Bitcoin [BTC] has a price, but does it have any value?

Is there a future income stream you can value on a discounted cash flow model?

Nope.

Are there any physical assets — plant, machinery, real estate?

Nope.

Is it a scalable and reliable medium of exchange?

From what I’ve read, the technology lacks the capability to handle large amounts of transactions in a short period. Reliable? Are you kidding? Look at the price action. It’s all over the shop. How can you enter a transaction when the medium of exchange can rise or fall $3,000 or more in minutes?

Bitcoin has limited commercial value.

So what gives bitcoin a US$40k price tag?

It’s a social construct.

Those who — with good reason — have no faith in central banks and fiat money want an alternative form of currency. One that’s free from the corruption and manipulation of the money-printing mandarins.

Belief…this is what’s holding up the price of a computer code which, by all practical valuation measurements, is next to valueless.

Seeing bitcoin as art

The whole bitcoin thing never made sense to me until I read Ben Hunt’s (of Epsilon Theory) take on it:

‘Bitcoin is good art.

‘Or better yet, because Bitcoin is elegant and beautiful fashion, sitting at the intersection of art and commerce.

‘Most importantly, because owning Bitcoin has been an authentic expression of identity, an extremely positive identity of autonomy, entrepreneurialism, and resistance to the Nudging State and the Nudging Oligarchy.

‘Good art is always worth something. But how do we measure that something…how do we put a price on the value of good art at this particular moment in time? It’s a REALLY tough question.

‘There are no cash flows to art. There are no fundamentals to art. There is no “use case” to art.

‘There is only story. There is only narrative. There is only common knowledge — what everyone knows that everyone knows — about the value of art, common knowledge that emerges from our social interaction with story and narrative.’

Seeing bitcoin as art helped me rationalise what I previously thought was irrational. There is NO value…there is only story. There is only narrative.

When you really think about art…there is also limited material value.

Canvas. Paint. Wooden frame.

Total cost…a few hundred dollars.

What gives art its value is the narrative.

This is a Rembrandt or Monet or Warhol or an up-and-coming artist.

I recall walking through the Museum of Modern Art in New York and some of the ‘art’ on display baffled me…a bullet hole in a wall and a raincoat on a coat hanger…this passes as art? Like beauty, what constitutes art or meaningless rubbish is obviously in the eye of the beholder.

Knowing bitcoin’s price, like art, is based solely on a perception derived from a narrative is somewhat reassuring.

While people believe in the story, bitcoin has a price.

Cryptos also share other characteristics of the art market.

Fakes, frauds, thefts, false certifications.

Is bitcoin an artful dodger?

What is an artful dodger?

‘Someone who is clever and manages to get out of difficult situations and avoid answering questions.’

Macmillan Dictionary

Those controlling the crypto story and narrative (the whales) are clever.

They’ve certainly managed to get out of difficult situations — hacking scandals; Tether [USDT] being exposed by the New York Attorney General for lying about the USD backing of its stablecoin; rug pulls, etc.

When caught out and exposed, they shift the narrative and avoid answering the questions.

The 3 March 2022 issue of The Gowdie Advisory looked at:

‘How the narrative is managed

‘Digital Currency Group (DCG) is a major player in the crypto world.

‘While you may not have heard directly about DCG, you might be familiar with two of its subsidiaries…Grayscale Investments and CoinDesk.

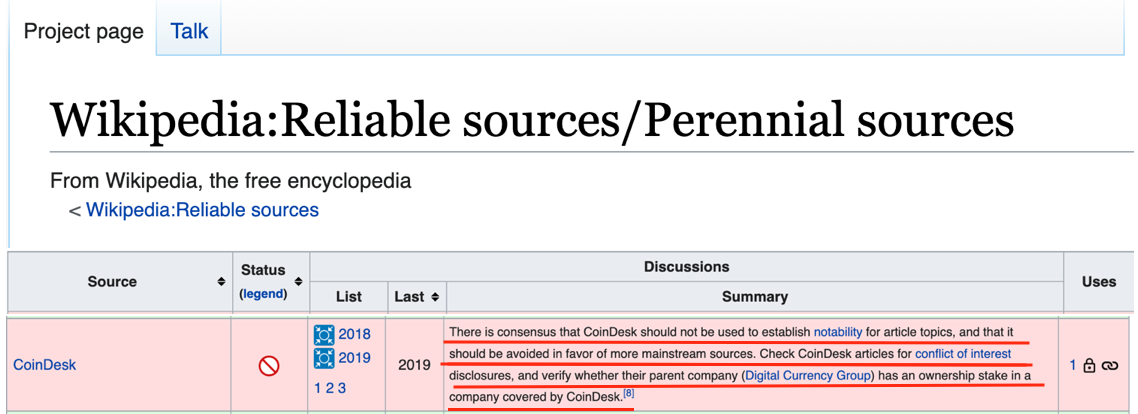

‘According to Wikipedia:

“Established in 2013, Grayscale Investments is a digital currency asset manager. It offers funds privately for institutional and accredited investors and publicly-traded products. They are the world’s largest asset manager for digital currency and in January 2021 Grayscale reported that they were managing $20.2 billion in assets. Grayscale also manages the Grayscale Bitcoin Investment Trust (OTCQX: GBTC), which was the first publicly quoted securities solely invested in the price of bitcoin upon its launch in 2013.”

