In today’s Money Morning…it’s not an open field forever…details of PayPal’s product…where to look for fintechs that aren’t BNPLs…and more…

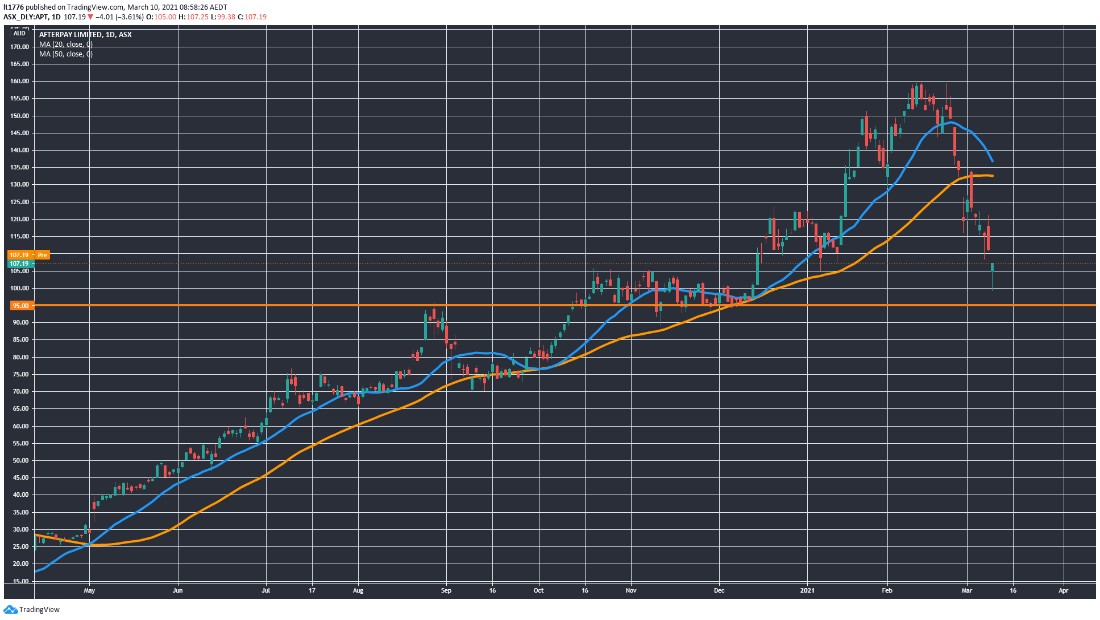

After getting used to a straight line up the charts, Afterpay Ltd [ASX:APT] investors would be forgiven for feeling a bit nervous.

You see, news emerged that PayPal Inc [NASDAQ:PYPL] is throwing its hat in the ring with a ‘pay in four’ option for users.

That was back in September though, and APT got past its jitters to push higher on more strong growth numbers.

After going as high as $160.05 on 11 February, the APT share price currently sits at $107.19 before today’s open.

You can see the relatively sharp fall on the chart below:

|

|

| Source: Tradingview.com |

If the negative momentum continues, another leg down could materialise after it breaches the $100 mark where there was some sideways trading between October and December.

But that’s just the technical picture.

At a deeper level, there is a story about innovation and competition.

It’s not an open field forever

Thomas Edison once said:

‘Continued innovation is the best way to beat the competition.’

And I think it’s highly relevant to Afterpay’s situation right now.

APT is sort of like the Bitcoin of fintechs — ‘the original and best’.

But its product has been around for a relatively long time now in terms of technological innovations, and it needs to adapt.

With any new product that offers a better way of doing things, competitors enter the market after its launch looking to mimic and improve.

In the case of Afterpay, its rise up the charts spawned a wave of fintechs, some with increasingly silly names.

Call it the ‘BNPL silly name market saturation signal’.

Now I’m not casting aspersions on any particular fintech, but I am making a point about how many of these companies may not survive the next 5–10 years.

For example, cast your mind back to the 2017/18 pot stock craze on the ASX.

Some of the stars of this period look like they are on a knife edge at the moment.

A regulatory change, or in the case of fintechs, innovation led to a glut of new market entrants, each looking to grab a slice of the pie.

Enticed by the prospects of future earnings, investors pile in only to realise it takes longer than expected for these companies to become profitable.

Then a slide happens and generally the largest and best run survive while gobbling up competitors during a consolidation period.

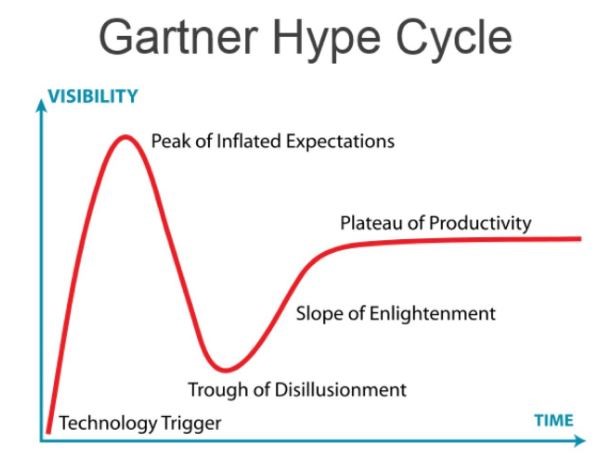

It’s the Gartner hype cycle all over again, which you can see for reference below:

|

|

| Source: www.diamandis.com |

Now I’m no fan of banks, and there are a whole range of reasons why the fintech glut could prove to not be a bubble.

But the point remains that with PayPal setting up to compete with Afterpay, competition risk is starting to become real for APT.

It’s not an open field forever.

Details of PayPal’s product and where to look for fintechs that aren’t BNPLs

As reported by the Australian Financial Review, these are the details:

‘Many analysts have pointed to PayPal’s huge scale — it has 375 million global customers — and lower merchant fees as the main threat to Afterpay.

‘PayPal charges merchants an average of 2.6 per cent of the cost of goods plus 30¢, much lower than Afterpay’s fee of around 4 per cent plus 30¢.

‘From early June, hundreds of thousands of merchants in Australia who already accept PayPal will have the option to add a “pay in four” button next to the existing PayPal option, to draw customers to accept the alternative interest-free offering.

‘PayPal users will also see the instalment option if they click the existing PayPal button.’

Lower merchant fees strike me as the real killer here.

The bigger story, however, could be that the broader theme of fintechs is not going away.

It was part of The Great Bank Unbundling thesis at Exponential Stock Investor.

The trick will be to identify the next fintech that could shoot up the charts, that specifically isn’t a BNPL.

That subclass of fintechs strikes me as particularly susceptible for a ‘Revenge of the Banks’ type regulatory retaliation.

It could be a fintech that does something with insurance, or some other financial product.

Or even a regtech company that helps regulators with vast troves of financial data.

Either way, there’s a whole range of avenues for investing in fintechs which doesn’t rely on the BNPL angle.

Regards,

|

Lachlann Tierney,

For Money Morning

Lachlann is also the Editorial Analyst at Exponential Stock Investor, a stock tipping newsletter that hunts for promising small-cap stocks. For information on how to subscribe and see what Lachy’s telling subscribers right now, please click here.

Comments