In today’s Money Morning…the butterfly effect…electricity prices explode…gas ignites…Australia’s future…the opportunity…and more…

Gas prices continue their stratospheric rise around the world.

What on Earth is going on and how can we make some money out of it?

It looks like the UK has been the catalyst for the latest surge in gas and electricity prices because it had the audacity to stop blowing a gale in the North Sea.

The Wall Street Journal released an article on Monday that said:

‘The episode underscored the precarious state the region’s energy markets face heading into the long European winter. The electricity price shock was most acute in the U.K., which has leaned on wind farms to eradicate net carbon emissions by 2050. Prices for carbon credits, which electricity producers need to burn fossil fuels, are at records, too.

‘“It took a lot of people by surprise,” said Stefan Konstantinov, senior energy economist at data firm ICIS, of the leap in power prices. “If this were to happen in winter when we’ve got significantly higher demand, then that presents a real issue for system stability.”

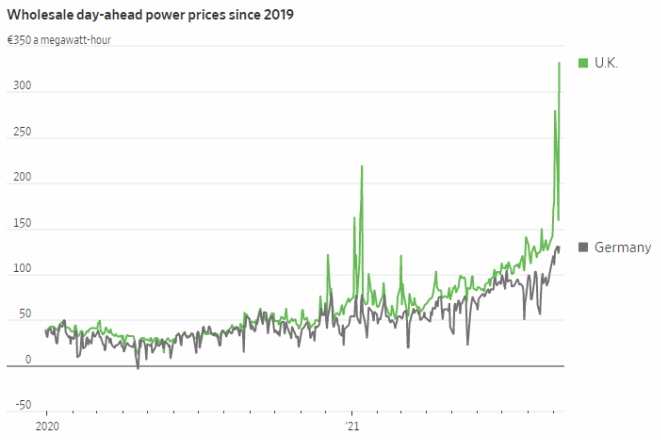

‘At their peak, U.K. electricity prices had more than doubled in September and were almost seven times as high as at the same point in 2020. Power markets also jumped in France, the Netherlands and Germany.

‘Prices for power to be dispatched the next day rocketed to £285 a megawatt hour in the U.K. when wind speeds dropped last week, according to ICIS. That is equivalent to $395 a megawatt hour and marked a record on figures going back to 1999.

‘After the wind dropped this month, National Grid asked Électricité de France SA to restart its West Burton A coal power station in Nottinghamshire. That won’t be possible in the future: The government has said all coal plants must close by late 2024.’

Let’s have a look at a chart of UK and German power prices over the past few years to see how dramatic the most recent move has been.

Electricity prices explode

|

|

| Source: Mishtalk.com |

The UK has 25% of their energy production sourced from wind farms, so when the wind stops blowing they need to lean heavily on gas to firm up supply.

Gas ignites

Gas inventories were already tight across Europe. As reported on Reuters.com:

‘Prices have accelerated since the start of April, when gas in storage first began falling below the pre-pandemic five-year average for 2015-2019, signalling an impending shortfall.

‘Since then, storage facilities have filled more slowly than normal, despite soaring prices, as Europe has struggled to import sufficient gas to reduce the deficit.

‘European importers have been locked in competition with Asian buyers to attract extra liquefied natural gas (LNG) cargoes, while pipeline deliveries from Russia have failed to respond…

‘…As a result, storage across the region is now only 71% full, compared with a pre-epidemic average of 84% for this time of year, according to data from Gas Infrastructure Europe.

‘Storage rates have not been below 77% at this point of the year throughout the past decade, threatening the region with a gas shortage this winter…

‘…Industrial users with heavy gas consumption, including steelworks, cement, ceramics, glassware, fertilisers and petrochemicals, will have to consider whether to reduce output or close temporarily to reduce fuel costs.

‘Some of the speculative “frothiness” that has built up in recent weeks is likely to deflate as initial signs of market rebalancing become clearer.

