Dear Reader,

Investors continue to be hit with bad news about the global economy. In fact, it’s par for the course.

In the US, the unemployment rate is over 13% and is expected to go higher. GDP for the second quarter is estimated to have fallen by 30–40% on an annualised basis, representing over $2 trillion of lost output in absolute value relative to the pre-pandemic trend.

Entire industries have been decimated while many others have seen revenues slashed in half. Not only is the drawdown severe, it happened in months compared to years during the Great Depression. The US economy has never suffered a setback this extreme in its history.

But as Jim Rickards explains below, the damage isn’t limited to economic statistics — or the US.

Read on for more.

| Until next time, |

| Shae Russell, |

A World-Historic Depression

The lockdown has imposed enormous costs over and above lost output. Due to quarantine and isolation, people are suffering from anxiety, depression, and anger. Rates of alcohol abuse, drug abuse, and suicide have all soared. These were serious problems before the pandemic and have become much worse since.

Just when the lockdowns were starting to lift, the riots came from Seattle to Atlanta, to New York, and many cities in between. Shops were smashed, burned, and looted.

It’s difficult to imagine the feelings of an entrepreneur or businessperson who barely scraped by during the 100-day lockdown in terms of lost sales and lost revenues, only to see her shop destroyed by rioters just as she was preparing to reopen.

That damage is more than economic; it leaves psychological scars. The reaction will be an urban exodus to the suburbs, exurbs, or to the countryside. Youth, talent, and capital will be part of the exodus.

Cities will become mere shells with oligarchs in penthouses and poor people in the streets. More radical ‘autonomous zones’ will be carved out by left-wing neo-fascists. Commerce and output will suffer in lockstep with the exodus.

That’s bad enough, but it’s not the whole story. This economic depression is truly global.

Even Australia will not escape recession, this time

The Chinese economy (the world’s second largest) was locked down before the US and Europe. Major economies such as Italy, Germany, and the UK suffered just as much or more than the US relative to the size of their population in terms of infections and deaths.

South America is now bearing the brunt of new infections. Brazil is second only to the US in the number of confirmed cases and fatalities, and the caseload there is growing quickly. China seemed to have the pandemic under control by late April, but a new outbreak in Beijing has recently emerged.

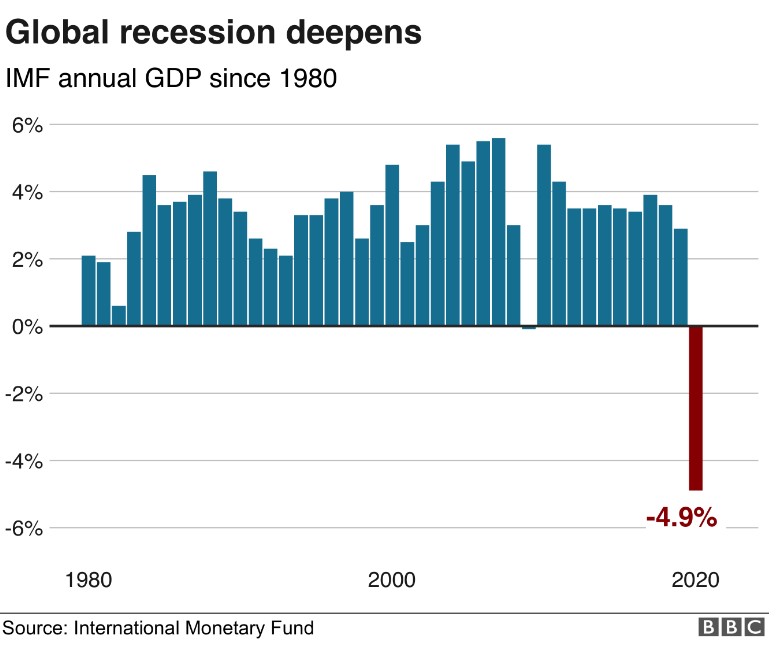

The IMF now expects a decline in global GDP of almost 5% in 2020. As recently as April, this forecast was just 3%. How does that compare? This chart from the BBC and IMF makes it clear that 2008 was a mere speedbump by comparison.

|

|

| Source: BBC |

What about Australia? Well, according to the IMF, the country’s economic outlook is second best of developed nations, behind only Korea, with a devastating -4.5% real GDP drop for 2020…

[conversion type=”in_post”]

A dollar shortage during QE?

The global impact of the pandemic has costs greater than the sum of lost output in each country. The added costs involve world trade and capital markets.

Even if one economy such as China is doing better locally, it may not be able to export to another country such as Brazil because that second country is in the worst phase of the pandemic. Likewise, countries ready to reopen factories may not be able to get raw materials from exporting nations that are locked down.

This stress on world trade also limits the ability of exporting nations to get dollars, which are typically used for invoicing trade. The resulting ‘dollar shortage’ makes it impossible for the exporters to service their dollar-denominated debt.

As those debts default, the losses fall on lending banks or investors, which raises the spectre of a financial crisis on top of the existing economic crisis. The new depression may not have started in the banks (unlike 2008), but it may end up there as the ripple effects of lost revenue, bad debts, and banks in distress play out.

The global dynamic of the economic crisis is illustrated below.

The everywhere crisis

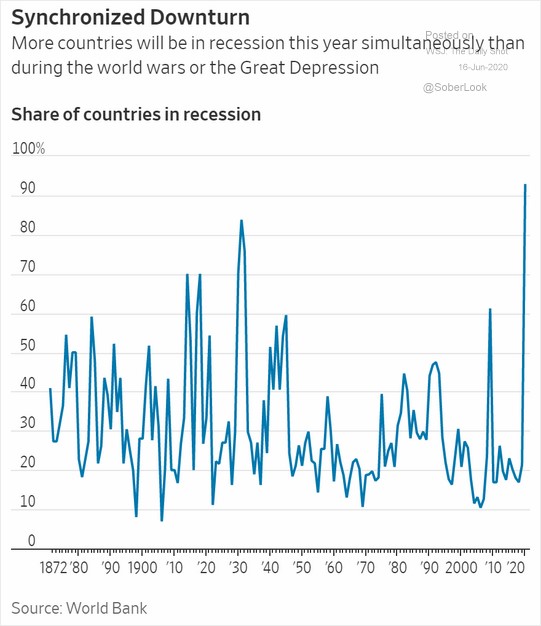

This graph shows the percentage of all the countries in the world that are in recession at the same time since 1870. Several spikes are prominent.

|

|

| Source: World Bank |

Over 80% of the world’s nations were in recession at the same time during the Great Depression in the early 1930s. The figure reached 60% right after the Second World War, as war industries demobilised, but domestic consumption had not yet ramped up. The 2008 global financial crisis put just over 60% of the world’s nations in recession at once.

Today the figure is 92% — the highest reading ever. That’s worse than both world wars, the Great Depression and the 2008 crisis. And that’s 92% of a much larger global economy than existed in the prior episodes.

Not only is this horrific in terms of absolute damage, it means there is no strong economic bloc to pull the world out of recession. There is no source of demand to help producing countries get off the mat.

This is one more reason why the current state of affairs is not just a technical recession; it’s a world-historic depression that will persist for years to come.

| All the best, |

|

| Jim Rickards, |

Comments