely…well, certain on…and I’m going to tell you about it over the next three days.

You see…

What if the real reason that we’re seeing prices soar higher in property, stock, and commodities markets could only truly be understood by going back to…

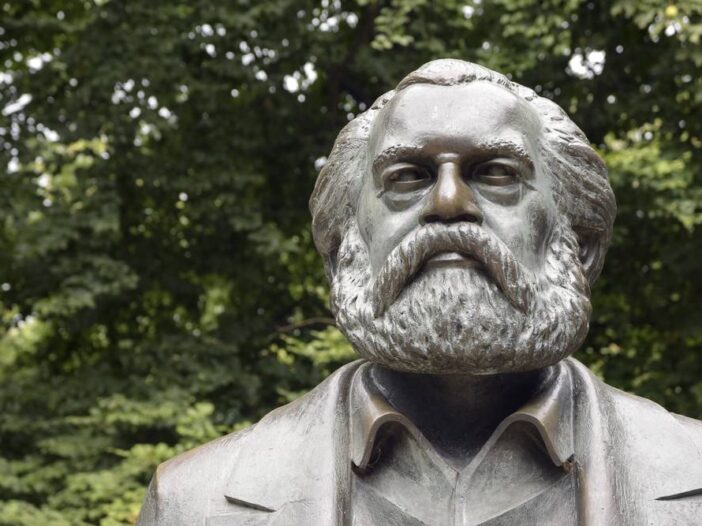

The work of…Karl Marx?

Sounds crazy, I know.

But it’s the idea I want to explore today.

I’m going to offer up an alternate theory of why we’re seeing mania in the stock market, why the stock market made an all-time high in August 2021, and why the price of everything from coal to cotton is soaring.

First up: don’t worry, I haven’t become a communist overnight. I’m not here to foment a class rebellion or bring down the capitalist state.

Instead, I want to talk to you about a ‘missing link’ in the economy that — I think — prevents us from truly understanding what’s going on.

Understanding what it is, is a bit of a light-bulb moment: things that appear to be completely irrational or random suddenly make sense. More on that in a second.

So what is it?

And what does it have to do with our old friend, Karl?

‘Vampire-like’

You might think of Marx as being the father of a completely discredited set of ideas — the kind of stuff that naïve 19-year-olds flirt with before rejecting once they grow up.

But in a very real way, Marx still looms large over more economic discussions, often in a completely inadvertent way.

It was Marx that popularised the idea that economics is largely a battle between two elemental forces of the economy:

Labour…and capital.

Marx saw everything through the prism of this battle. To quote the ‘great’ man himself:

‘Capital is dead labour, that, vampire-like, only lives by sucking living labour, and lives the more, the more labour it sucks.

‘The time during which the labourer works, is the time during which the capitalist consumes the labour-power he has purchased of him.’

A full analysis of that sort of nonsense is beyond the scope of this email. (Just remember, the next time you tuck a bit of your income away as savings for future investment…you’re ‘vampire-like’ in the eyes of Big K.)

My point is a bigger one.

Marx and Marxism may have been widely discredited (further reading: see the Gulag). But those terms — labour and capital — have survived.

They still largely define how we talk about the economy. They’ve left their footprint on the political world, too.

Think about it. Most Western nations have a major political party dedicated to fighting the corner of labour, in one sense or another. And most people understand ‘capitalism’ to be the economic system we live by.

Labour and capital. Capital and labour. They’re still the two key forces of the economy — the prism by which we see and understand what’s going on.

But what if that’s wrong?

What if there’s something more important than BOTH capital and labour?

A ‘missing link’ that both explains and helps to predict what’s going on in the economy.

I’m here to tell you that there is.

It’s LAND.

How to Survive Australia’s Biggest Recession in 90 Years. Download your free report and learn more.

Understand land, understand everything

Take a step back and this becomes obvious.

In traditional economic theory, land is defined as a subset of capital. It’s just another asset class, like bonds or shares or gold.

But that’s not true, is it?

Even thinking about it intuitively, land is much more integral to both the real economy AND the financial system.

Our homes are built on land (the vast majority of bank lending is in some way secured against land). So are our businesses. So are our transportation systems and other infrastructure projects.

This is true even in a digital world. Amazon may be an online business, but it still has warehouses all over the world, connected by a network of road, rail, and aviation systems.

Land is critical to all those things.

And it still requires its customers to have access to the internet, most of which comes via fibre optic networks embedded within the land itself.

Living in the dark

Long story short: in one way or another, everything in the economy comes back to land.

It’s the ‘master asset’, in that sense. It’s at least as important as labour and capital, if not more.

Leaving land out of your analysis is like trying to cook with the lights switched off: you might be able to have a good guess at what’s happening, but you’re far more likely to make a mess and burn yourself in the process.

But put land at the heart of your investing (and even trading), and you’d be surprised how successful you can be.

Why is that?

Well, it turns out that once you start to study land prices, you see they tend to move in a very predictable way.

Specifically, they move in a cycle that tends to last 18–20 years. As you’ll see tomorrow, this cycle corresponds in an uncannily accurate way with many of the biggest economic turning points in history.

Booms. Busts. Panics. Manias. They can all be explained by understanding what’s going on in the land cycle.

The problem is most people — including most economists — have only the vaguest sense of what’s going on with the land cycle.

That means they’re in the dark.

They can’t make sense of what’s happening in front of them.

And they certainly don’t have any real sense of what’s coming next.

Case in point: we’re seeing a huge boom in stock, property, and commodity prices…even in the face of grim economic data.

That baffles a lot of people. They think the crash is just around the corner. They stay on the sidelines. Meanwhile, the markets just keep grinding higher.

Feel familiar?

But as I’m going to show you tomorrow: there is another way.

A way of understanding what’s going on right now with perfect clarity.

A way of potentially capitalising on our fast-rising stock and property markets, without making crazy, high-risk speculations.

And a way of getting out BEFORE the downturn comes (which it will…just not when you might think).

I’ll show you what I mean in tomorrow’s essay.

And to jump ahead: on Wednesday, I’m going to share an investing masterclass we’ve put together, sharing five smart things to consider doing with your money right now to potentially profit in 2022 and beyond. I’ll tell you more about it tomorrow.

Until then,

|

Callum Newman,

Editor, The Daily Reckoning Australia

PS: Don’t forget to check out my free podcast here. Already we’ve covered commodities, property, cannabis, day trading, and gold shares. And there’s plenty more coming up…and it’s all FREE. Give it a go!