‘But prices are likely to remain elevated for some time, until evidence emerges of demand destruction in the form of reduced gas generation, industrial plant closures and resales, increased deliveries from Russia and LNG, or the winter proves milder than usual.’

The troubles in Europe are reverberating around the world with spot prices for LNG in Asia quadrupling since the start of the year.

Asian LNG still rising

|

|

| Source: Tradingview.com |

Australia’s future

Welcome to the brave new world of renewable energy where a few days of fine conditions without wind can cause electricity and gas prices to go vertical.

Australia is heading in the same direction, so what you see above is probably our future too.

This topic can become quite heated, and I have found each side likes to bait the other side with nasty catchphrases or nicknames. ‘Go woke, go broke’, for example.

I try to stay apolitical in my writing because I read enough articles where people are banging their own drum and I personally get sick of it all.

I’d rather focus on the realities of the situation and try to figure out where markets are heading next as a result.

The fact of the matter is that when the sun isn’t shining and the wind isn’t blowing, an oversupplied electricity market can become undersupplied in a flash.

There has to be something backing up the renewables to ensure that we can turn the lights on.

Your strongly held beliefs about the danger or not of fossil fuels isn’t relevant. If we stop all oil, coal, and gas production today in order to save the planet, we will cause utter chaos.

Unless you are prepared to go and live under a log without your mobile phone, car, and central heating, you agree with me. This isn’t a political statement. It’s a statement of fact.

We’re not ready yet, so we need to find the best way forward until we have a lasting solution that ticks all the boxes.

It seems clear that coal’s days are numbered. The baseload generators are struggling to make money in the new world of renewables. Even with some government support so they stick around a bit longer than they’d like to, we are not that far away from coal becoming a much smaller part of the energy mix.

Renewables are growing like the clappers off a very low base, but as we saw above, the more renewables you create the more you need something to back it up.

Until we figure out a way to cheaply store the excess energy produced during the day by renewables and then use that energy overnight when there’s no sun, gas will be the thing we need to keep things running.

The political pressure that has built up to stop all forms of fossil fuel generation as quickly as possible has got to a point where it is destabilising markets. It is also setting up a trade of the decade for those willing to put their ideology aside and take advantage of what is a cold hard reality.

Gas must be the bridging fuel we need until we work out how to get rid of it completely. Uranium is the other potential baseload generator that may come back into fashion, and the recent spike in uranium prices shows that the rumours of its death were greatly exaggerated.

But as LNG prices around the world move higher and higher each day, oil and gas stocks in Australia continue to sell off as the smartest guys and girls in the room run away from exposure to the wickedness that may tarnish their ESG credentials.

The opportunity

I wrote to you a couple of weeks ago saying that ‘Woodies [Woodside Petroleum] will look like a bargain under $20 if oil prices keep running.’

Fast-forward two weeks and it’s trading above $21.00 and still looking cheap to me.

And as Greg Canavan, our Editorial Director, wrote in an email exchange about the issue yesterday:

‘It’s really bizarre. I think this ESG thing is creating a massive opportunity. Origin Energy Ltd [ASX:ORG] trades on a forecast FCF yield of more than 15%!

‘Beach [Beach Energy Ltd [ASX:BPT]] is on a single-digit PE and will be selling LNG cargoes for the first time in a few years. ESG scares woke fund managers and also prevents new supply coming online. That can only mean higher prices over the longer term.’

It’s not often you come across a situation where the fundamentals stack up so strongly, but ideological and political pressure is forcing stock prices in the opposite direction.

At some point ideology always comes face-to-face with reality. I know who I’m backing.

Regards,

|

Murray Dawes,

For Money Morning

PS: Bill Bonner had quite a few places to choose from to spend his COVID lockdown in during 2020. But he chose Argentina…and managed to get in right before the borders closed. Why that choice? Bill needed as much quiet as possible. And needed to get as remote as possible. He had his final book to complete…click here to learn how to access it…