In today’s Money Morning…Powell takes a leaf out of Lowe’s playbook…ASX futures balk, despite US gains…I’m not alone in this line of thinking…and more…

When I was very young, one of my favourite series of books was The Faraway Tree by Enid Blyton. A collection of stories that detailed the adventures of several children and a mystical tree that would transport them to weird and wonderful places.

However, one of these fantastical places horrified me as a child.

It was a world known as Topsy Turvy. A place where everything is upside down, right down to the way people walk — which is on their hands by the way.

Doesn’t sound so bad, does it?

Well, when one of the children gets a spell cast on him that forces him to also walk on his hands, my six-year-old mind was terrified. I didn’t want to end up in a place where nothing made sense and I was forced to live in a strange way…

Fortunately, like most childhood fears, mine would prove irrational.

After all, the land of Topsy Turvy doesn’t really exist. Or at least, that’s what I thought…

Because if I’m being honest, when I look at what’s happening in the stock market right now, I feel like I’m living in some kind of Topsy Turvy nightmare. One where investors have become terrified of inflation, while central bankers have simply shrugged it off.

Powell takes a leaf out of Lowe’s playbook

If you haven’t already heard, the key Fed meeting overnight delivered a dramatic conclusion.

Jerome Powell, like Philip Lowe, has committed to low rates for longer. Stating that he expects interest rates to remain at the 0.0 to 0.25 percent range until 2023.

Discover our top three ASX-listed pot stocks in 2021. Click here to learn more.

This is despite the fact that the Fed also recognised that the US economy is growing faster than expected too. With GDP figures forecast to top 6.5% this year, way up from the 4.2% previously predicted just a few months ago.

On top of this, as this story was making headlines, millions of Americans were handed their latest stimulus cheques. Courtesy of Joe Biden’s ongoing US$1.9 trillion ‘Rescue Plan’.

Suffice to say, it is clear that both Powell and Biden are pumping their economy as hard as they can. Which is precisely why the Dow Jones closed above the 33,000 mark for the first time ever. A new all-time high for the mammoth index.

And yet, despite all this bullish sentiment from the Fed and the US government, some are seeing it as ‘too good to be true’. With plenty of investors worried about an inflationary influence on the stock market.

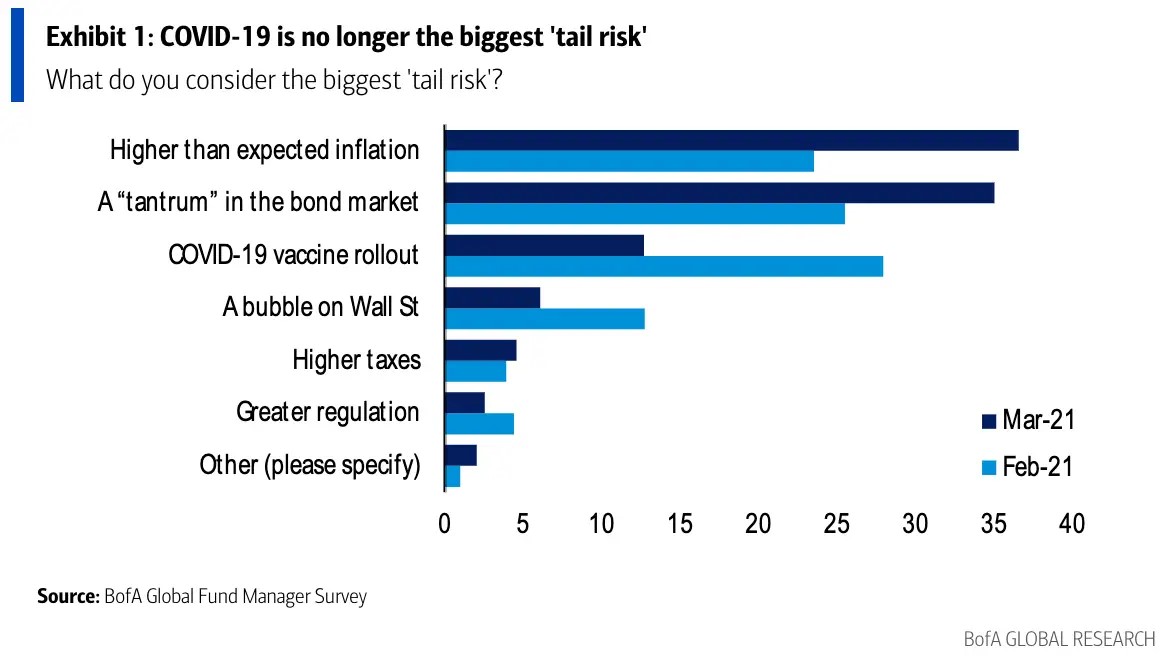

As a recent Bank of America survey of Fund Managers shows, inflation has overtaken COVID-19 as the primary thing keeping them up at night:

|

|

|

Source: Business Insider/Bank of America |

While I’m not totally surprised by these fears, I am surprised at the huge difference in rhetoric between the fund managers and the Fed. With investors suddenly afraid of growth being too strong; to the point that it negatively affects their investments.

It sounds bizarre, but that’s just the kind of crazy world of finance that we get during ‘Life at Zero’, as our Editorial Director Greg Canavan calls it. So, if you’re wondering just what the hell to do amidst all this chaos, I highly recommend listening to what he has to say, right here.

ASX futures balk, despite US gains

Meanwhile, away from all the jubilation on Wall Street, the ASX is looking far glummer.

Local stocks have been trading sideways for almost two months now. With the All Ords and S&P 200 down from their February highs.

It seems investors can’t make up their minds as to whether to be fearful or greedy. Despite the fact that our own central bank and government are doing just as much pumping as their US peers.

Like I said last week, I’m surprised at just how flat our local markets have been, despite all the recent stimulus. With our local market falling way behind the US, despite equally lax policies.

Perhaps local investors are just as afraid of runaway inflation as US hedge funds. But I personally don’t think they should be.

Central banks have spent years trying to make inflation budge. And while they have gone to extreme lengths to move it this time around, I would still wait to see if it has actually worked.

Fortunately, we should get an indication on that front today, thanks to some employment figures.

But, don’t get your hopes up for any big developments.

The CBA is estimating that just 30,000 new jobs were created in February. Representing a 0.2% fall in unemployment — bringing it to 6.2% in total.

A step in the right direction as they put it, but far from the runaway inflation fears that seem to have gripped investors. Which is precisely why I think this volatility and middling market is an opportunity not a threat.

And I’m not alone in this line of thinking.

My colleague Callum Newman also believes there is reason to be excited about the market right now. As he told readers of the Insider yesterday:

‘Volatility can play havoc with this dynamic.

‘That’s because in a volatile market, like we’ve seen recently, shares gyrate wildly.

‘If you don’t understand the company you’re holding, and — more importantly — the reason why you’re holding it, the market can whipsaw you out in a panic.

‘However, a stock going down can present a MASSIVE buying opportunity if you have a good idea what’s coming up in the short term.’

It may sound crazy, or reckless, but Cal’s track record proves that it can work. Which is why I definitely recommend you also check out what he is saying right now, by following this link.

Because in our Topsy Turvy world, it may pay to be a little unorthodox…

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning

Ryan is also the Editor of Australian Small-Cap Investigator, a stock tipping newsletter that hunts down promising small-cap stocks. For information on how to subscribe and see what Ryan’s telling subscribers right now, click here.