In today’s Money Morning…this isn’t the dotcom boom, yet…whether you like value or growth stocks, just pick the right ones!…how to handle life at zero…and more…

In short, no, not yet.

If Friday’s trading on the ASX was a sea of red, today’s trading should go far smoother for those with a bunch of growth stocks.

In fact, after the most minor of panics, I expect the run for the speculative end of the stock market to continue unabated for a while yet.

This is becoming par for the course for a world where central banks are committed to holding rates at zero.

And it’s totally unsurprising to wake up this morning to a headline that details the S&P 500’s best day since June.

The cause for enthusiasm?

Bond yields, particularly on the all-important US 10-year Treasuries, retreated.

Now, bonds are not Money Morning’s usual focus of discussion.

But according to Murray Dawes who writes to you on Saturdays, US 10-year Treasuries are ‘the most important asset in the world.’

Murray saw what was happening from a long way off and made some moves in the excellent Pivot Trader service ahead of Friday’s leg down.

I won’t go too far into the thicket on bonds, suffice to say, if yields climb the future earnings of growth companies are less appealing.

So, what I’m really interested in looking at today, is whether the heat will come out of ASX small-caps.

This isn’t the dotcom boom, yet

Take a look at this interesting chart below:

|

|

| Source: longtermtrends.net |

This is the Wilshire Growth/Value Index which ‘divides the Wilshire US Large-Cap Growth Index by the Wilshire US Large-Cap Value Index. When the ratio rises, growth stocks outperform value stocks — and when it falls, value stocks outperform growth stocks.’

We can see it’s elevated, but not quite at 2000-era mania.

I think things are a little different this time round though.

Many of those tech stocks from the 2000s that survived are now tech giants, with huge cash stockpiles.

Maybe Tesla Inc [NASDAQ:TSLA] is in a sort of one-stock bubble? But that’s neither here nor there.

You can also see the index is tapering off right at the tail end.

Which could be hinting that value stocks are back on the menu, if only just.

These are companies that are actually making money, and potentially paying dividends.

Companies that ‘make sense’.

But I’d also warn against the old narrative of rational value versus irrational growth.

As in, I don’t think the two are mutually exclusive.

Maybe the index above moves sideways for a period of time, meaning that growth and value stocks are keeping pace with each other.

Which brings me to the next crucial point.

Whether you like value or growth stocks, just pick the right ones!

It’s easier said than done.

Looking around the market, it’s been significantly harder to find the companies and charts that I really like for Exponential Stock Investor.

It’s almost as if everything in the small-cap universe bolted long ago.

From experience, the companies with real potential are generally in the process of snapping a downtrend and have a killer project or product to bring to market.

The forgotten-about ones that the market is waking up to again.

For value stocks, I’d suspect that you’d have a fair bit more to choose from if this kind of chart is what you are looking for.

As a class of stocks, most value stocks have been forgotten for an extended period of time.

