James here.

Before we begin, I just want to bring your attention to something.

As part of our Fat Tail New Years’ Countdown, you can very briefly get a subscription to my advisory Diggers and Drillers at 70% off.

This is where I’ll aim to help you find mining stocks that have the potential to rise…based on my 15-year experience and talking to my network of insiders in the Aussie mining industry.

But this 70% off deal will only be for the next few days.

It could be a very opportune time to join me, as I’ll explain below.

It also comes with a 30-day subscription refund guarantee.

So you can even receive that 70%-discounted subscription back if you decide it’s not for you in the first 30 days.

So what’s in store for exploration stocks in the year ahead…and what’s our attack plan?

Well, first turn your attention back 12 months from today…

Tech was tanking.

Gold stunk.

Banking was on the verge of a systemic meltdown.

Global real estate was balancing on the edge of an interest rate cliff.

And…COVID lockdowns were still on in China!

It was a torrid time…

As reported by Reuters, economist’s consensus was for a 70% recession probability in the US.

Yet despite the misery, there was a bright spot…

Lithium.

In the second half of 2022, lithium producers began to emerge…slowly at first.

But with EV sales strengthening across China and the US, the miners undertook a six-month campaign that defied market misery.

Developers, producers and explorers rose in unison.

The lithium boom was on.

Market-caps swelled; revenues shot up!

The ASX200 became inundated with emerging lithium producers.

Miners like Pilbara Minerals [ASX:PLS] ascended 158% in just four months.

For explorers, gains were higher still.

But fast forward to today and boy oh boy, things have certainly changed!

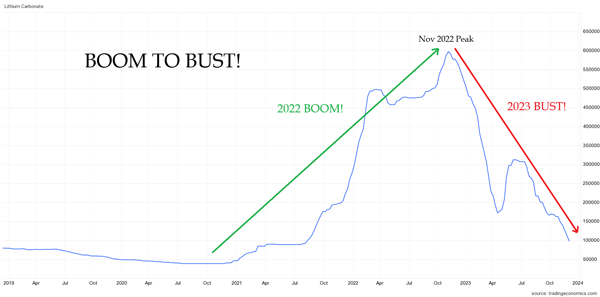

Take a look at the 5-year chart for lithium carbonate, below:

| |

| Source: Trading Economics |

Classic!

On 7 November 2022 the commodity made an all-time high of 569,000 CNY (Chinese Yuan) per tonne.

12 months later and the metal trades for just 81,000 CNY/tonne.

That’s an earth shattering 86% capitulation…a textbook boom to bust tale.

While falls haven’t been as hefty among the lithium producing heavyweights…last year’s stock market darlings have certainly lost favour.

Over the last 12 months, IGO [ASX:IGO] has shed around 45%.

Mineral Resources [ASX:MIN] and Allkem [ASX:AKE] have both lost around 30%.

While US lithium giant Albemarle [NYSE:ALB] has given up over half of its value.

2023 will go down as a brutal year for lithium investors.

As a sidenote, I had many readers asking me about lithium stocks at the end of 2022.

Diggers & Drillers happened to launch right alongside peak euphoria.

But at that time, I had no intention of getting readers into this frothy market.

Just as well, given the steep falls that followed.

Yet we didn’t dodge the wreckage, entirely.

By mid-2023, we began to test the waters…adding two lithium plays offering hefty discounts.

But as it turns out, that was still too early…the sector continued to sell down for the next half of 2023.

Is lithium close to bottoming?

I wish I had the answer…but really, does it matter?

After all, electric vehicle (EV) sales continue to break new records in the US.

Year-to-date sales have just surpassed 1 million for the first time ever in the world’s largest economy.

Despite analysts forecasting waning interest, sales are booming.

This single factor will drive demand as battery makers scour the market for more metal.

Meanwhile, data from market research firm Rho Motion showed EV sales in China jumped 29% year-to-date.

That’s despite authorities ending a generous subsidy that’s kept sales buoyant over the last 11 years.

But it’s not just EV sales boosting the outlook…

2023 has seen rampant M&A activity across the sector.

Mining heavy weights Gina Rinehart, SQM and Albemarle have all taken part in multi-billion arm wrestles as they jostle for quality lithium assets.

Meanwhile, the world’s fourth largest oil producer, Exxon mobile, is pivoting to become a major global supplier!

This $400 billion oil giant is looking to tap lithium-rich brines across its landholding in the US state of Arkansas.

But as the big wigs clamber for more lithium, small-time investors head for the exits.

For most shareholders, lithium has had its time in the spotlight in 2022. The boom is well and truly over.

But if that were the case, why are the world’s biggest players ratcheting up exposure?

Do they know something the rest of us fail to see?

You can count on it!

For this reason, I expect small, exploration stocks in this arena to really fire if the lithium boom re-ignites in 2024.

Lithium is wild, volatile, risky and moves with little predictability.

Right now, last year’s overhyped investment theme looks over.

But with EV demand rising in the world’s two largest economies…just as multi-billion corporates vie for more assets…

LITHIUM could be the number one contrarian trade opportunity in 2024.

It’s risky, though. You can lose a lot of money with the wrong move.

But landing on the right one can lead to handsome benefits.

And a subscription to Diggers and Drillers can help you here.

If you’d like to jump on board, now’s the time to do it!

To get Diggers and Drillers for 70% off the regular price…before midnight 1 January, click here.

Regards,

|

James Cooper,

Editor, Diggers & Drillers and Mining: Phase One

Comments