In today’s Money Morning…localised energy issues…what about China, though?…recency bias and the return to normal…and more…

Everywhere you look, you can’t escape the energy crisis narrative.

Whether it be reports of dry petrol stations in the UK, or Chinese power quotas and shutdowns, or even speculation as to whether OPEC will increase production — everyone is talking about energy.

More importantly, though, most of the media keeps framing it as a ‘crisis’.

And don’t get me wrong, a lot of people are doing it tough due to these energy supply issues. But I am yet to be convinced that this is the result of some unforeseeable catalyst or event…

As far as I can tell, this is simply a case of energy demand returning to pre-pandemic expectations.

Granted, there are a few extrinsic circumstances causing more headaches for some. As can be seen within the aforementioned issues gripping both the UK and China.

In my opinion, though, the developments in energy markets should (largely) be seen as a positive.

Let me explain…

Localised energy issues

First, let’s clear up the whole UK and China situation. Because I am unconvinced that they’re indicative of some global energy crunch.

The UK’s woes, for instance, are strictly because of supply chain issues. They simply have a shortage of trucks and truck drivers to transport the fuel from storage facilities to petrol stations.

As for why there is a shortage, the main reason seems to be a lack of truck drivers. A shortage that has been blamed on both Brexit and the pandemic.

Either way, though, the point is that the UK hasn’t run out of fuel — it just has supply chain issues.

What about China, though?

Well, similarly to the UK, their fuel crisis is also mostly self-inflicted.

The Chinese government is enforcing energy quotas and limits. Forcing consumers and businesses to ration their electricity usage, for a handful of reasons…

For instance, we’ve seen China take a fairly combative approach to commodity prices recently. Trying to intervene and reduce their reliance on key resources in order to stop costs from getting out of hand. And some of this will extend to key energy markets.

Coal, for instance, is a big issue in China. Many of the plants that used to power the nation’s industries are now unable to operate at an economically feasible rate. Forcing them to close for good and taking their energy capacity with them.

On top of this, though, China is desperately trying to move to cleaner energy solutions too. Not only in the long term, but also the short term.

The Beijing Winter Olympics are just over four months away. An event that China has been desperately trying to clean up for, having already curbed their steel industry production in order to try and achieve some semblance of cleaner skies.

So don’t get caught up in thinking these very specific circumstances will lead to a broader energy crisis. Because even as energy prices begin to rise globally, I wouldn’t call it a crisis. It’s more like a rebound…

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

Recency bias and the return to normal

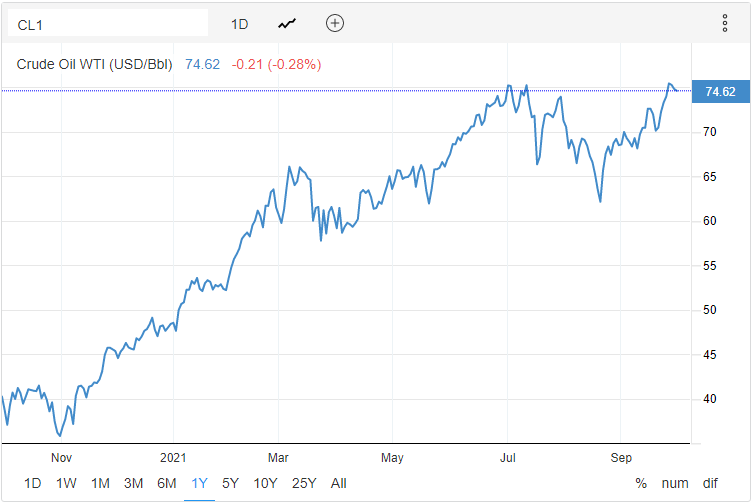

If we take a look at what the oil price has gone through recently, it is easy to see where some of hysteria is coming from. After all, a quick look at a simple chart paints a clear picture:

|

|

|

Source: Trading Economics |

In the graph above, you can see the surging price of oil over the past year, showcasing how a barrel of crude has almost doubled in price in the past 12 months.

And yes, in isolation this may warrant some concerns about energy demand or supply.

But if we extend the graph over a longer time frame, things don’t look nearly as bad:

|

|

|

Source: Trading Economics |

As you can see now, 2021’s rise, while still impressive, isn’t really some massive breakout. Rather, it is simply a return to a price that is closer to pre-pandemic levels.

And this is the point I really want to drive home. Because it’s not just prices that are returning to pre-pandemic levels, it is demand too.

The world is finally moving beyond living with COVID. Lifting vaccination rates, reopening businesses and communities, and returning to some sort of normalcy.

As a result, energy demand is logically increasing. Which is a good thing, not a cause for concern.

It proves that industries and economies are finally getting back on track. Delivering the kind of productivity that we need to return to growth and prosperity. Something that the market should welcome with open arms.

Granted, that doesn’t mean there won’t be teething problems.

For instance, supply chain issues, like those gripping the UK, will still prove challenging. Global shipping, too, is yet to fully recover, with backlogs still proving to be an issue.

Again, though, my point is that this really shouldn’t be seen as a crisis.

Not yet at least.

Because while there are certainly cracks beginning to show in certain markets and sectors, the tide hasn’t turned just yet. There is still a whole lot of stimulus and excess capital floating around out there. And for that reason, I would not be surprised if stocks have a lot more room to run higher.

So while it certainly pays to be a cautious investor, don’t succumb to fear.

After all, the market opportunities still far outweigh the concerns in my opinion.

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning

PS: Ryan is also the Editor of Australian Small-Cap Investigator, a stock tipping newsletter that hunts down promising small-cap stocks. For information on how to subscribe and see what Ryan’s telling subscribers right now, click here.