‘And…

“CoinDesk is a global media, research, and events platform that was acquired by Digital Currency Group in 2016. It reports on blockchain’s daily news, provides a Bitcoin Price Index and publishes a quarterly State of Bitcoin report. CoinDesk also hosts a conference on digital currencies and blockchain technologies titled Consensus.”

‘This is a cosy arrangement. Grayscale looks after the money and CoinDesk looks after the reporting.

‘Potential conflict of interest?

‘Wikipedia thinks so:

|

|

|

Source: Wikipedia |

‘Wikipedia obviously harbours doubts over the independence of CoinDesk’s media and research.

‘When price is determined by a process of creating artificial levels of trading volume to incentivise real entities to trade and speculate, controlling the narrative is absolutely crucial to the success of the operation.

‘Finding independent and well-qualified sources offering an opinion on the real value and real risks of bitcoin, is a time-consuming exercise.

‘Therefore, it’s easy to see why people buy the industry narrative.’

For those wanting to balance out the insider’s narrative, The Gowdie Advisory looked at the…

‘Findings of US government agencies

‘When it comes to cryptos, is the US government an independent source of reference OR is it doing its utmost to protect its fiat monopoly?

‘Or could it be serving both purposes?

‘Have the agencies found sufficient proof of deception and malfeasance to act in the public interest?

‘And, at the same time, are they compiling a body of evidence (for when cryptos threaten the stability of the system) to prosecute their case for the need of an independent, transparent, and regulated central bank digital currency?

‘Yes, the US government most likely does have an agenda. But does that make the findings less truthful?

‘You be the judge.

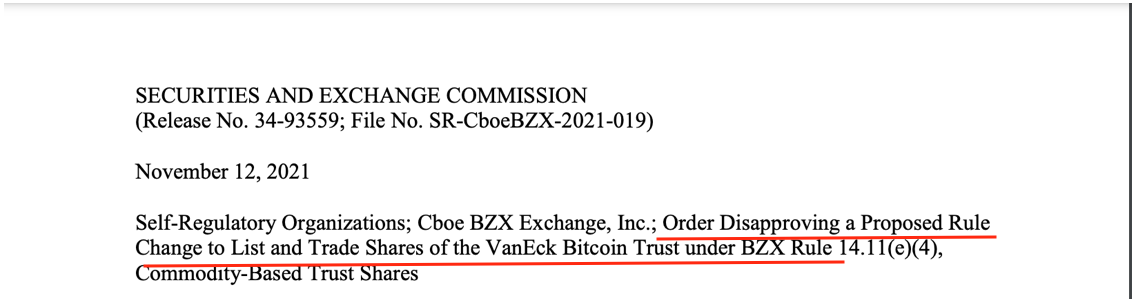

‘On 12 November 2021, the US Securities and Exchange Commission (SEC) rejected a bitcoin exchange-traded fund (ETF) proposed by Van Eck Associates Corporation.

‘The fund intended to invest directly in bitcoin…as opposed to bitcoin futures.

|

|

|

Source: SEC |

‘In the Order Disapproving of the listing, the SEC stated (emphasis added):

“…[the Cboe] BZX [exchange] does not sufficiently contest the presence of possible sources of fraud and manipulation in the bitcoin spot market generally that the Commission has raised in previous orders, which have included:

“(1) ‘wash’ trading,

(2) persons with a dominant position in bitcoin manipulating bitcoin pricing,

(3) hacking of the bitcoin network and trading platforms,

(4) malicious control of the bitcoin network,

(5) trading based on material, non-public information, including the dissemination of false and misleading information,

(6) manipulative activity involving the purported ‘stablecoin’ Tether (USDT), and

(7) fraud and manipulation at bitcoin trading platforms.”‘Look at the language being used…fraud, manipulation, misleading, hacking, malicious.

‘Is it just me or are these serious red flags people should take note of?

‘But in reality, how many people who are seriously tempted to invest in (or remain invested in) cryptos, would bother reading the findings in the 51-page SEC Order?

‘Not many.’

Buying the anti-establishment story is easier and less taxing on the grey matter.

So is bitcoin ART or an ARTFUL dodger?

For now, it’s a bit of both.

However, cryptos, unlike art, are a threat to establishment control.

Regulations are coming.

How tight will they be?

The authorities’ response will be proportionate…the greater the threat, the greater the controls.

What’s Bitcoin’s destiny?

A valuable artwork or a worthless bit in 2020s memorabilia?

If belief holds up, it’ll be the former.

But if those controlling the narrative believe the social construct is unravelling, they’ll rush the exits, and it’ll be the latter.

Bitcoin is an interesting social experiment.

One I’ll watch from the sidelines.

Regards,

|

Vern Gowdie,

For The Daily Reckoning Australia