In today’s Money Morning…pandemic spending: boom to bust…inventory glut…what to expect…finding investment ideas with secular headwinds…and more…

I visited my local shopping centre on the weekend, and while the experience was as drab as ever, I did notice something.

Many shops were offering huge discounts. 50%, 60%, even 70% off.

A deserted men’s fashion retailer was offering 70% off on suit jackets and cashmere sweaters.

Shopping centres always have some stores offering discounts.

But this felt different. Almost everywhere I looked, I saw banners, stickers, and placards advertising big sales.

I wondered, is there anything in this?

Can my local shopping centre be emblematic of a wider phenomenon?

Pandemic spending: boom to bust

The pandemic — and lockdowns — were a boon for many retailers.

Cooped up at home, with our savings growing, we splurged on goods.

Home office upgrades, home renovations, latest tech gadgets, Pelotons…

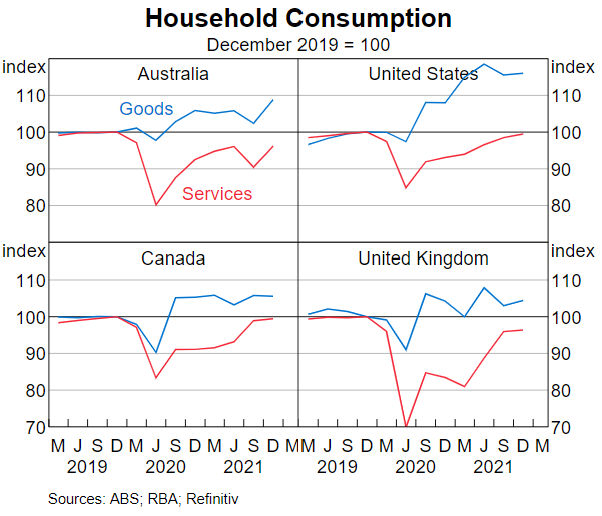

As a Reserve Bank of Australia retrospective noted:

‘Goods consumption increased strongly as consumers substituted away from services where consumption possibilities were limited or not available. Groceries to cook homemade meals replaced restaurant visits, sports equipment substituted for closed gyms, home office equipment filled in for trips to workplaces, and toys and games stood in for organised children’s activities. Similar patterns have been observed in other advanced economies.

‘The strength in goods consumption was most pronounced for home entertainment items, appliances, furniture and home renovation goods, with retail sales for these categories in the June quarter of 2020 typically 20–30 per cent higher than a year earlier.’

|

|

|

Source: RBA |

Our spending on goods was so exuberant that it quickly bounced higher than pre-pandemic levels.

But it was a mistake to think this was a permanent shift.

Our splurging simply brought future purchases forward. We weren’t going to sustain the trend forever.

We didn’t need to buy a new standing desk every year, or a new laptop, or a new set of dumbbells.

And once restrictions eased, our focus on goods shifted back to services.

It all painted a lousy picture for retailers who continued to operate under the assumption that consumer spending would be elevated indefinitely.

And that’s before inflation spiked.

Here’s a quick illustration, a tale in two pictures:

|

|

|

|

Inventory glut

As economies worldwide titter on the edge of recession and households grapple with rising prices, companies are facing an inventory glut.

Retailers’ inventory problem is also exacerbated by supply chain delays, as back orders arrive months after consumers lose interest…or the capacity to pay.

Just look at what’s happening to the largest retailers in the US.

As Talk Business reported in late June:

‘Last month, Walmart surprised investors when it reported 32% higher-then-expected inventory for the first quarter ending Feb. 1. Costco said inventories were up 26% from the previous year, and Target saw inventories up 43% against a 4% revenue gain in its recent quarter.

‘The cost of carrying extra inventory took a toll on company revenues for the recent quarter. The inventory glut was widespread across the retail landscape with a 17% gain at Macy’s, 40% inventory growth at Kohl’s and Dick’s Sporting Goods with Gap seeing a 34% inventory oversupply.’

All this prompted Moody’s Investors Service analyst Mickey Chadha to tell the Wall Street Journal that ‘there are going to be discounts like you’ve never seen before’.

Earnings season: outlook too rosy?

Significant discounts — like you’ve never seen before — will squeeze profits.

So what I’ve seen at my local shopping centre might indicate a tough near-term outlook for retail stocks.

But the outlook isn’t all that rosy for stocks generally if part of the reason retailers are struggling is waning consumer demand across the board.

A good test is looming in the form of the upcoming earnings season.

And on that front, things aren’t looking too good.

Echoes of what goes down on Wall Street are often heard soon after in other markets. So what’s Wall Street saying?

As the Wall Street Journal reported overnight (emphasis added):

‘Earnings among companies in the S&P 500 are projected to have risen 4.3% in the second quarter from a year earlier as of Friday, according to FactSet. That would mark the slowest pace of growth since the fourth quarter of 2020.

‘Many companies have already telegraphed to investors that their businesses have weakened recently. The second quarter has seen the highest number of companies in the S&P 500 issue downbeat earnings guidance since 2019, according to FactSet.

‘By sector, the S&P 500’s consumer-discretionary group—home to companies including Nike, Target and Amazon.com Inc.—has seen the largest downward revision of earnings estimates, according to FactSet. The financials, consumer-discretionary and utilities segments are expected to post the biggest declines in profits.’

|

|

|

Source: Wall Street Journal |

Downbeat earnings guidance isn’t surprising.

Consumers are facing some of the highest inflation levels in decades, all the while dealing with rising interest rates. Not to mention that real wages growth is low — even negative in some economies.

So the cost of living is going up, and servicing debt is getting more expensive.