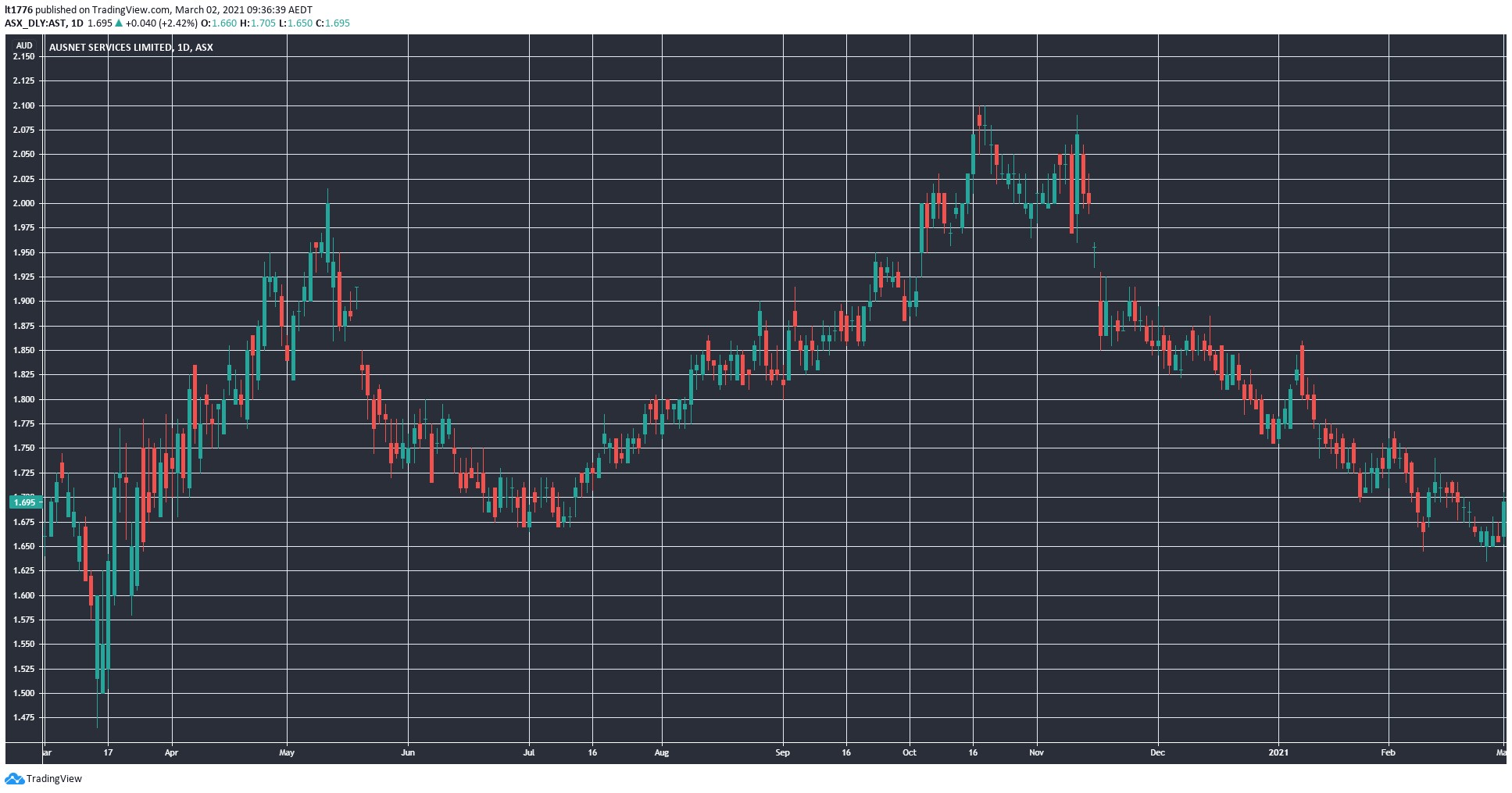

By way of example, you could look at electricity distributor Ausnet Services Ltd [ASX:AST], which has a long history of dividends:

|

|

| Source: Tradingview.com |

People will always need energy.

And if you look at their most recent results from November, you can see some strong numbers:

|

|

| Source: Ausnet Services Ltd |

From the outside, it looks like a company that is powering along.

However, the chart is telling you something different from November onwards.

To give you a clear answer on why there’s a divergence here, I’d need to do a much deeper dive.

So, what I’m trying to say is that I’m not equipped to go toe to toe with value stock pickers out there.

Which is why you should pay attention to what Greg Canavan has to say in his upcoming webinar.

How to handle life at zero

Greg’s our Editorial Director in the business and he’s been thinking long and hard about how to operate in the markets if rates are going to be hovering around nil for a long time.

He excels at the value side of things, which is a strategy geared for a certain type of investor.

It aims at consistently getting returns without going full bore on risk.

From a ‘whole of portfolio’ perspective, this could be exactly the right way to go about things.

Level-headed investments in companies that the market should wake up to eventually.

He’s running a free webinar on his strategy which you can get a virtual ‘seat’ for right here.

If you are working with a bigger chunk of change, or simply want to understand the mechanics of his investment strategy, I strongly encourage you to check it out.

You’ll definitely learn a thing or two.

Regards,

|

Lachlann Tierney,

For Money Morning

Comments