Well, he’s finally done it.

Jerome Powell has abandoned any care about inflation…

The US Federal Reserve Chair confirmed this at this year’s (virtual) Jackson Hole summit. Stating that the Fed would no longer be strictly targeting an average 2% inflation rate for the US economy.

Not that they’ve even come close in recent years anyway. At least according to the calculations the Fed puts out.

Effectively, Powell is simply moving the goal posts. Proving once more that the central banking stooges have no idea what the hell they’re doing.

But of course, rather than admitting to that, Powell is doubling down.

After all, if they can’t manage inflation why not flat out ignore it. When it suits them of course…

In Powell’s own words:

‘On price stability, the FOMC adjusted its strategy for achieving its longer-run inflation goal of 2 percent by noting that it “seeks to achieve inflation that averages 2 percent over time.”

‘To this end, the revised statement states that “following periods when inflation has been running persistently below 2 percent, appropriate monetary policy will likely aim to achieve inflation moderately above 2 percent for some time.”’

Meaning that inflation will be allowed to run wild if it betters the US economy in the long run.

Or, in simpler terms: The Fed has conceded that they want more inflation. Welcoming it with open arms in order to boost wages, jobs, and the broader economy.

Let’s just say, I have my doubts that Powell will get the result he wants…

Four Innovative Aussie Stocks That Could Shoot Up after Lockdown

Will they ever learn?

The reason for my pessimism is because I believe the Fed is blind to reality.

The problem isn’t that inflation is too low — the problem is that it’s skewed.

Since the end of the global financial crisis, inflation evolved. The US economy, and the rest of the world for that matter, all saw a seismic shift.

Consumer Price Indices (CPIs) had become stagnant. For whatever reason (and there are a lot of them), prices for everyday goods and services stayed fairly flat.

For the central bankers, like the Fed, this was a problem. Their methods of measuring inflation have historically relied on these consumer prices more than most. Often ignoring the flows of money into other areas.

Like assets, for example…

Let’s compare, shall we.

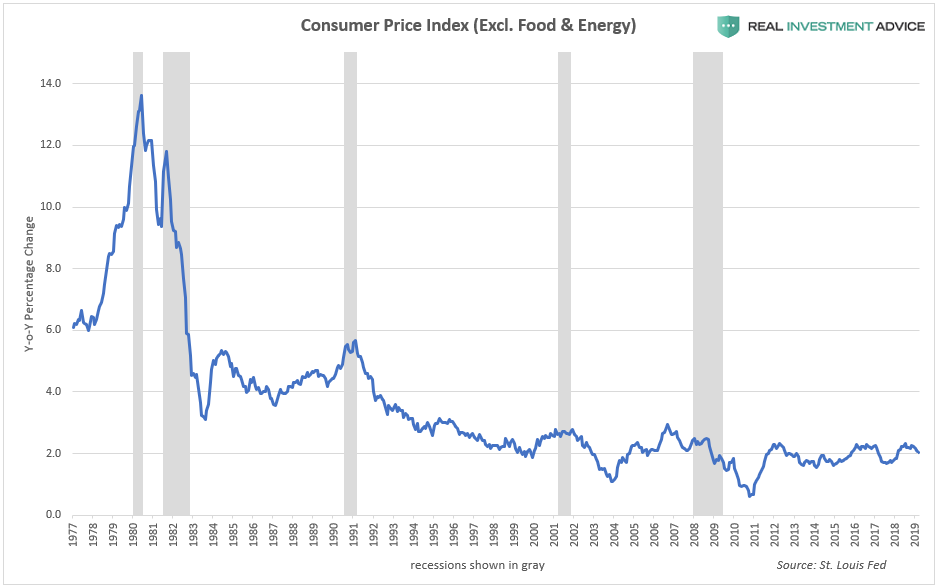

Here is the US CPI from 1977 to 2019:

|

|

|

Source: Real Investment Advice / St Louis Fed |

As you can see, after a brief spurt in 2011/12 — the CPI has been totally flat. Failing to budge higher or lower in eight years.

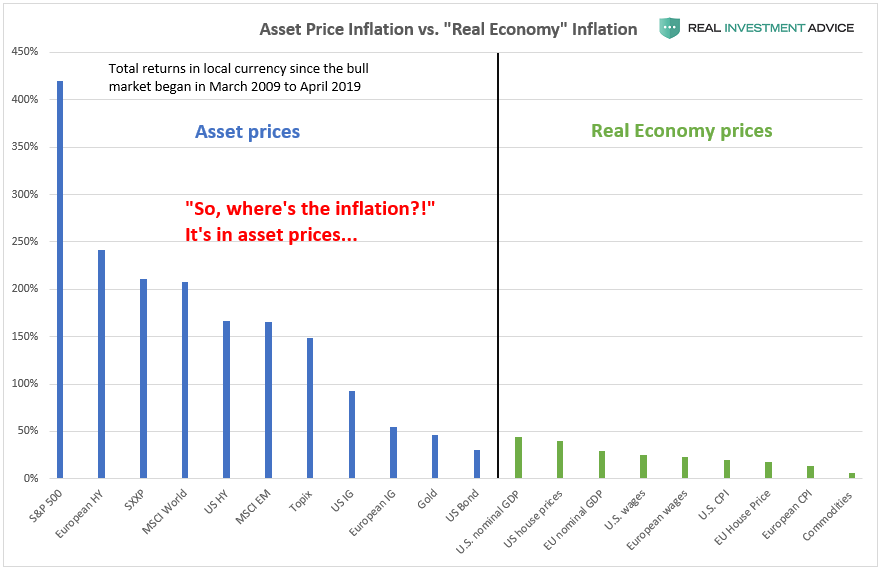

Asset prices on the other hand, have gone absolutely nuts:

|

|

|

Source: Real Investment Advice |

US shares — the clear inflationary winners — soared roughly 425% over the decade. Easily outstripping every other contender.

Much of which has (arguably) been fuelled by Powell and his predecessors. With low rates and easy money (via Quantitative Easing) all serving to prop up stocks, bonds, and other assets.

Even today, after a vicious pandemic-led crash, the S&P 500 is back to all-time highs. All thanks to the Fed’s willingness to ‘save the economy’.

And now they want to let inflation run even harder…

The bubble of all bubbles

Look, it doesn’t take a genius to see that the US stock market is in a precarious position.

Earlier this week we saw Warren Buffett’s favourite market indicator; total stock market value relative to GDP, break a new record.

The ratio is now sitting at 183%, well above the healthy range of roughly 100%. Signalling just how overvalued the stock market is right now.

But, as my colleague Greg Canavan would tell you, even that doesn’t paint the whole picture. Because it’s not that the US market is overvalued, it’s that the top stocks within it are. With big tech stocks like Apple and Microsoft doing a lot of the heavy lifting in terms of market returns.

That’s a matter for another day though…

Right now, my point is that US assets and particularly shares, are heavily inflated.

Normally that would be a troubling sign. An indicator that should tell any sane investor to get out of the market before the bubble bursts.

Not now though.

With this decision by the Fed to ignore inflation, expect the bubble to only get bigger. Which means stocks, particularly in the US, could run a lot higher still.

It’s insane, I know, but that’s the world we live in at the moment.

Powell is about to take the US down a very unnerving road. Testing the limits of everything we thought we knew about inflation.

In the end though, something will have to give. And when it does, expect it to be very ugly.

Until then though, as the old saying goes, make hay while the sun shines. Because Jerome Powell may have just ensured that the US stock market meltup is only just beginning.

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.