No wonder many retailers are resorting to huge discounts. Who would want to buy an expensive cashmere sweater right now?

As recent research on people’s shopping habits during the downturn of 2007–09 revealed:

‘Coping strategies took the form of households switching their purchasing to cheaper outlets and brands, while purchasing more products on deal.

‘Households had to resort to micro-level coping strategies to reduce expenditures.’

What to expect

If the earnings downgrades and retail liquidations are a sign of recessionary times ahead, what can investors expect?

We can look to history for guidance.

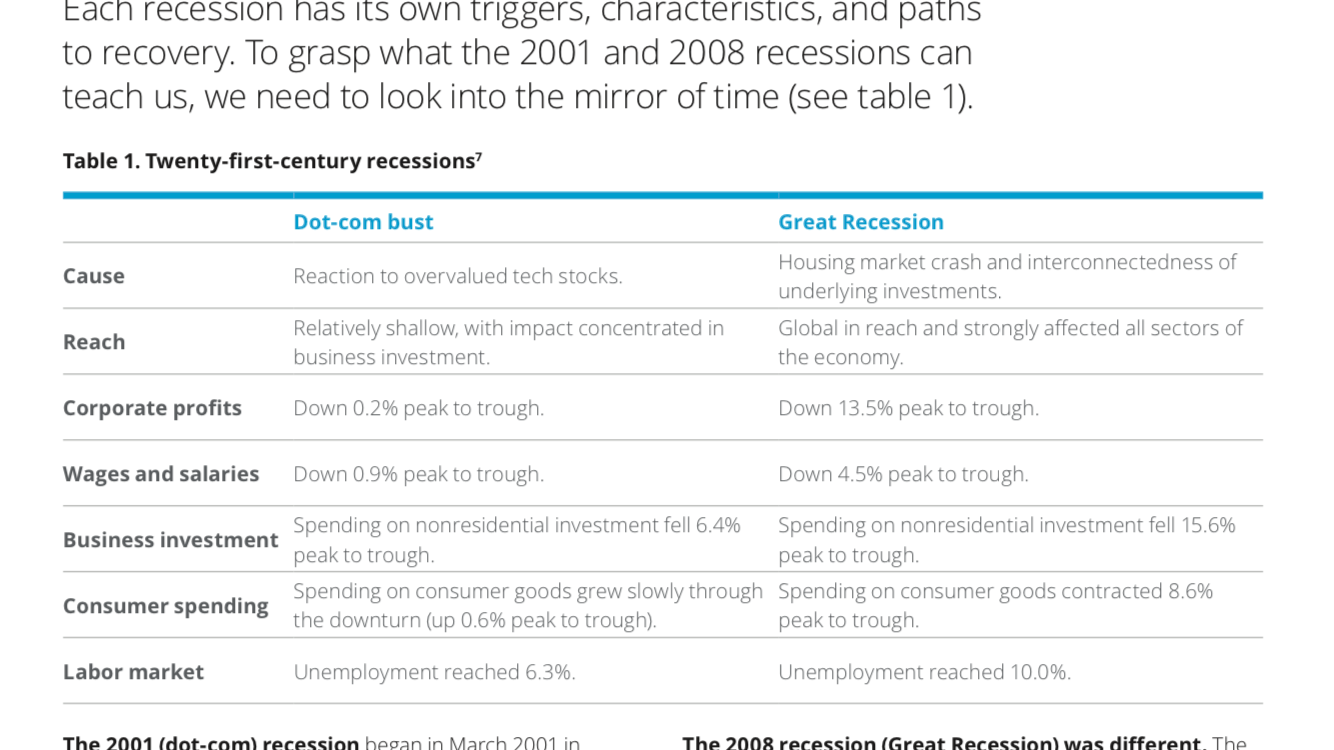

Deloitte recently released a report looking at past recessions and their effects.

Here’s a nice chart of the key findings for the two most recent recessions — the dotcom bust and the Great Recession:

Source: Deloitte

So what should investors expect in the coming months?

Our Editorial Director, Greg Canavan, recently published his thoughts in Livewire. Here is an excerpt:

‘The next phase of the bear will be the margin compression I mentioned earlier. This will result in stocks taking another leg lower.

‘Then, by September, I expect central banks, and certainly the Fed, to move to an ‘on hold’ stance. By then those positive real rates will really be starting to bite.

‘And don’t forget, quantitative tightening is scheduled to double to around US$100 billion per month on 1 September.

‘Neither the stock market nor commodities, for that matter, are going to like that.

‘The good news is that this ugly macro combo will produce lower stock prices in the months ahead. It will provide plenty of investment opportunities at the back end of the year so remain patient and be stingy with your cash.’

Finding investment ideas with secular headwinds

While current economic conditions are tough — and will negatively affect sectors like retail and consumer discretionary — some sectors are more resistant to external macroeconomic noise than others.

What sectors are still being propelled by powerful megatrends? Megatrends resilient to temporary economic slowdowns?

What trends will continue despite economic turbulence?

My colleague Callum Newman, editor of Australian Small-Cap Investigator, thinks battery tech is a sector at the confluence of multiple trends unlikely to be halted by temporary economic setbacks.

The world’s course for the EV future is set. We are headed for more electric cars and more battery storage.

But how do you exploit that as an investor when the easy money is likely already made (see lithium stocks’ recent correction).

Callum’s also taken a unique approach to analysing the sector.

He’s been following the Tesla money trail, aiming to identify producers likely to be handpicked by Tesla as it hunts critical materials for its leading EVs.

They’re miners that could help a giant EV automaker like Tesla with the looming battery metals supply crunch.

You can read about the stocks and Callum’s thesis right here.

Regards,

By Kiryll Prakapenka,

For Money Morning